Answered step by step

Verified Expert Solution

Question

1 Approved Answer

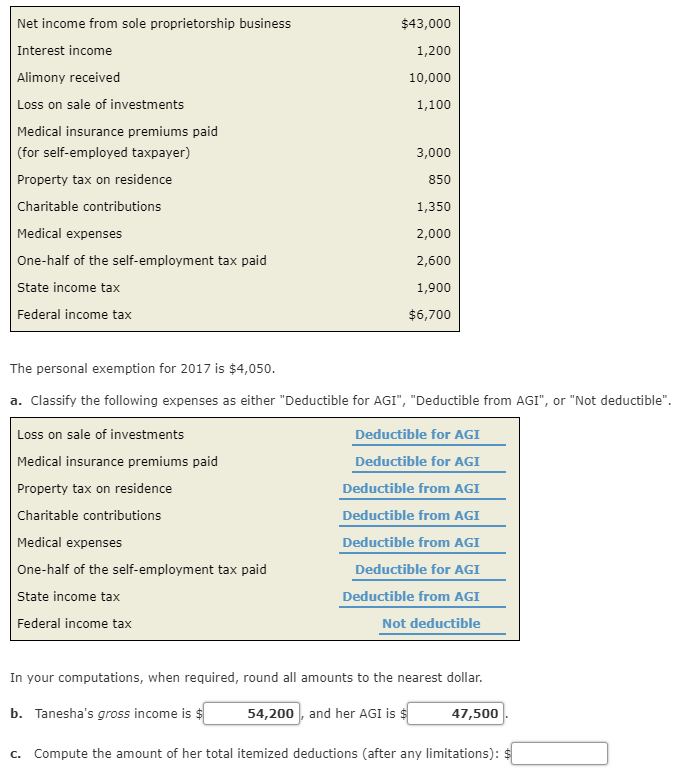

Tanesha, aged 66, is single. She has the following income and expenses in 2017: Please check my answers. Net income from sole proprietorship business Interest

Tanesha, aged 66, is single. She has the following income and expenses in 2017:

Please check my answers.

Net income from sole proprietorship business Interest income Alimony received Loss on sale of investments Medical insurance premiums paid (for self-employed taxpayer) Property tax on residence Charitable contributions Medical expenses One-half of the self-employment tax paid State income tax Federal income tax $43,000 1,200 10,000 1,100 3,000 850 1,350 2,000 2,600 1,900 $6,700 The personal exemption for 2017 is $4,050 a. Classify the following expenses as either "Deductible for AGI", "Deductible from AGI", or "Not deductible". Loss on sale of investments Medical insurance premiums paid Property tax on residence Charitable contributions Medical expenses One-half of the self-employment tax paid State income tax Federal income tax Deductible for AGI Deductible for AGI Deductible from AGI Deductible from AGI Deductible from AGI Deductible for AGI Deductible from AGI Not deductible In your computations, when required, round all amounts to the nearest dollar. b. Tanesha's gross income is c. Compute the amount of her total itemized deductions (after any limitations): 54,200, and her AGI is 47,500Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started