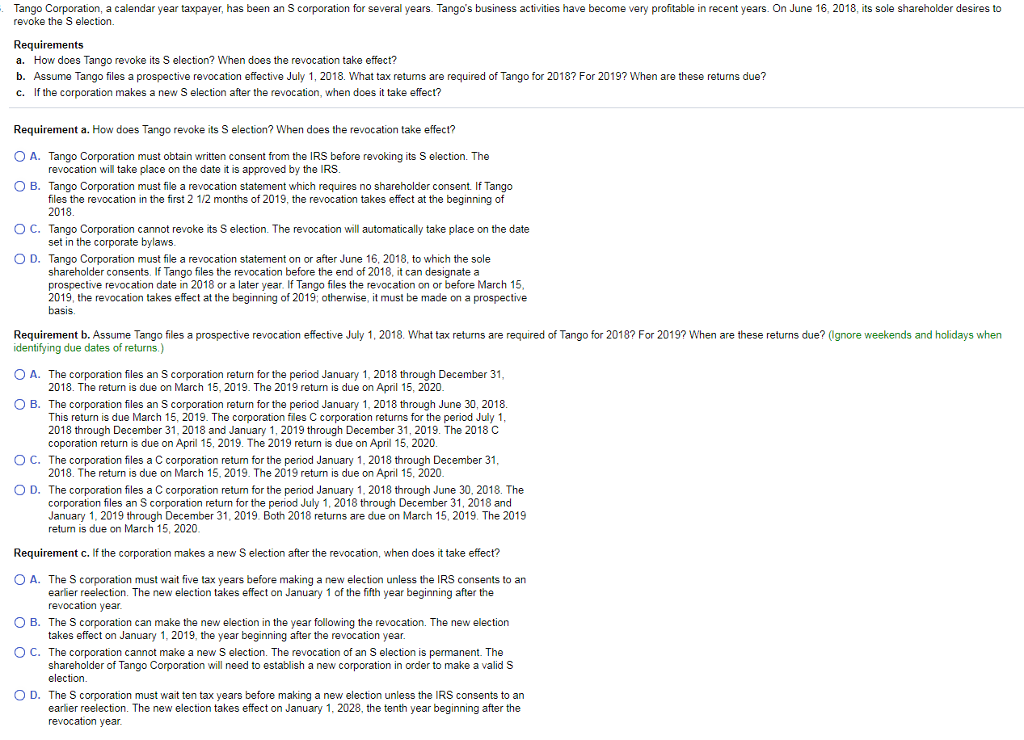

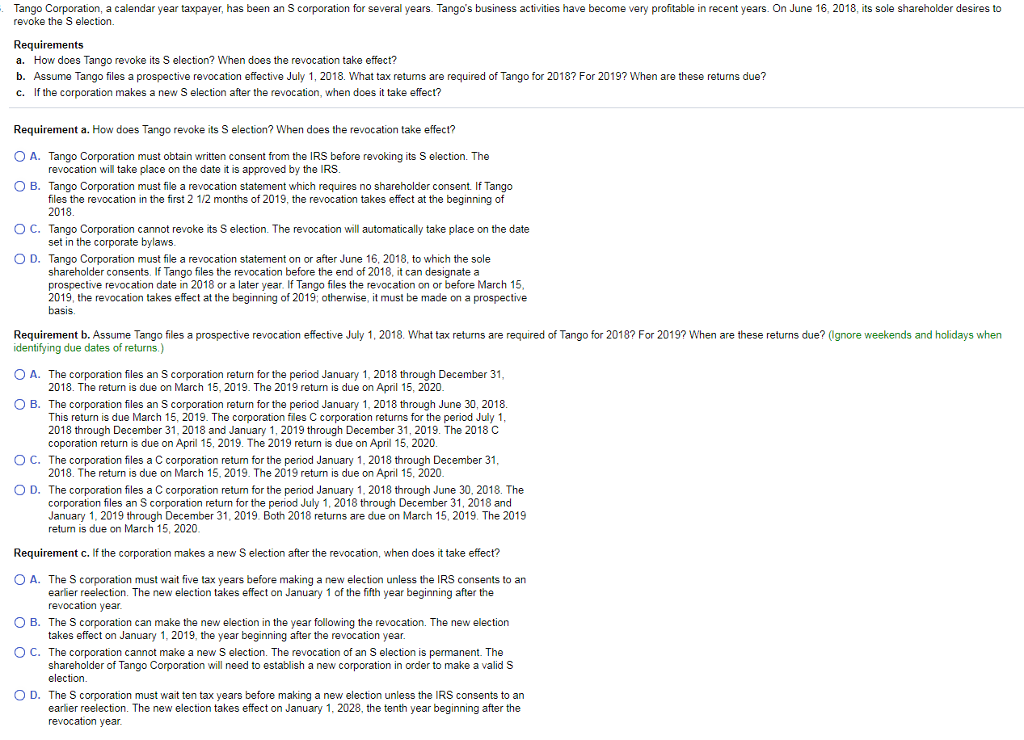

Tango Corporation, a calendar year taxpayer, has been an S corporation for several years. Tangos business activities have become very profitable in recent years. On June 16, 2018, its sole shareholder desires to revoke the S election Requirements a. How does Tango revoke its S election? When does the revocation take effect? b. Assume Tango files a prospective revocation effective July 1, 2018. What tax returns are required of Tango for 2018? For 2019? When are these returns due? c. If the corporation makes a new S election after the revocation, when does it take effect? Requirement a. How does Tango revoke its S election? When does the revocation take effect? O A. Tango Corporation must obtain written consent from the IRS before revoking its S election. The O B. Tango Corporation must file a revocation statement which requires no shareholder consent If Tango revocation will take place on the date it is approved by the IRS files the revocation in the first 2 1/2 months of 2019, the revocation takes effect at the beginning of 2018 O C. Tango Corporation cannot revoke its S election. The revocation will automatically take place on the date set in the corporate bylaws O D. Tango Corporation must file a revocation statement on or after June 16, 2018, to which the sole shareholder consents. If Tango files the revocation before the end of 2018, it can designate a prospective revocation date in 2018 or a later year, If Tango files the revocation on or before March 15 2019, the revocation takes effect at the beginning of 2019; otherwise, it must be made on a prospective basis Requirement b. Assume Tango files a prospective revocation effective July 1, 2018. What tax returns are required of Tango for 2018? For 2019? When are these returns due? (Ignore weekends and holidays when identifying due dates of returns.) O A. The corporation files an S corporation return for the period January 1, 2018 through December 31 O B. The corporation files an S corporation return for the period January 1, 2018 through June 30, 2018 2018. The return is due on March 15, 2019. The 2019 return is due on April 15, 2020 This return is due March 15, 2019. The corporation files C corporation returns for the period July 1 2018 through December 31, 2018 and January 1, 2019 through December 31, 2019. The 2018 C coporation return is due on April 15, 2019. The 2019 return is due on April 15, 2020 O C. The corporation files a C corporation return for the period January 1, 2018 through December 31 2018. The return is due on March 15, 2019. The 2019 return is due on April 15, 2020 D. The corporation files a C corporation return for the penod January 1, 2018 through June 30, 2018. The corporation files an S corporation return for the period July 1, 2018 through December 31, 2018 and January 1, 2019 through December 31, 2019. Both 2018 returns are due on March 15, 2019. The 2019 return is due on March 15, 2020 Requirement c. if the corporation makes a new S election after the revocation, when does it take effect? O A. The S corporation must wait five tax years before making a new election unless the IRS consents to an earlier reelection. The new election takes effect on January 1 of the fifth year beginning after the revocation vear O B. The S corporation can make the new election in the year following the revocation. The new election es 1, 2019, the year beginning after the revocation year C. The corporation cannot make a new S election. The revocation of an S election is permanent. The shareholder of Tango Corporation will need to establish a new corporation in order to make a valid S election O D. The S corporation must wait ten tax years before making a new election unless the IRS consents to an earlier reelection. The new election takes effect on January 1, 2028, the tenth year beginning after the