Answered step by step

Verified Expert Solution

Question

1 Approved Answer

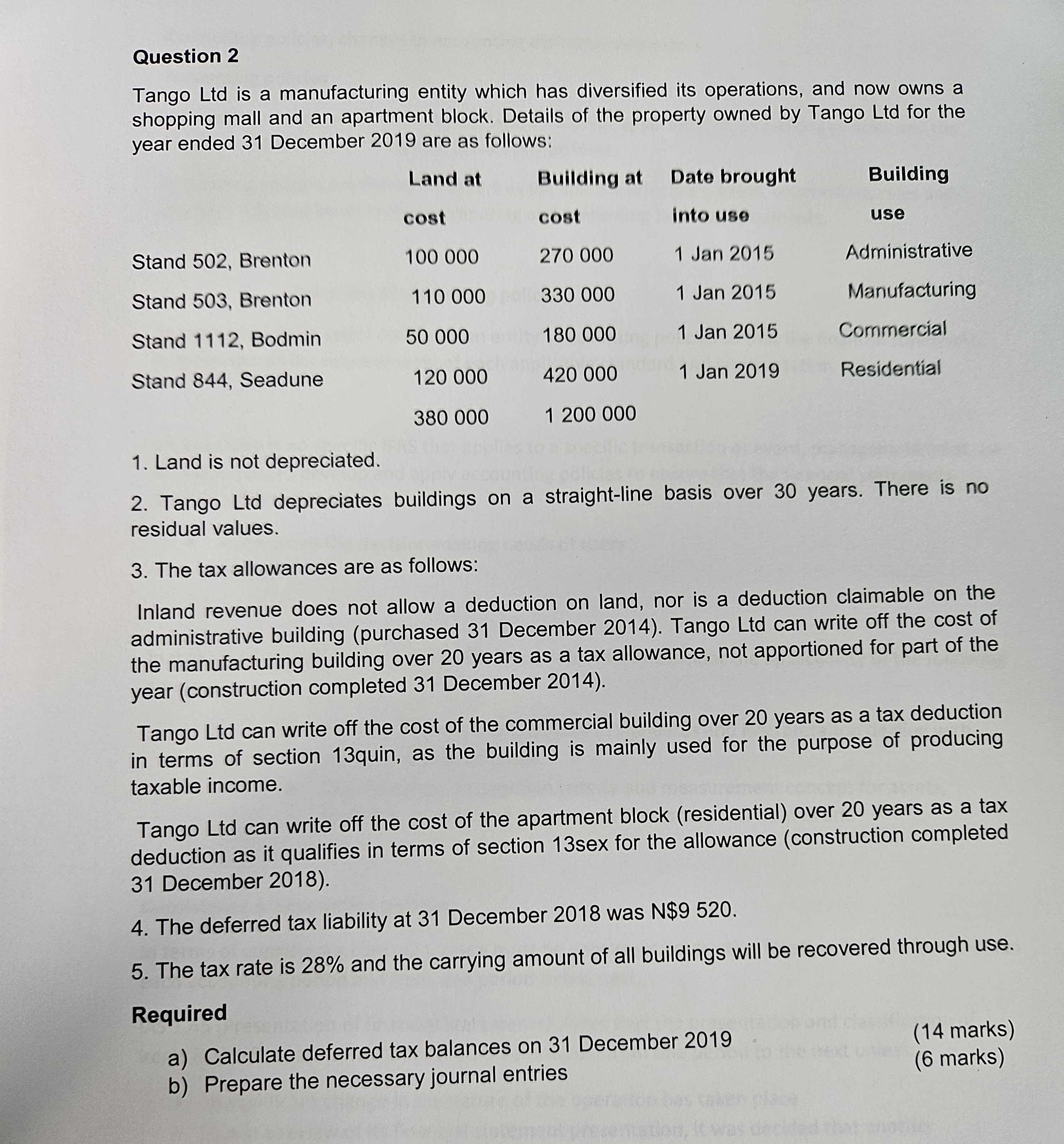

Tango Ltd is a manufacturing entity which has diversified its operations, and now owns a shopping mall and an apartment block. Details of the property

Tango Ltd is a manufacturing entity which has diversified its operations, and now owns a shopping mall and an apartment block. Details of the property owned by Tango Ltd for the year ended Land at Building at Date brought Building

cost cost into use use

Stand Brenton Jan Administrative

Stand Brenton Jan Manufacturing

Stand Bodmin Jan Commercial

Stand Seadune Jan Residential

Land is not depreciated.

Tango Ltd depreciates buildings on a straightline basis over years. There is no residual values.

The tax allowances are as follows:

Inland revenue does not allow a deduction on land, nor is a deduction claimable on the administrative building purchased December Tango Ltd can write off the cost of the manufacturing building over years as a tax allowance, not apportioned for part of the

year construction completed December

Tango Ltd can write off the cost of the commercial building over years as a tax deduction in terms of section quin, as the building is mainly used for the purpose of producing taxable income.

Tango Ltd can write off the cost of the apartment block residential over years as a tax deduction as it qualifies in terms of section sex for the allowance construction completed December

The deferred tax liability at December was $

The tax rate is and the carrying amount of all buildings will be recovered through use.

Required

a Calculate deferred tax balances on December

b Prepare the necessary journal entries

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started