Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Tania died on 14 February 2020 having made the following gifts during her lifetime. 1. On 20 December 2013, Tania gave 380,000 to a

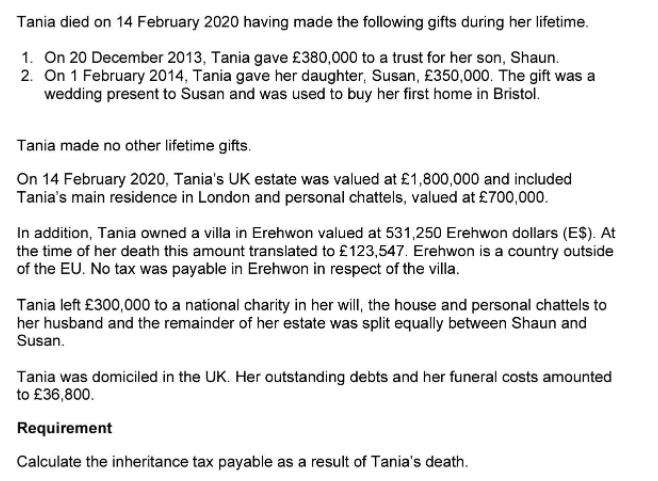

Tania died on 14 February 2020 having made the following gifts during her lifetime. 1. On 20 December 2013, Tania gave 380,000 to a trust for her son, Shaun. 2. On 1 February 2014, Tania gave her daughter, Susan, 350,000. The gift was a wedding present to Susan and was used to buy her first home in Bristol. Tania made no other lifetime gifts. On 14 February 2020, Tania's UK estate was valued at 1,800,000 and included Tania's main residence in London and personal chattels, valued at 700,000. In addition, Tania owned a villa in Erehwon valued at 531,250 Erehwon dollars (E$). At the time of her death this amount translated to 123,547. Erehwon is a country outside of the EU. No tax was payable in Erehwon in respect of the villa. Tania left 300,000 to a national charity in her will, the house and personal chattels to her husband and the remainder of her estate was split equally between Shaun and Susan. Tania was domiciled in the UK. Her outstanding debts and her funeral costs amounted to 36,800. Requirement Calculate the inheritance tax payable as a result of Tania's death.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Answer The inheritance tax payable as a result of Tanias death would be 360000 Explana...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started