Tanner is choosing between two investment options. He can invest $500 now and get (guaranteed) $550 in one year, or invest $500 now and

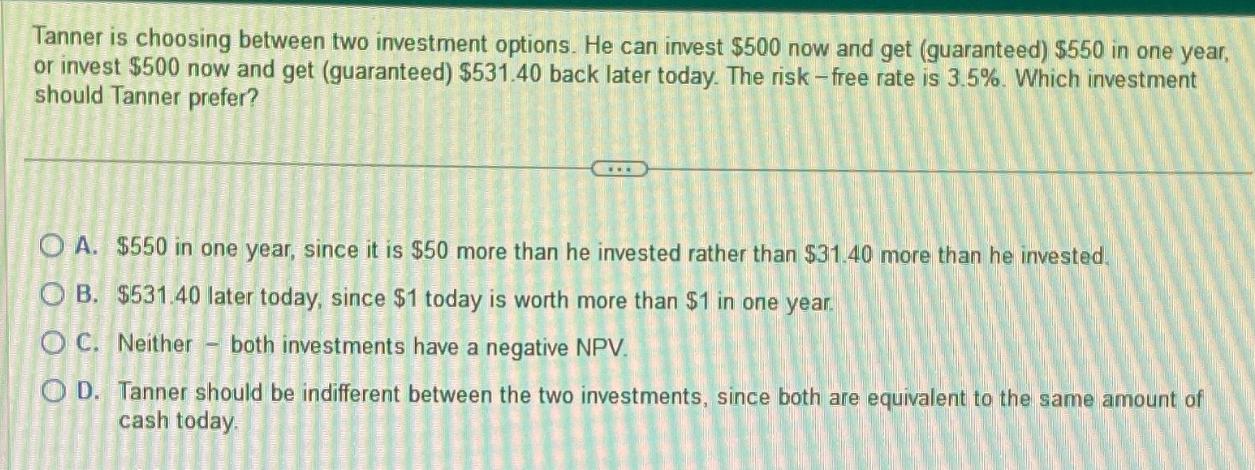

Tanner is choosing between two investment options. He can invest $500 now and get (guaranteed) $550 in one year, or invest $500 now and get (guaranteed) $531.40 back later today. The risk-free rate is 3.5%. Which investment should Tanner prefer? OA. $550 in one year, since it is $50 more than he invested rather than $31.40 more than he invested. OB. $531.40 later today, since $1 today is worth more than $1 in one year. OC. Neither both investments have a negative NPV. OD. Tanner should be indifferent between the two investments, since both are equivalent to the same amount of cash today.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To solve this problem we need to understand the concept of the time value of money which suggests th...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started