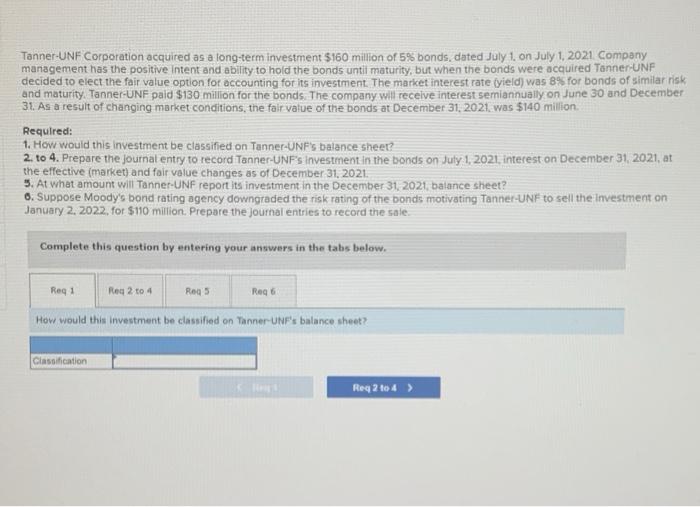

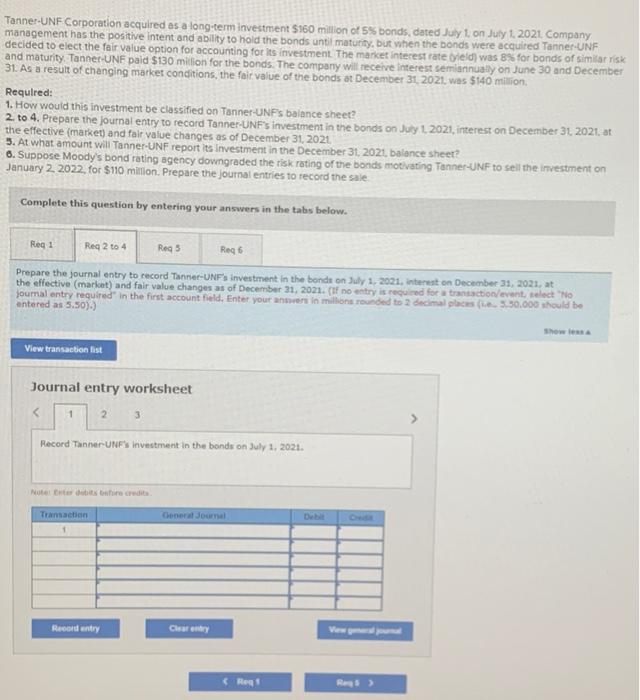

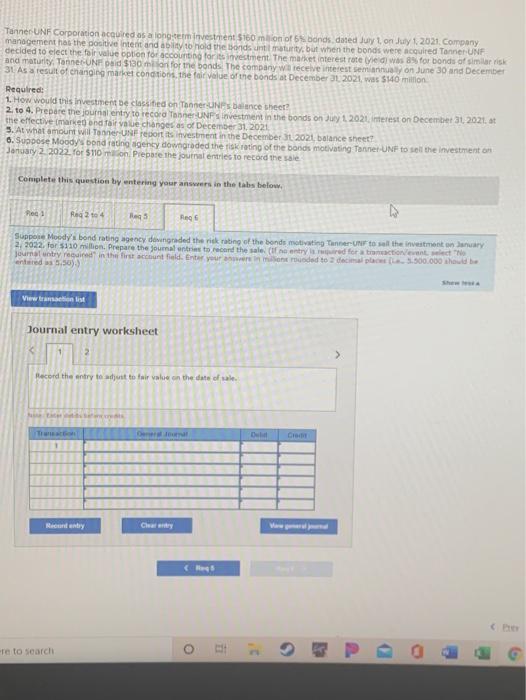

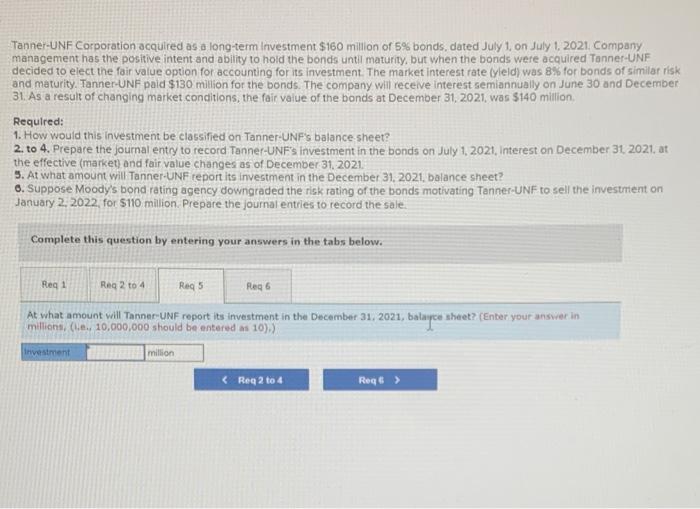

Tanner-UNF Corporation acquired as a long-term investment $160 million of 5% bonds, dated July 1. on July 1, 2021 Company management has the positive intent and ability to hold the bonds until maturity, but when the bonds were acquired Tanner-UNF decided to elect the fair value option for accounting for its investment. The maricet interest rate (yield) was 8% for bonds of similar risk and maturity, Tanner-UNF paid $130 million for the bonds. The company will receive interest semiannually on June 30 and December 31. As a result of changing market conditions, the fair value of the bonds at December 31, 2021. was $140 million Required: 1. How would this investment be classified on Tanner-UNF's balance sheet? 2. to 4. Prepare the Journal entry to record Tanner-UNF s investment in the bonds on July 1, 2021. interest on December 31, 2021, at the effective market) and fair value changes as of December 31, 2021. 5. At what amount will Tanner-UNF report its investment in the December 31, 2021 balance sheet? 0. Suppose Moody's bond rating agency downgraded the risk rating of the bonds motivating Tanner-UNF to sell the Investment on January 2, 2022, for $110 million. Prepare the journal entries to record the sale. Complete this question by entering your answers in the tabs below. Reg 1 Reg 2 to 4 Reg 5 Reg 6 How would this investment be classified on Tanner-UNP's balance sheet? Classification Req2 to 4 > Tanner-UNF Corporation acquired as a long-term investment $150 million of 5% bonds, dated July 1, on July 1.2021 Company management has the positive intent and ability to hold the bonds until maturity, but when the bonds were acquired Tanner-UNF decided to elect the fair value option for accounting for its investment. The market interest rate yield) was 83 for bonds of similar risk and maturity, Tanner. UNF paid $130 million for the bonds. The company will receive interest semiannually on June 30 and December 31. As a result of changing market conditions, the fair value of the bonds at December 31, 2021, was $140 million Required: 1. How would this investment be classified on Tanner-UNFs balance sheet? 2. to 4. Prepare the journal entry to record Tanner-UNF's investment in the bonds on July 2021, interest on December 31 2021, ar the effective (market) and fair value changes as of December 31, 2021 3. At what amount will Tanner-UNF report its investment in the December 31, 2021. balance sheet? 6. Suppose Moody's bond rating agency downgraded the risk rating of the bonds motivating Tanner-UNF to sell the investment on January 2, 2022 for $110 million. Prepare the journal entries to record the sale Complete this question by entering your answers in the tabs below. Reg 1 Reg 2 to 4 Reg 5 Reqs Prepare the journal entry to record Tannee-UNF's investment in the bonds on July 1, 2021, Interest on December 31, 2021, at the effective market) and fair value changes as of December 31, 2021. (if no entry is required for a transaction/eventslect "No Journal entry required in the first account field. Enter your answers in millions rounded to 2 decimal places 5.30.000 should be antered as 5.50).) Show less View transaction list Journal entry worksheet Tanner UNF Corporation acquired as a long-term investment $160 mlion of 5 bonds dated Jul on July 1 2021. Company management has the potentent and ability to hold the bonds untiaturty, but when the bonds were acquired Tanner UNF decided to elect the fair value option for accounting for its investment. The market interest rate Ved was for bonds of similar risk and maturity, Tanner-UN paid $180 mln for the bonds. The company will receive interest seminar on June 30 and December 3. As a result of changing market conditions, the fair value of the bonds at December 3 2021 was 140 milion Required: 1. How would this investment se classified on Tanner-UNPS bance sheet 2. to 4. Prepare the journal entry to record Tanner UPS Investment in the bonds on suy 1 2021. Interest on December 31, 2021. at the effective market and fair value changes as of December 31, 2021 3. At what amount will Toner-UNF reports investment in the December 312021, balance sheet? 6. Suppose Moodycond rating agency downgraded the risk rating of the bonds motivating Tanner-UNF to sell the investment on January 2 2032. for 5110 ml on Prepare the journal entries to record the sale Complete this question by entering your answers in the tabs below Pogi Reg 2 to 4 Reg Suppose Moody's bond rating agency downgraded the risk rating of the bonds motivating Tunner-Un to all the investment on January 2, 2022. for $110 million. Prepare the journals to record the sale of no entry is wred for atractivated jours try required in the first account field. Enter your needed to decimal places 1.500.000 hodbe and 5.30) View transit Journal entry worksheet > Record the entry to adjust to fair value on the date of sale DO D Minty Cha Te to search O Tanner-UNF Corporation acquired as a long-term Investment $160 million of 5% bonds, dated July 1, on July 1, 2021. Company management has the positive intent and ability to hold the bonds until maturity, but when the bonds were acquired Tanner-UNF decided to elect the fair value option for accounting for its Investment. The market interest rate Vield) was 8% for bonds of similar risk and maturity. Tanner-UNF paid $130 million for the bonds. The company will receive interest semiannually on June 30 and December 31. As a result of changing market conditions, the fair value of the bonds at December 31, 2021 was 5140 million Required: 1. How would this investment be classified on Tanner-UNP's balance sheet? 2. to 4. Prepare the journal entry to record Tanner-UNE's investment in the bonds on July 1, 2021, Interest on December 31, 2021. at the effective market and fair value changes as of December 31, 2021. 5. At what amount will Tanner-UNF report its investment in the December 31, 2021. balance sheet? 6. Suppose Moody's bond rating agency downgraded the risk rating of the bonds motivating Tanner-UNF to sell the investment on January 2, 2022. for $110 million. Prepare the journal entries to record the sale. Complete this question by entering your answers in the tabs below. Reg 1 Reg 2 to 4 Reqs Reg 6 Investment At what amount will Toner UNF report its investment in the December 31, 2021, balance sheet? (Enter your answer in should million