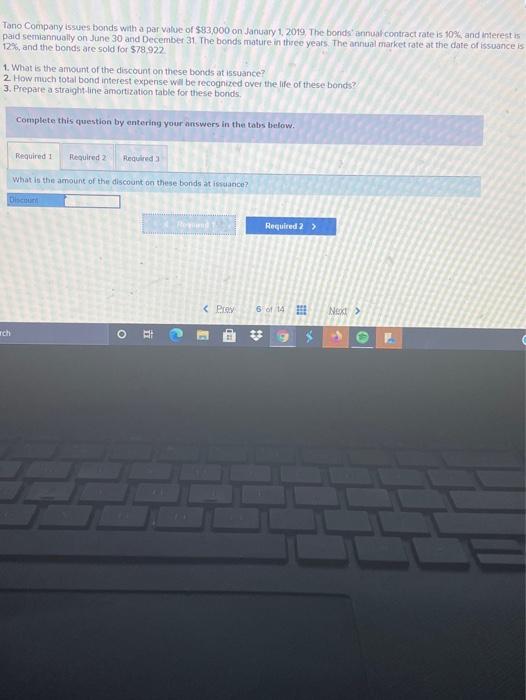

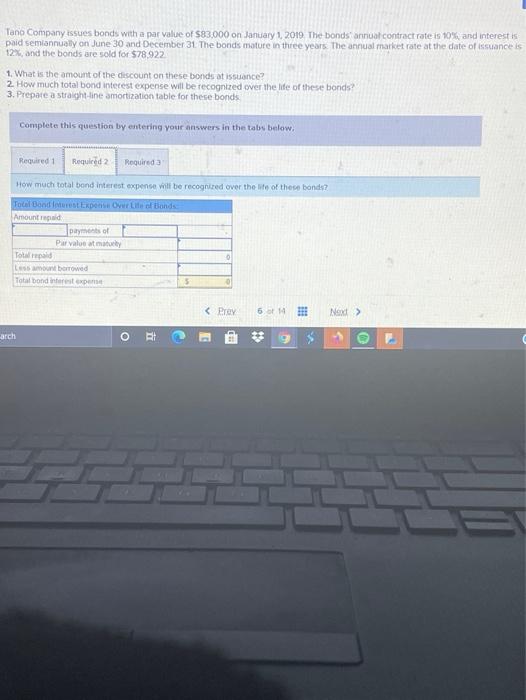

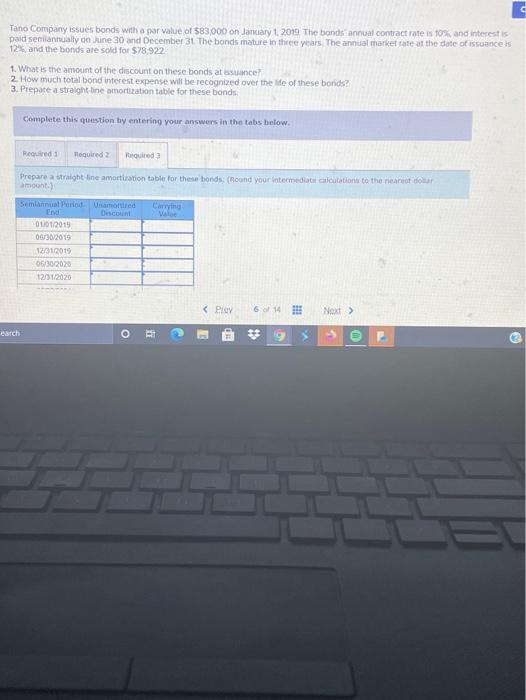

Tano Company issues bonds with a par value of $83,000 on January 1, 2019 The bonds' annual contract rate is 10% and interestis paid semiannually on June 30 and December 31 The bonds mature in three years. The annual market rate at the date of issuance is 12%, and the bonds are sold for $78,922 1. What is the amount of the discount on these bonds at issuance? 2. How much total bond interest expense will be recognized over the life of these bonds? 3. Prepare a straight line amortization table for these bonds Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required What is the amount of the discount on these bonds at issuance? Uhr Required 2 > Tch o RE * 9 c Tano Company issues bonds with a par value of $83.000 on January 1, 2019 The bonds annual contract rate is 10% and interest is paid semiannually on June 30 and December 31. The bonds mature in three years. The annual market rate at the date of issuance is 12%, and the bonds are sold for $78,922 1. What is the amount of the discount on these bonds at issuance? 2 How much total bond interest expense will be recognized over the life of these bonds? 3. Prepare a straight-line amortization table for these bonds Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required a How much total bond interest expense will be recognized over the life of these bonde? Tocil Dondures Expo Our Life of Bands Amounted payment of Par value at may Total Lembut borrowed Total bondestens 5 arch O R Tano Company issues bonds with a par value of $83,000 on January 1, 2019 The bonds annual contract rate is 10% and interest paid secilannually on June 30 and December 31 The bonds mature in three years. The annual market rate at the date of issuance is 12% and the bonds are sold for $78,922 1. What is the amount of the discount on these bonds at issuance! 2. How much total bond interest expense will be recognized over the life of these bonds? 3. Prepare a straight line amortization table for these bonds Complete this question by entering your answers in the tabs below. Required Tequired Tequired Prepare a straight line amortization table for these bonds (Bound your intermediate calculation to the nearest doar amount Selannual Prod Umorised Carry End Decount Vale 01.01.2015 06/30/2015 12312019 06/30/2020 1201/2020

earch O c E HE * 19 $ U 2