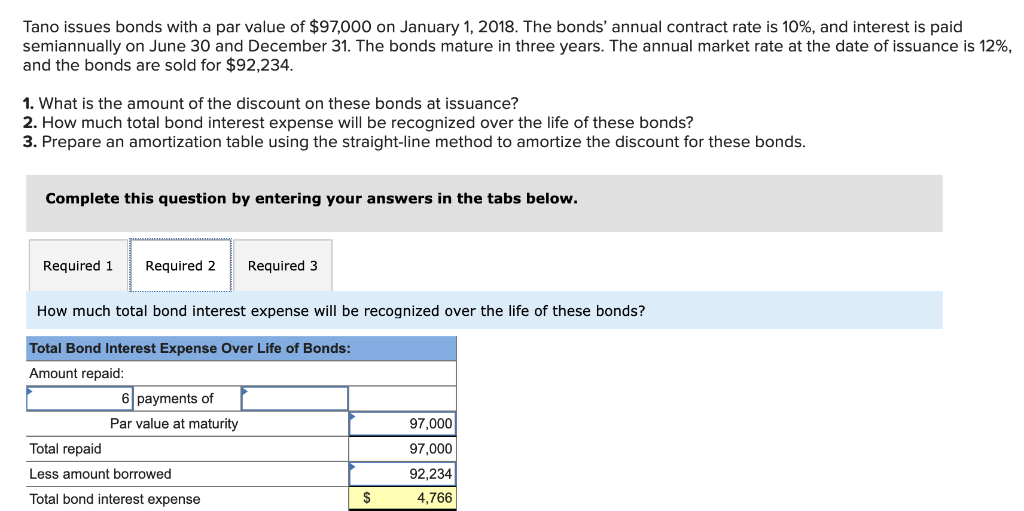

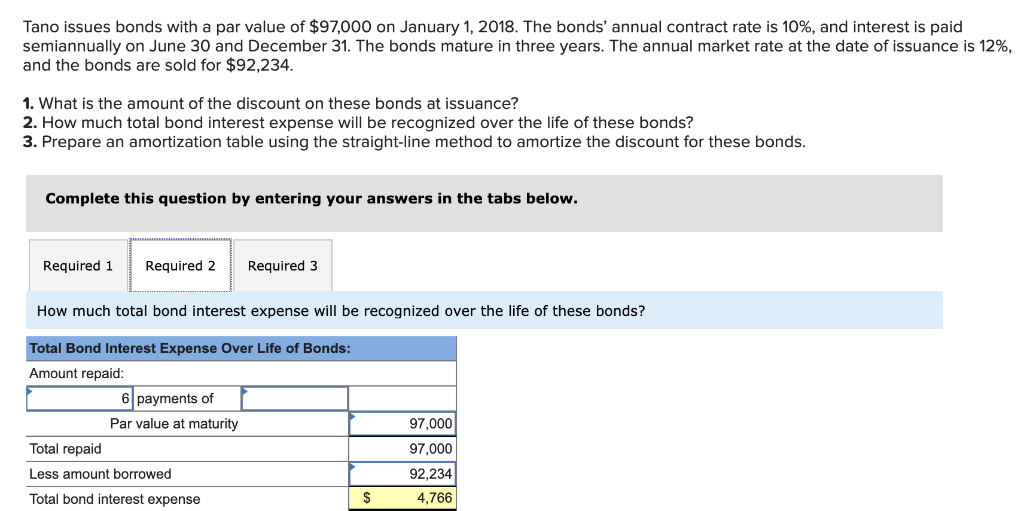

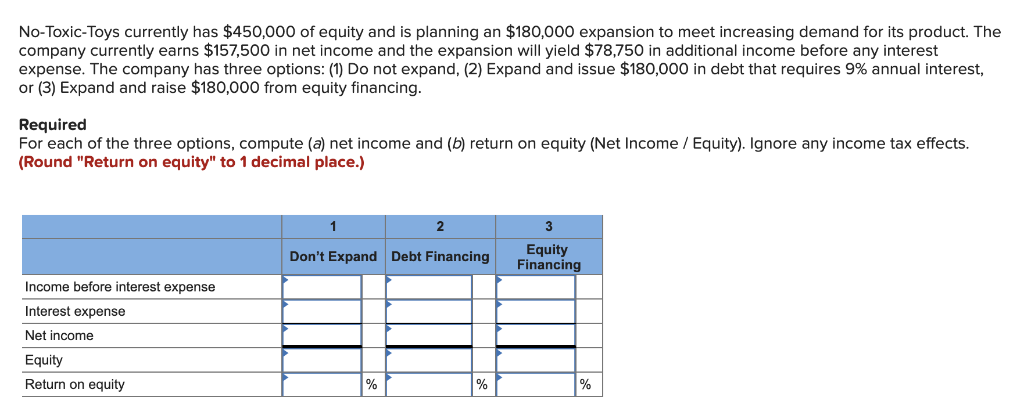

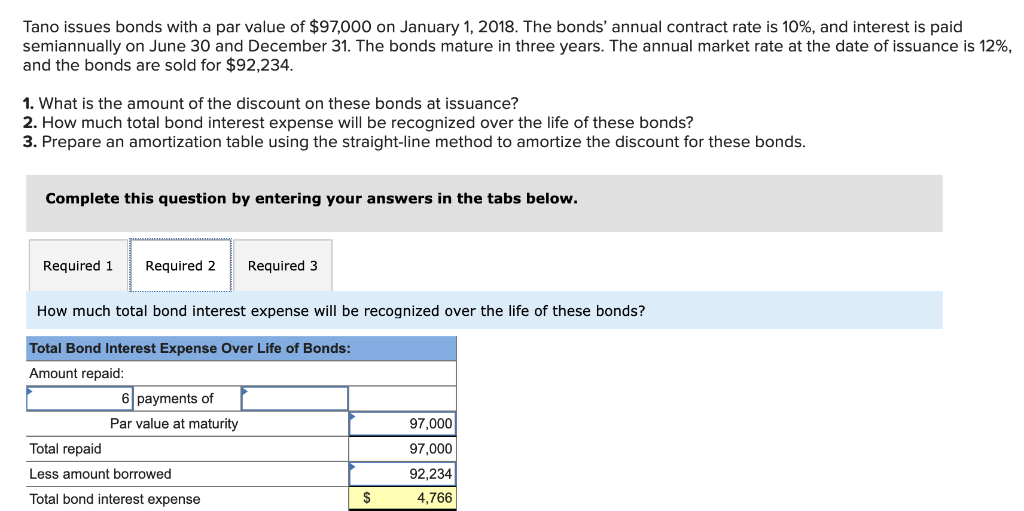

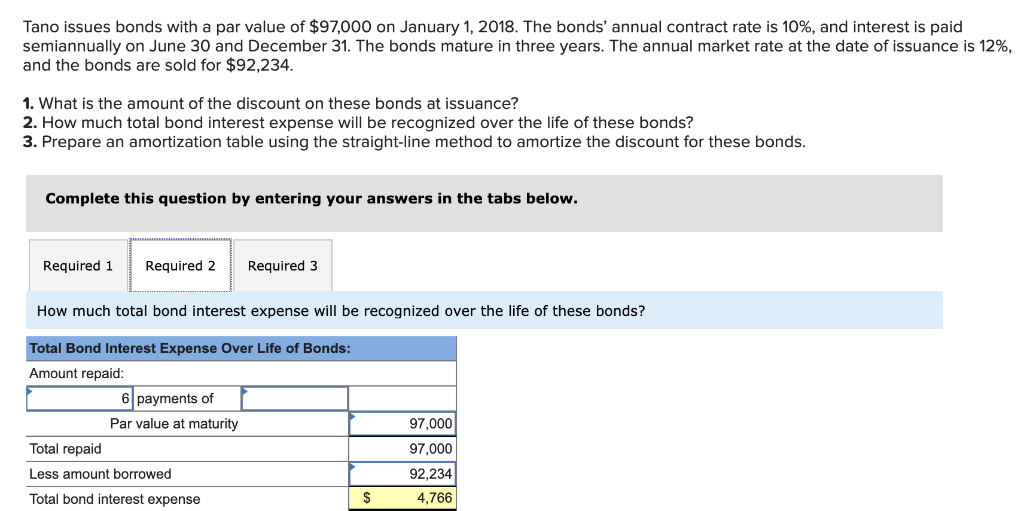

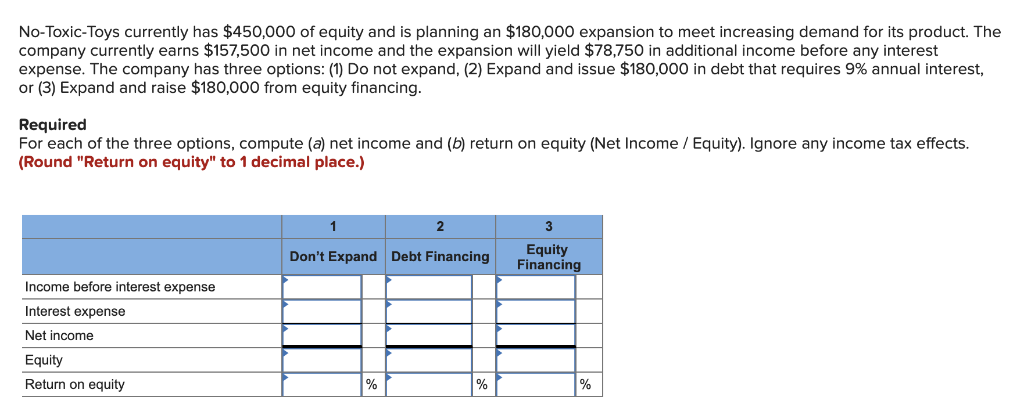

Tano issues bonds with a par value of $97,000 on January 1, 2018. The bonds' annual contract rate is 10%, and interest is paid semiannually on June 30 and December 31, The bonds mature in three years. The annual market rate at the date of issuance is 12%, and the bonds are sold for $92,234 1. What is the amount of the discount on these bonds at issuance? 2. How much total bond interest expense will be recognized over the life of these bonds? 3. Prepare an amortization table using the straight-line method to amortize the discount for these bonds Complete this question by entering your answers in the tabs below. Required 1Required 2Required 3 How much total bond interest expense will be recognized over the life of these bonds? Total Bond Interest Expense Over Life of Bonds Amount repaid: 6 payments of Par value at maturity Total repaid Less amount borrowed Total bond interest expense 97,000 97,000 92,234 4,766 Tano issues bonds with a par value of $97,000 on January 1, 2018. The bonds' annual contract rate is 10%, and interest is paid semiannually on June 30 and December 31, The bonds mature in three years. The annual market rate at the date of issuance is 12%, and the bonds are sold for $92,234 1. What is the amount of the discount on these bonds at issuance? 2. How much total bond interest expense will be recognized over the life of these bonds? 3. Prepare an amortization table using the straight-line method to amortize the discount for these bonds Complete this question by entering your answers in the tabs below. Required 1Required 2Required 3 How much total bond interest expense will be recognized over the life of these bonds? Total Bond Interest Expense Over Life of Bonds Amount repaid: 6 payments of Par value at maturity Total repaid Less amount borrowed Total bond interest expense 97,000 97,000 92,234 4,766 No-Toxic-Toys currently has $450,000 of equity and is planning an $180,000 expansion to meet increasing demand for its product. The company currently earns $157,500 in net income and the expansion will yield $78,750 in additional income before any interest expense. The company has three options: (1) Do not expand, (2) Expand and issue $180,000 in debt that requires 9% annual interest, or (3) Expand and raise $180,000 from equity financing. Required For each of the three options, compute (a) net income and (b) return on equity (Net Income / Equity). Ignore any income tax effects. (Round "Return on equity" to 1 decimal place.) 2 Don't Expand Debt Financing Financing Equity Income before interest expense Interest expense Net income Equity Return on equity