Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Tanya purchased a trailer park, as a sole proprietorship, on Jan 1, 2021. She did not record her transactions during the first four months of

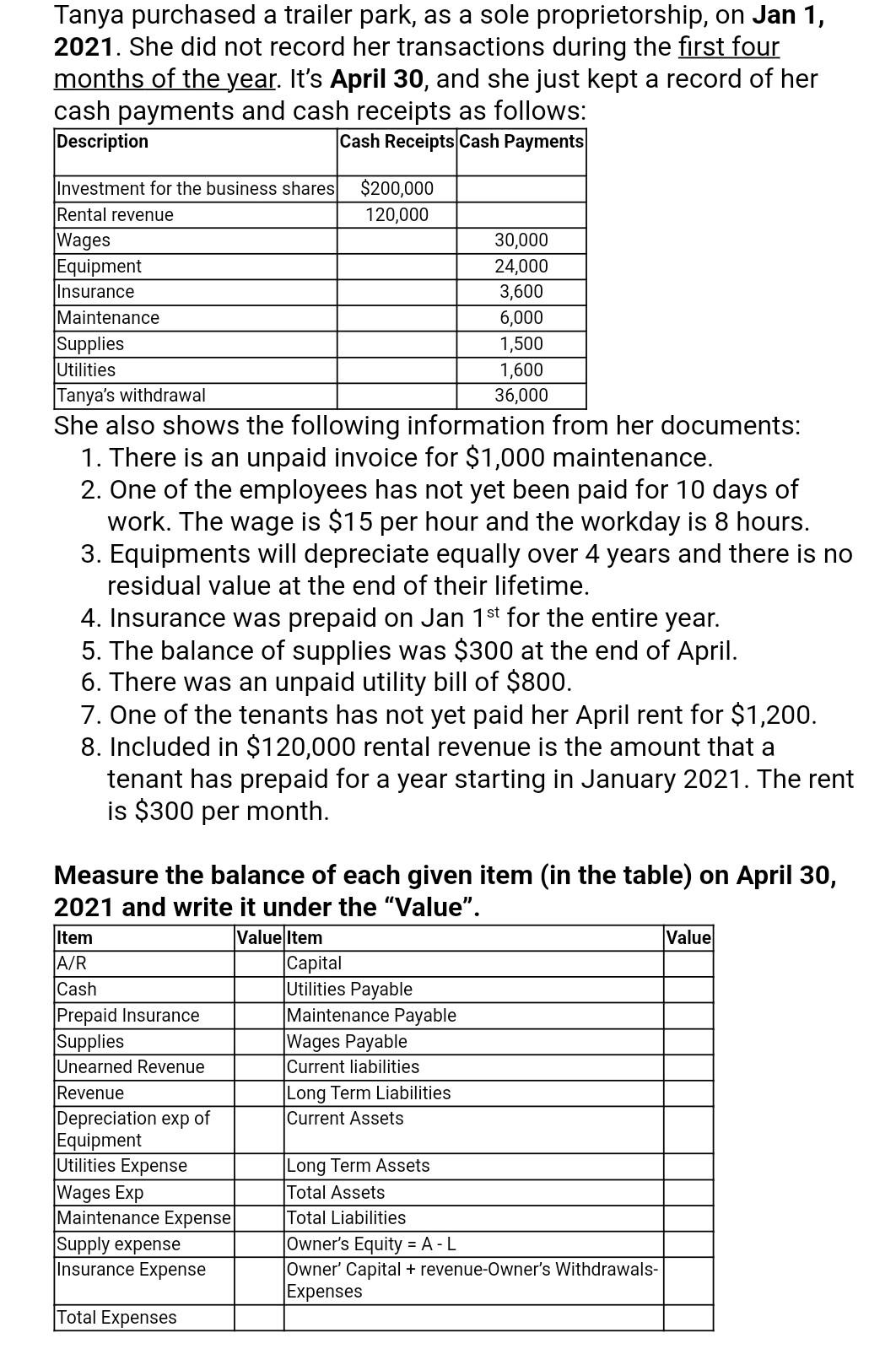

Tanya purchased a trailer park, as a sole proprietorship, on Jan 1, 2021. She did not record her transactions during the first four months of the year. It's April 30, and she just kept a record of her cash payments and cash receipts as follows: She also shows the following information from her documents: 1. There is an unpaid invoice for $1,000 maintenance. 2. One of the employees has not yet been paid for 10 days of work. The wage is $15 per hour and the workday is 8 hours. 3. Equipments will depreciate equally over 4 years and there is no residual value at the end of their lifetime. 4. Insurance was prepaid on Jan 1st for the entire year. 5. The balance of supplies was $300 at the end of April. 6. There was an unpaid utility bill of $800. 7. One of the tenants has not yet paid her April rent for $1,200. 8. Included in $120,000 rental revenue is the amount that a tenant has prepaid for a year starting in January 2021. The rent is $300 per month. Measure the balance of each given item (in the table) on April 30, 2021 and write it under the "Value

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started