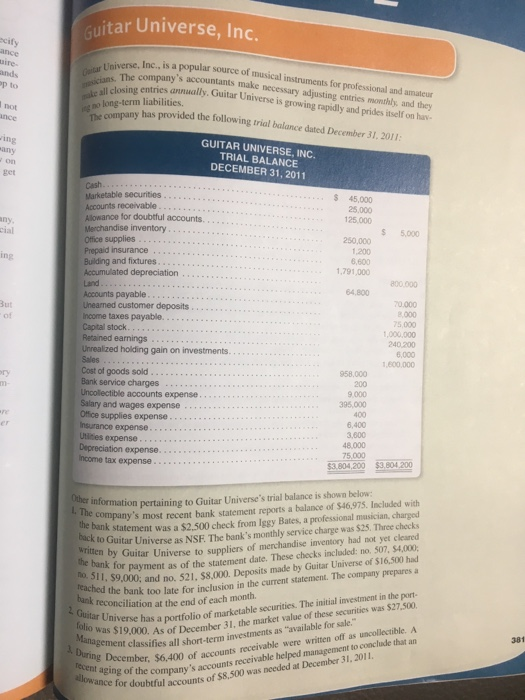

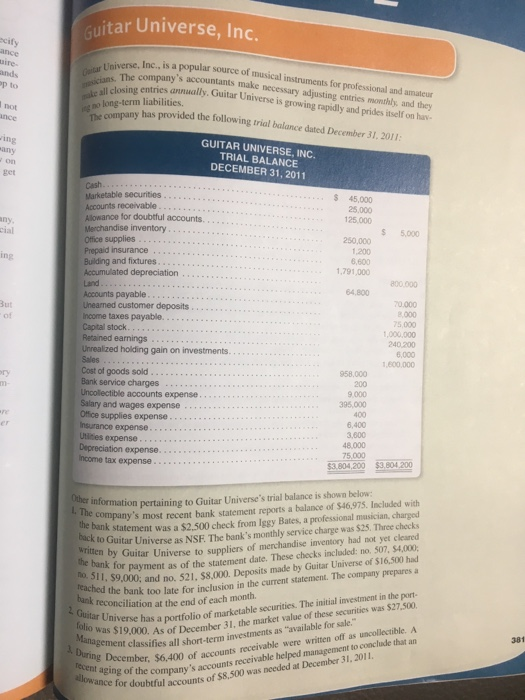

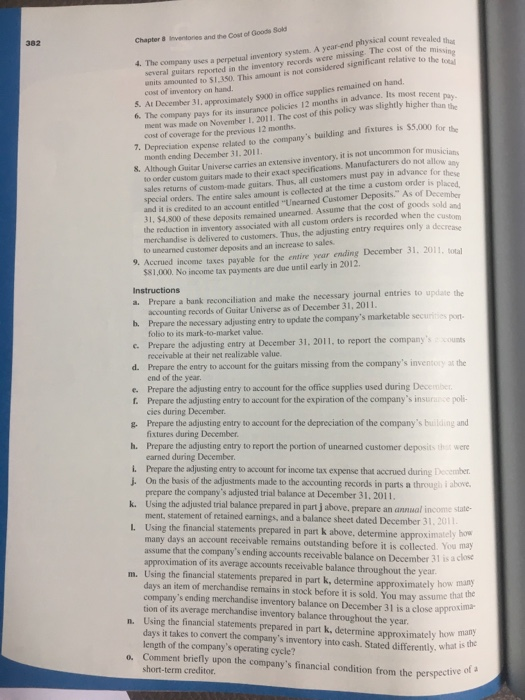

tar Universe, Inc. cify Joiverse, Inc., is a popular source of musical i instruments for professional and amateur The company's accountants make necessary adjusting entries monthly, and they ands P to entries annually, Guitar Universe is growing rapidly and prides itself on hav- ke all closing g no long-term liabilities. company has provided the following trial balance dated December 31, 2011 GUITAR UNIVERSE, INC. TRIAL BALANCE DECEMBER 31,2011 on get Marketable securities Accounts receivable Alowance for doubtful accounts. Merchandise inventory Office supplies Prepaid insurance Building and fixtures Accumulated depreciation Land S 45,000 25,000 125.000 cial S 5,00 250,000 1,200 6,600 791,000 800.000 64.800 70000 Accounts payable Uneaned customer deposits Income taxes payable.. Capital stock Retained earnings ,000 5,000 1,000,000 240.200 6,000 800,000 Unrealized holding gain on investments. Cost of goods sold... Bank service charges Uncollectible accounts expense 958.000 200 9.000 Salary and wages expense Office supplies expense Insurance expense 400 6,400 3,600 48.000 75.000 Jtities expense $3.804,200 $3,804 .200 information pertaining to Guitar Universe's trial balance is shown below: company's most recent bank statement reports a balance of $46,975. Included with bank statement was a $2.500 check from lggy Bates, a professional masician, charged Universe as NSF. The bank's monthly service charge was $25. Three checks uitar Universe to suppliers of merchandise inventory had not yet cleared back to Guitar the bank too late for inclusion in the current statement. The company prepares a reconciliation at the end of each month. for payment as of the statement date. These checks included: no. 507, $9,000: and no. 521, $8,000. Deposits made by Guitar Universe of $16,500 had 900As of December 31, the market value of these securities was $27.500 ment classifies all short-term investments as "available for sale. Guitar Un folio was S verse has a portfolio of marketable securities. The initial investment in the port- ts pecember, $6,400 of accounts receivable were written off as uncollectible. A recent ag 381 was needed at December 31, 2011 of the company's accounts receivable helped management to ance for doubtful accounts of $8,500