Answered step by step

Verified Expert Solution

Question

1 Approved Answer

target capital structure. Its 15 year bonds have a 3.5% coupon rate and sell for $944. Bond coupons are semi-annual. Rolling's stock beta is 1.3

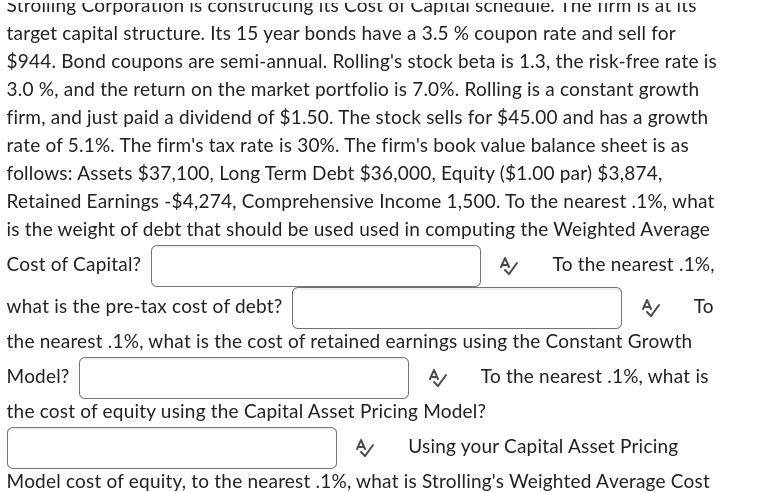

target capital structure. Its 15 year bonds have a 3.5% coupon rate and sell for $944. Bond coupons are semi-annual. Rolling's stock beta is 1.3 , the risk-free rate is 3.0%, and the return on the market portfolio is 7.0\%. Rolling is a constant growth firm, and just paid a dividend of $1.50. The stock sells for $45.00 and has a growth rate of 5.1%. The firm's tax rate is 30%. The firm's book value balance sheet is as follows: Assets $37,100, Long Term Debt $36,000, Equity ( $1.00 par) $3,874, Retained Earnings $4,274, Comprehensive Income 1,500 . To the nearest .1%, what is the weight of debt that should be used used in computing the Weighted Average Cost of Capital? A To the nearest .1\%, what is the pre-tax cost of debt? A To the nearest .1\%, what is the cost of retained earnings using the Constant Growth Model? A To the nearest .1\%, what is the cost of equity using the Capital Asset Pricing Model? A Using your Capital Asset Pricing

target capital structure. Its 15 year bonds have a 3.5% coupon rate and sell for $944. Bond coupons are semi-annual. Rolling's stock beta is 1.3 , the risk-free rate is 3.0%, and the return on the market portfolio is 7.0\%. Rolling is a constant growth firm, and just paid a dividend of $1.50. The stock sells for $45.00 and has a growth rate of 5.1%. The firm's tax rate is 30%. The firm's book value balance sheet is as follows: Assets $37,100, Long Term Debt $36,000, Equity ( $1.00 par) $3,874, Retained Earnings $4,274, Comprehensive Income 1,500 . To the nearest .1%, what is the weight of debt that should be used used in computing the Weighted Average Cost of Capital? A To the nearest .1\%, what is the pre-tax cost of debt? A To the nearest .1\%, what is the cost of retained earnings using the Constant Growth Model? A To the nearest .1\%, what is the cost of equity using the Capital Asset Pricing Model? A Using your Capital Asset Pricing Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started