Target Corporation prepares its financial statements according to U.S. GAAP. Targets financial statements and disclosure notes for the year ended February 3, 2018, are available here. This material is also available under the Investor Relations link at the companys website (www.target.com).(FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the tables provided.)

Required: In its Analysis of Financial Condition: New Accounting Pronouncements, Targets financial statements for the year ended February 3, 2018, the company indicates that In February 2016, the FASB issued ASU No. 2016-02, Leases, to require organizations that lease assets to recognize the rights and obligations created by those leases on the balance sheet. The new standard is effective in 2019.

Refer to Note 22: Leases. New lease accounting guidance requires companies to record a right-of-use asset and a lease liability for all leases, with the exception of short-term leases, at present value. If Target had used the new lease accounting guidance in its fiscal 2017 (February 3, 2018) financial statements, what would be the amount reported as a liability for its leases, operating and capital (finance) combined ? (Do not round intermediate calculations. Enter your answers to nearest millions. Round final answer to the nearest whole value.)

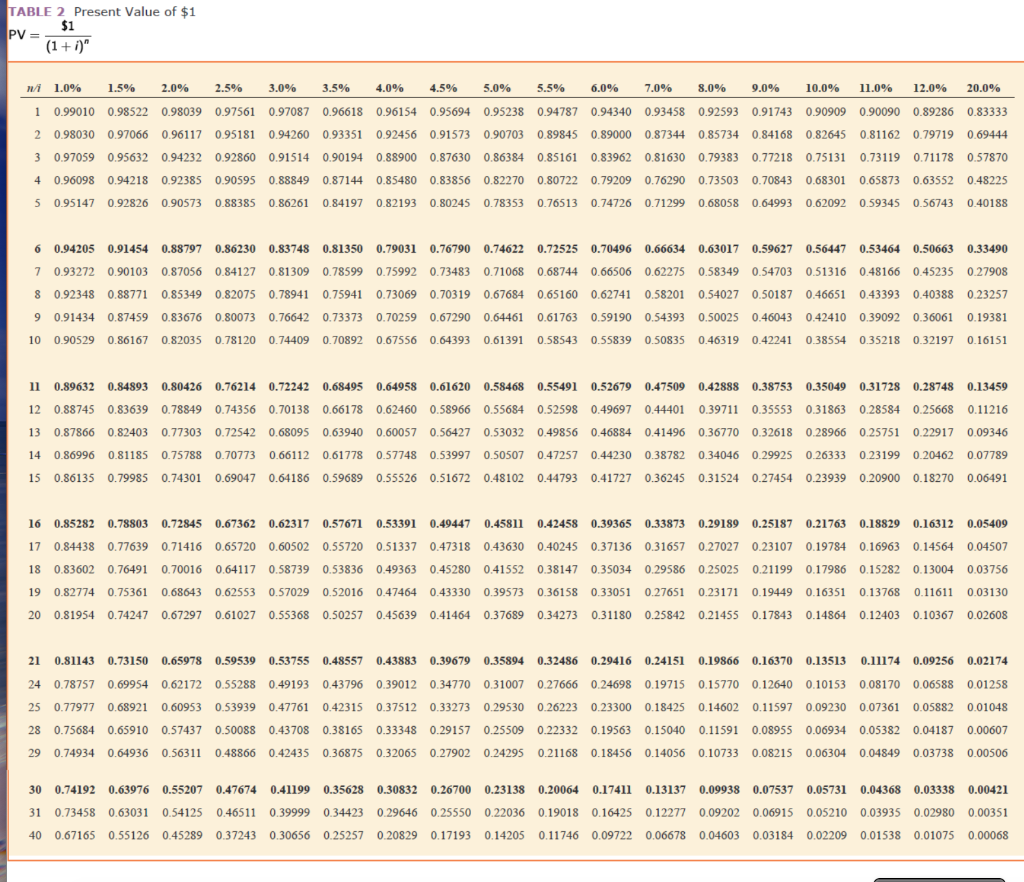

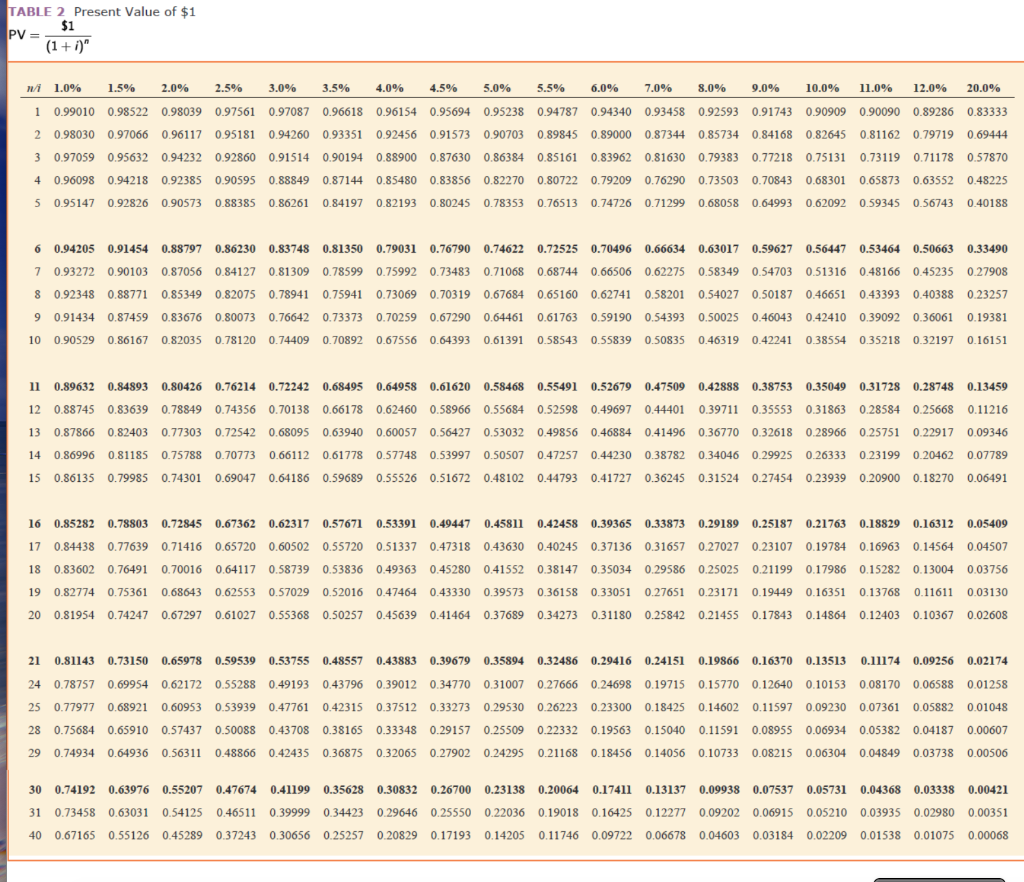

Hint: Assume the payments after 2020 are to be paid evenly over a 16-year period and all payments are at the end of years indicated. Target indicates elsewhere in its financial statements that 6% is an appropriate discount rate for its leases.

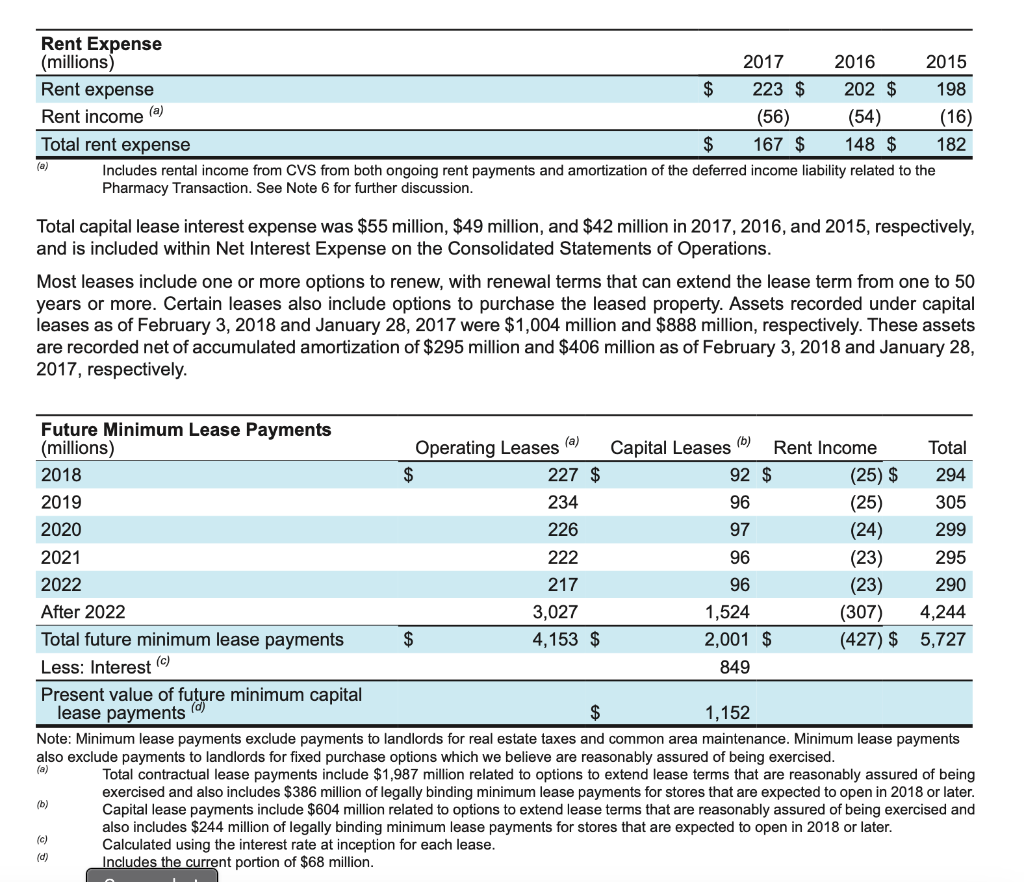

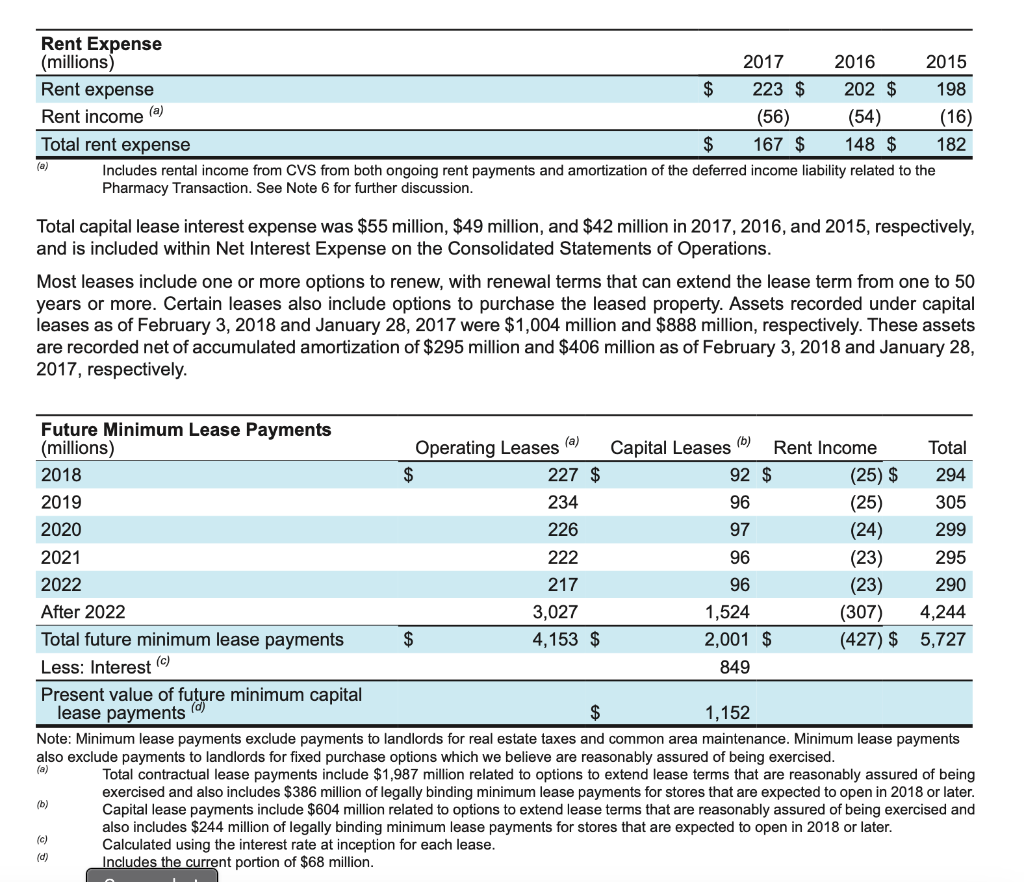

Pharmacy Transaction. See Note 6 for further discussion. Total capital lease interest expense was $55 million, $49 million, and $42 million in 2017, 2016, and 2015, respectively, and is included within Net Interest Expense on the Consolidated Statements of Operations. Most leases include one or more options to renew, with renewal terms that can extend the lease term from one to 50 years or more. Certain leases also include options to purchase the leased property. Assets recorded under capital leases as of February 3,2018 and January 28,2017 were $1,004 million and $888 million, respectively. These assets are recorded net of accumulated amortization of $295 million and $406 million as of February 3,2018 and January 28 , 2017, respectively. Note: Minimum lease payments exclude payments to landlords for real estate taxes and common area maintenance. Minimum lease payments also exclude payments to landlords for fixed purchase options which we believe are reasonably assured of being exercised. (a) Total contractual lease payments include $1,987 million related to options to extend lease terms that are reasonably assured of being exercised and also includes $386 million of legally binding minimum lease payments for stores that are expected to open in 2018 or later. (b) Capital lease payments include $604 million related to options to extend lease terms that are reasonably assured of being exercised and also includes $244 million of legally binding minimum lease payments for stores that are expected to open in 2018 or later. Calculated using the interest rate at inception for each lease. Includes the current portion of $68 million. TABLE 2 Present Value of $1 PV=n$1 Pharmacy Transaction. See Note 6 for further discussion. Total capital lease interest expense was $55 million, $49 million, and $42 million in 2017, 2016, and 2015, respectively, and is included within Net Interest Expense on the Consolidated Statements of Operations. Most leases include one or more options to renew, with renewal terms that can extend the lease term from one to 50 years or more. Certain leases also include options to purchase the leased property. Assets recorded under capital leases as of February 3,2018 and January 28,2017 were $1,004 million and $888 million, respectively. These assets are recorded net of accumulated amortization of $295 million and $406 million as of February 3,2018 and January 28 , 2017, respectively. Note: Minimum lease payments exclude payments to landlords for real estate taxes and common area maintenance. Minimum lease payments also exclude payments to landlords for fixed purchase options which we believe are reasonably assured of being exercised. (a) Total contractual lease payments include $1,987 million related to options to extend lease terms that are reasonably assured of being exercised and also includes $386 million of legally binding minimum lease payments for stores that are expected to open in 2018 or later. (b) Capital lease payments include $604 million related to options to extend lease terms that are reasonably assured of being exercised and also includes $244 million of legally binding minimum lease payments for stores that are expected to open in 2018 or later. Calculated using the interest rate at inception for each lease. Includes the current portion of $68 million. TABLE 2 Present Value of $1 PV=n$1