Answered step by step

Verified Expert Solution

Question

1 Approved Answer

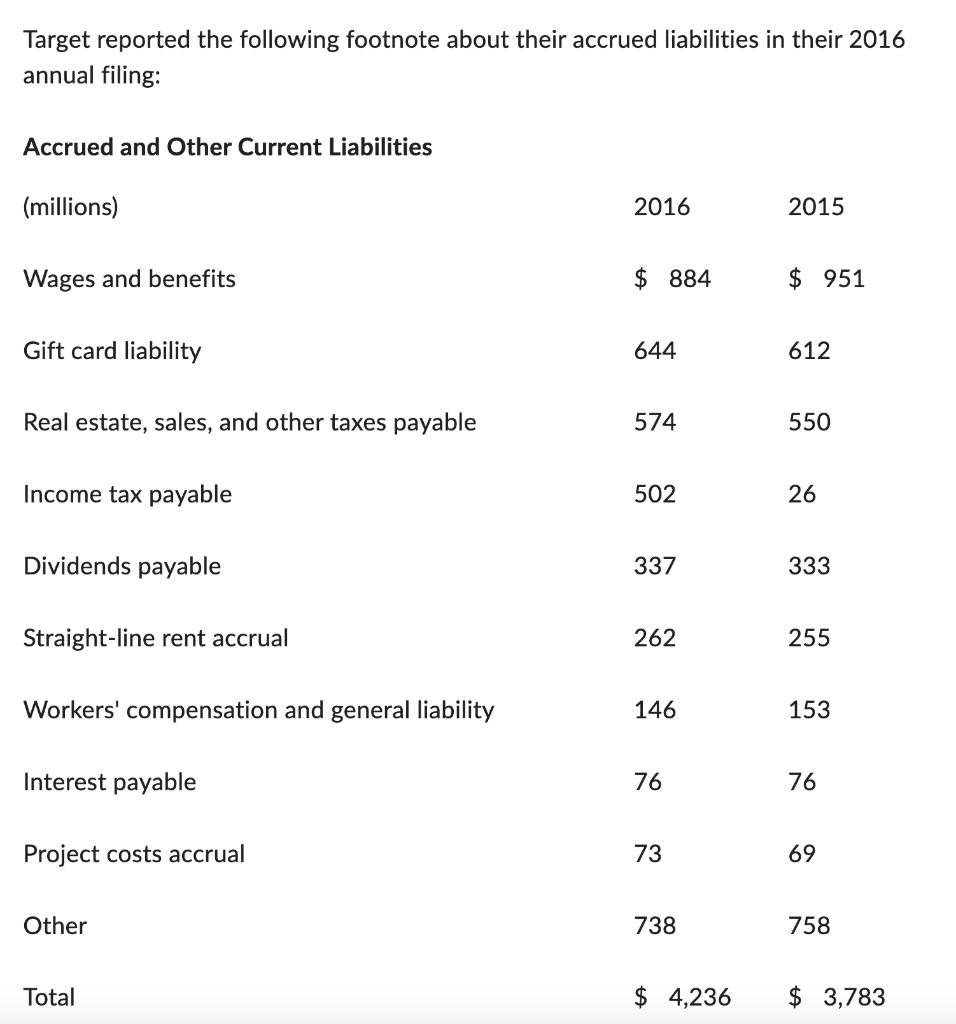

Target reported the following footnote about their accrued liabilities in their 2016 annual filing: Accrued and Other Current Liabilities (millions) Wages and benefits Gift

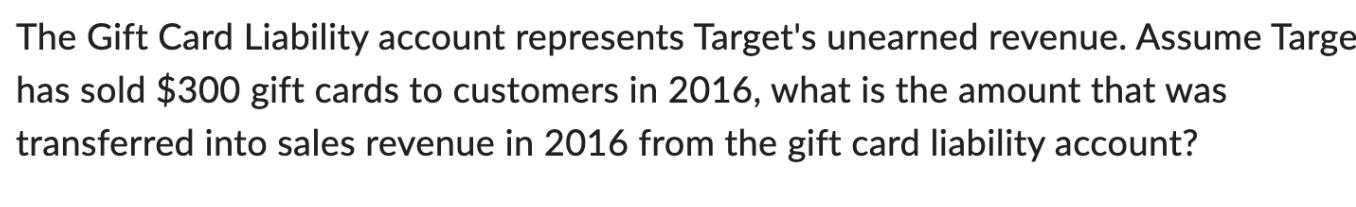

Target reported the following footnote about their accrued liabilities in their 2016 annual filing: Accrued and Other Current Liabilities (millions) Wages and benefits Gift card liability Real estate, sales, and other taxes payable Income tax payable Dividends payable Straight-line rent accrual Workers' compensation and general liability Interest payable Project costs accrual Other Total 2016 $884 644 574 502 337 262 146 76 73 738 $ 4,236 2015 $ 951 612 550 26 333 255 153 76 69 758 $3,783 The Gift Card Liability account represents Target's unearned revenue. Assume Targe has sold $300 gift cards to customers in 2016, what is the amount that was transferred into sales revenue in 2016 from the gift card liability account?

Step by Step Solution

★★★★★

3.52 Rating (165 Votes )

There are 3 Steps involved in it

Step: 1

To determine the amount transferred into sales revenue from the gift card liability account in 2016 we need to calculate the change in the gift card liability balance between 2015 and 2016 In 2015 the ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started