Answered step by step

Verified Expert Solution

Question

1 Approved Answer

target walmart what information is needed ? Evaluating stock as an investment 9. Price Earnings (P/E) ratio Note: Use Basic Earnings per share as the

target

walmart

what information is needed ?

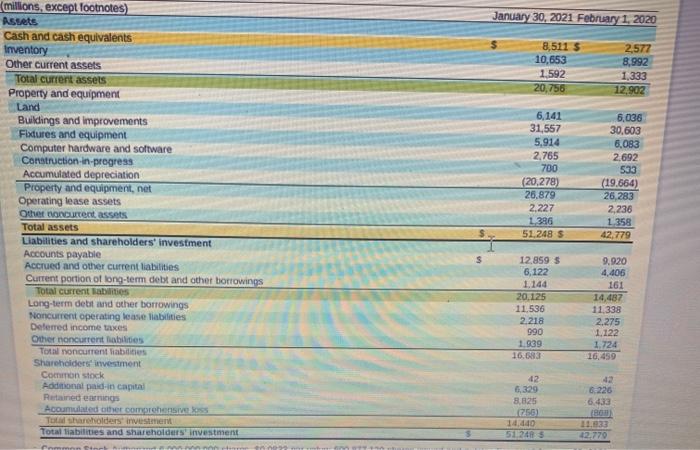

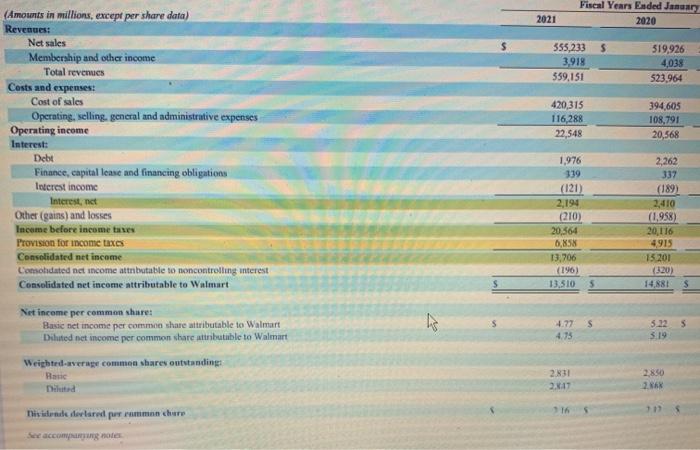

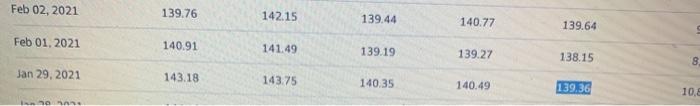

Evaluating stock as an investment 9. Price Earnings (P/E) ratio Note: Use Basic Earnings per share as the Earings per share to get the market price per share, you will need to look up the stock price as of the close of trading on the last day of the fiscal year. To get the market price of stock go to https://inance yahoo com. In the Search box, enter Walmart's stock symbol (WMT) and Delta's stock symbol (TGT) On the next screen, click on Historical Data. You will see the recent stock prices. Because January 30 and 31 fell over the weekend in 2021, you need the stock price on January 29,2021. Change the Time Period to 01/29/2021 - 02/01/2021 Click Done and Apply. Use the Adj Close on January 29, 2021 as the market price at the end of the fiscal year for the P-E ratio calculation January 30, 2021 February 1, 2020 8,511 5 10,653 1.592 20,756 2,577 8,992 1,333 12,902 (millions, except footnotes) Astets Cash and cash equivalents Inventory Other current assets Total current assets Property and equipment Land Buildings and improvements Fixtures and equipment Computer hardware and software Construction in progress Accumulated depreciation Property and equipment, net Operating lease assets Other Woutent assets Total assets Liabilities and shareholders' investment Accounts payable Accrued and other current liabilities Current portion of long-term debt and other borrowings Total current satis Long-term debit and other borrowings Noncurrent operating lease liabilities Deferred income taxes Other noncurrent abilities Total noncurrent liabilities Shareholders investment Common stock Additional paid in capital Retained earnings Acumulated other comprehensivos To shareholders investment Total liabilities and shareholders investment 6.141 31,557 5,914 2.765 700 (20,278) 26,879 2.227 1 386 51.248 5 6,038 30,603 6,083 2,692 533 (19.664) 26,283 2,236 1.358 42,779 12 859 $ 6,122 1.144 20.125 11.536 2.218 990 1939 16.683 9.920 4,406 161 14,487 11.338 2.275 1.122 1.724 16.459 6226 6.4.13 42 6,329 8,625 260 14.440 51245 11.933 42.770 month Fiscal Years Eaded January 2020 2021 $ 555,233 3918 559,151 319,926 4,038 523.964 420,315 116,288 22 548 394,605 108.791 20,568 (Amounts in millions, except per share data) Revenues: Net sales Membership and other income Total revenues Costs and expenses: Cost of sales Operating, selling, general and administrative expenses Operating income Interest: Debt Finance, capital lease and financing obligation loterest income Interest, net Other (gains) and losses Income before income taxes Provision for income taxes Consolidated net income Comohdated net income attributable to noncontrolling interest Consolidated net income attributable to Walmart 1,976 339 (121) 2,194 (210) 20,364 6,858 13,706 (196) 13.510 2,262 337 (189) 2,410 (1958) 20.116 4915 15 201 (320) 14,881 Net income per common share: Basic net income per common share attributable to Walmart Diluted net income per common share attributable to Walmart S 3 4.77 4.75 5.22 319 Weighted average common shares outstanding Ratic Diluted 2.31 2.17 2850 2. TA Dis donde estar pre prima chere See accompanying notes Feb 02, 2021 139.76 142.15 139.44 140.77 139.64 Feb 01, 2021 140.91 141.49 139.19 139.27 138.15 S Jan 29, 2021 143.18 143.75 140.35 140.49 139.36 10.5 10 Evaluating stock as an investment 9. Price Earnings (P/E) ratio Note: Use Basic Earnings per share as the Earings per share to get the market price per share, you will need to look up the stock price as of the close of trading on the last day of the fiscal year. To get the market price of stock go to https://inance yahoo com. In the Search box, enter Walmart's stock symbol (WMT) and Delta's stock symbol (TGT) On the next screen, click on Historical Data. You will see the recent stock prices. Because January 30 and 31 fell over the weekend in 2021, you need the stock price on January 29,2021. Change the Time Period to 01/29/2021 - 02/01/2021 Click Done and Apply. Use the Adj Close on January 29, 2021 as the market price at the end of the fiscal year for the P-E ratio calculation January 30, 2021 February 1, 2020 8,511 5 10,653 1.592 20,756 2,577 8,992 1,333 12,902 (millions, except footnotes) Astets Cash and cash equivalents Inventory Other current assets Total current assets Property and equipment Land Buildings and improvements Fixtures and equipment Computer hardware and software Construction in progress Accumulated depreciation Property and equipment, net Operating lease assets Other Woutent assets Total assets Liabilities and shareholders' investment Accounts payable Accrued and other current liabilities Current portion of long-term debt and other borrowings Total current satis Long-term debit and other borrowings Noncurrent operating lease liabilities Deferred income taxes Other noncurrent abilities Total noncurrent liabilities Shareholders investment Common stock Additional paid in capital Retained earnings Acumulated other comprehensivos To shareholders investment Total liabilities and shareholders investment 6.141 31,557 5,914 2.765 700 (20,278) 26,879 2.227 1 386 51.248 5 6,038 30,603 6,083 2,692 533 (19.664) 26,283 2,236 1.358 42,779 12 859 $ 6,122 1.144 20.125 11.536 2.218 990 1939 16.683 9.920 4,406 161 14,487 11.338 2.275 1.122 1.724 16.459 6226 6.4.13 42 6,329 8,625 260 14.440 51245 11.933 42.770 month Fiscal Years Eaded January 2020 2021 $ 555,233 3918 559,151 319,926 4,038 523.964 420,315 116,288 22 548 394,605 108.791 20,568 (Amounts in millions, except per share data) Revenues: Net sales Membership and other income Total revenues Costs and expenses: Cost of sales Operating, selling, general and administrative expenses Operating income Interest: Debt Finance, capital lease and financing obligation loterest income Interest, net Other (gains) and losses Income before income taxes Provision for income taxes Consolidated net income Comohdated net income attributable to noncontrolling interest Consolidated net income attributable to Walmart 1,976 339 (121) 2,194 (210) 20,364 6,858 13,706 (196) 13.510 2,262 337 (189) 2,410 (1958) 20.116 4915 15 201 (320) 14,881 Net income per common share: Basic net income per common share attributable to Walmart Diluted net income per common share attributable to Walmart S 3 4.77 4.75 5.22 319 Weighted average common shares outstanding Ratic Diluted 2.31 2.17 2850 2. TA Dis donde estar pre prima chere See accompanying notes Feb 02, 2021 139.76 142.15 139.44 140.77 139.64 Feb 01, 2021 140.91 141.49 139.19 139.27 138.15 S Jan 29, 2021 143.18 143.75 140.35 140.49 139.36 10.5 10 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started