targets

walmarts

please help lost with numbers

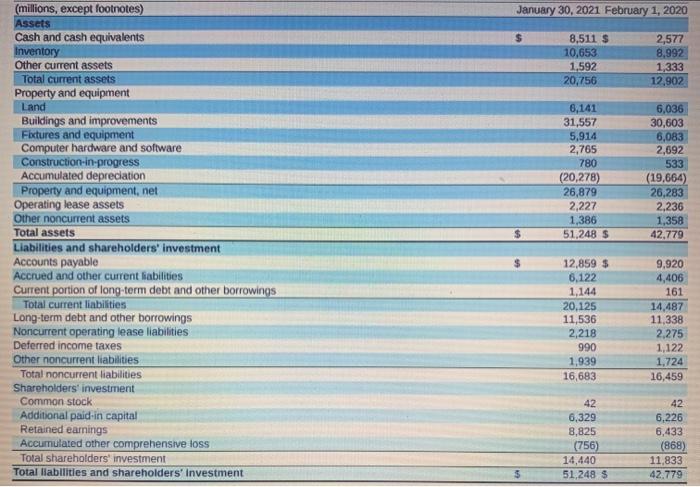

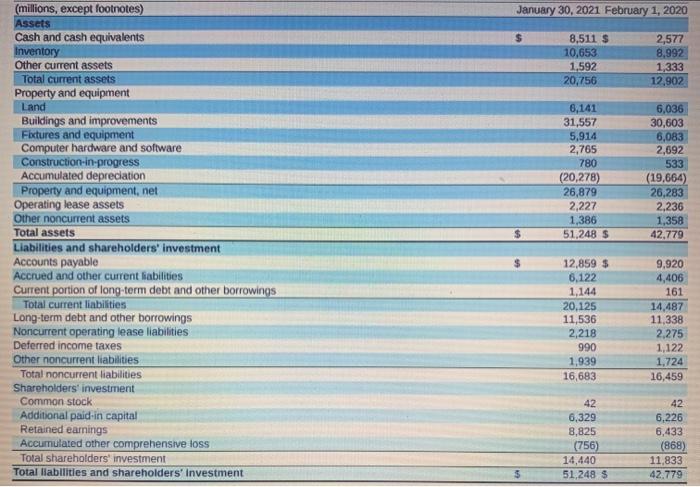

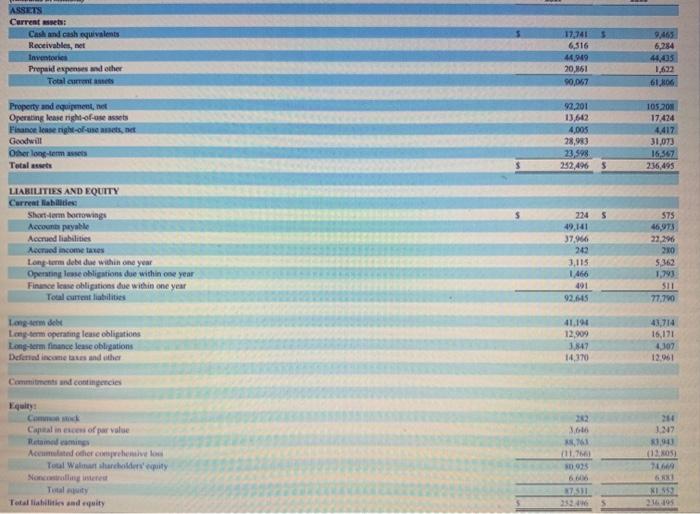

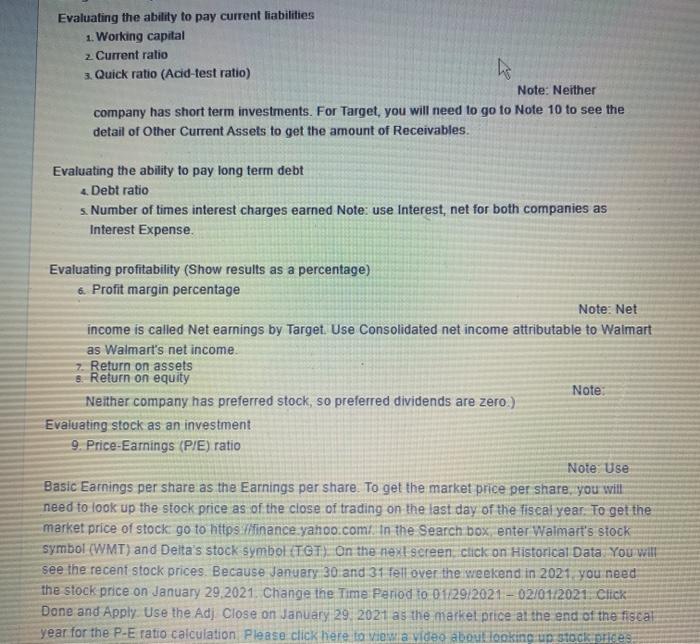

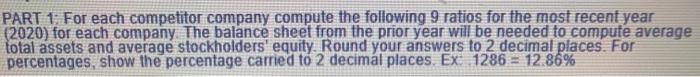

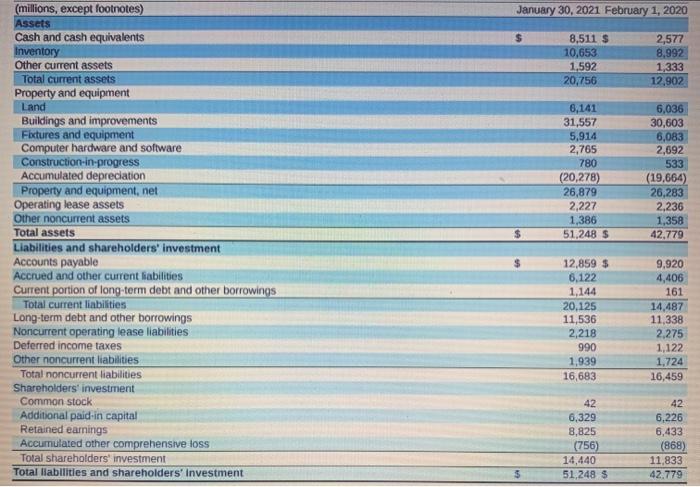

January 30, 2021 February 1, 2020 $ 8,511 $ 10,653 1,592 20,756 2,577 8,992 1,333 12,902 (millions, except footnotes) Assets Cash and cash equivalents Inventory Other current assets Total current assets Property and equipment Land Buildings and improvements Fixtures and equipment Computer hardware and software Construction-in-progress Accumulated depreciation Property and equipment, net Operating lease assets Other noncurrent assets Total assets Liabilities and shareholders' investment Accounts payable Accrued and other current liabilities Current portion of long-term debt and other borrowings Total current liabilities Long-term debt and other borrowings Noncurrent operating lease liabilities Deferred income taxes Other noncurrent liabilities Total noncurrent liabilities Shareholders' investment Common stock Additional paid-in capital Retained earnings Accumulated other comprehensive loss Total shareholders' investment Total liabilities and shareholders' Investment 6,141 31,557 5,914 2,765 780 (20,278) 26,879 2,227 1,386 51.248 S 6,036 30,603 6,083 2,692 533 (19,664) 26,283 2,236 1,358 42,779 12,859 $ 6,122 1,144 20.125 11,536 2,218 990 1,939 16,683 9,920 4,406 161 14,487 11,338 2,275 1,122 1,724 16,459 42 6,329 8,825 (756) 14,440 51,248 $ 42 6,226 6,433 (868) 11,833 42.779 $ s ASSETS Current Cash and cash equivalents Receivables, et Inventor Prepaid expenses and other Total 17,741 6,516 44,99 20.861 90,067 9.463 6,284 44,005 1,632 61.06 Property and equipment, Operating last night-of-se assets anotone right ones.net Goodwill Other long-term Total 92,201 13,642 4,005 28,983 23,598 282,496 105.2011 17.424 4417 31,073 16,367 2.36,495 5 $ 224 49.141 37,966 LIABILITIES AND EQUITY Current Rahiti Short-term borrowings Account proble Accrued liabilities Accred income taxes Long tum debt de within one year Operating se obligations doe within one year Finance les obligations due within one year Totalcument liabilities 20 3,115 1,466 491 92.645 575 46,973 29.296 210 5362 1,793 SIL 77.700 Long-term dele Long-term operating lense obligations Long-term finance lease obligations Defend income and other 41,194 12,909 3.847 14.370 41,714 15,171 4307 12.961 200 27 Commitments and contingencie Equity Com Capaal in excess of our value Remedim Aceste oder geheel Tuul Walschodierity Noncologie Total Total liabilities and equity OS 11 11.760 005 6 *7531 2324 SE 216.95 Evaluating the ability to pay current liabilities 1. Working capital 2. Current ratio 3. Quick ratio (Acid-test ratio) Note: Neither company has short term investments. For Target, you will need to go to Note 10 to see the detail of Other Current Assets to get the amount of Receivables. Evaluating the ability to pay long term debt 4. Debt ratio s. Number of times interest charges earned Note: use Interest, net for both companies as Interest Expense. Evaluating profitability (Show results as a percentage) 6. Profit margin percentage Note: Net income is called Net earnings by Target. Use Consolidated net income attributable to Walmart as Walmart's net income. 7. Return on assets 8. Return on equity Note Neither company has preferred stock, so preferred dividends are zero.) Evaluating stock as an investment 9. Price-Earnings (P/E) ratio Note Use Basic Earnings per share as the Earnings per share. To get the market price per share, you will need to look up the stock price as of the close of trading on the last day of the fiscal year. To get the market price of stock go to https finance.yahoo.com in the Search box enter Walmart's stock symbol (WMT) and Delta's stock symbol TGT) On the next sereen click on Historical Data You will see the recent stock prices. Because January 30 and 31 Tell over the weekend in 2021 you need the stock price on January 29,2021. Change the Time Period to 01/29/2021 - 02/01/2021. Click Done and Apply Use the Adj. Close on January 29 2021 as the market price at the end of the fiscal year for the P-E ratio calculation Please click here to view a video about looking up stockages PART 1: For each competitor company compute the following 9 ratios for the most recent year (2020) for each company. The balance sheet from the prior year will be needed to compute average total assets and average stockholders' equity. Round your answers to 2 decimal places. For percentages, show the percentage carried to 2 decimal places. Ex 1286 = 12.86%