Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Targett Company had no short-term investments prior to the year 2017. It had the following transactions involving short-term investments in available-for-sale securities during 2017. April

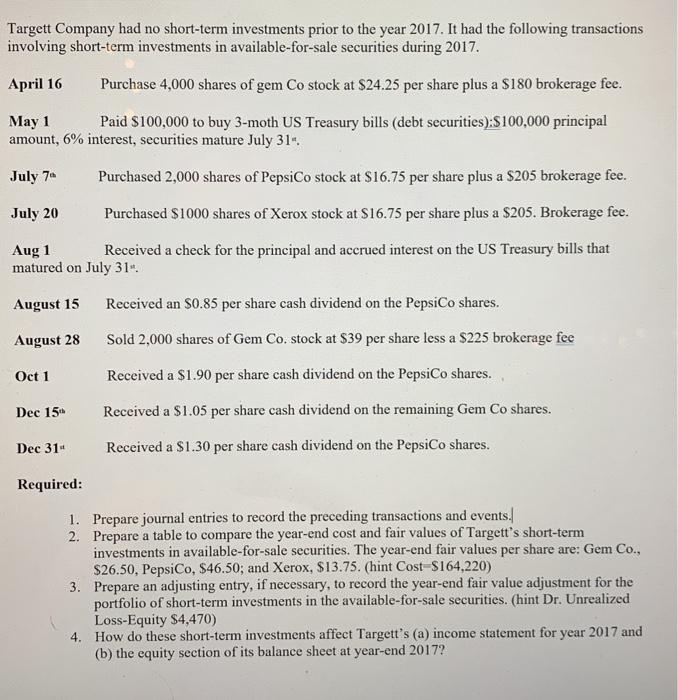

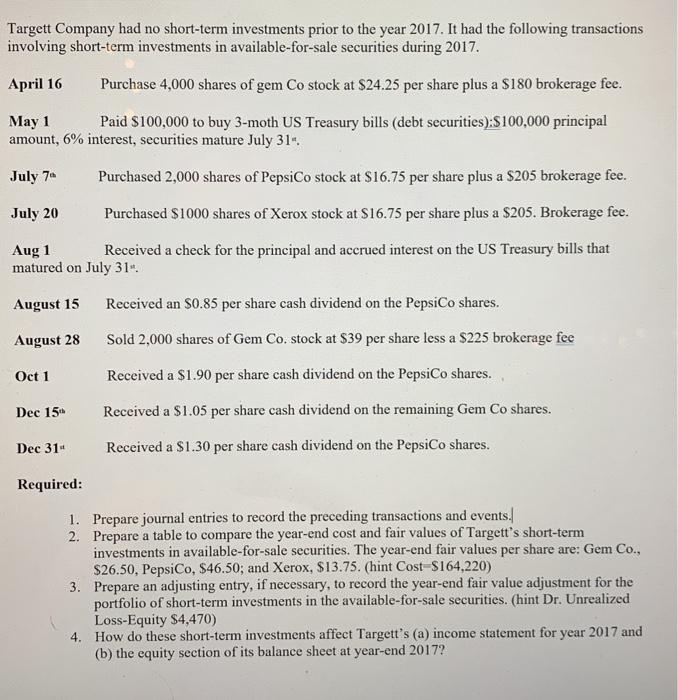

Targett Company had no short-term investments prior to the year 2017. It had the following transactions involving short-term investments in available-for-sale securities during 2017. April 16 Purchase 4,000 shares of gem Co stock at $24.25 per share plus a $180 brokerage fee. May 1 Paid $100,000 to buy 3-moth US Treasury bills (debt securities):$100,000 principal amount, 6% interest, securities mature July 31. July 7 Purchased 2,000 shares of PepsiCo stock at $16.75 per share plus a $205 brokerage fee. July 20 Purchased $1000 shares of Xerox stock at $16.75 per share plus a $205. Brokerage fee. Aug 1 Received a check for the principal and accrued interest on the US Treasury bills that matured on July 31 August 15 Received an 80.85 per share cash dividend on the PepsiCo shares. August 28 Sold 2,000 shares of Gem Co. stock at $39 per share less a $225 brokerage fee Received a $1.90 per share cash dividend on the PepsiCo shares. Oct 1 Dec 15 Received a $1.05 per share cash dividend on the remaining Gem Co shares. Dec 31 Received a $1.30 per share cash dividend on the PepsiCo shares. Required: 1. Prepare journal entries to record the preceding transactions and events. 2. Prepare a table to compare the year-end cost and fair values of Targett's short-term investments in available-for-sale securities. The year-end fair values per share are: Gem Co., $26.50, PepsiCo, $46.50; and Xerox, $13.75. (hint Cost-S164,220) 3. Prepare an adjusting entry, if necessary, to record the year-end fair value adjustment for the portfolio of short-term investments in the available-for-sale securities. (hint Dr. Unrealized Loss-Equity $4,470) 4. How do these short-term investments affect Targett's (a) income statement for year 2017 and (b) the equity section of its balance sheet at year-end 2017

Targett Company had no short-term investments prior to the year 2017. It had the following transactions involving short-term investments in available-for-sale securities during 2017. April 16 Purchase 4,000 shares of gem Co stock at $24.25 per share plus a $180 brokerage fee. May 1 Paid $100,000 to buy 3-moth US Treasury bills (debt securities):$100,000 principal amount, 6% interest, securities mature July 31. July 7 Purchased 2,000 shares of PepsiCo stock at $16.75 per share plus a $205 brokerage fee. July 20 Purchased $1000 shares of Xerox stock at $16.75 per share plus a $205. Brokerage fee. Aug 1 Received a check for the principal and accrued interest on the US Treasury bills that matured on July 31 August 15 Received an 80.85 per share cash dividend on the PepsiCo shares. August 28 Sold 2,000 shares of Gem Co. stock at $39 per share less a $225 brokerage fee Received a $1.90 per share cash dividend on the PepsiCo shares. Oct 1 Dec 15 Received a $1.05 per share cash dividend on the remaining Gem Co shares. Dec 31 Received a $1.30 per share cash dividend on the PepsiCo shares. Required: 1. Prepare journal entries to record the preceding transactions and events. 2. Prepare a table to compare the year-end cost and fair values of Targett's short-term investments in available-for-sale securities. The year-end fair values per share are: Gem Co., $26.50, PepsiCo, $46.50; and Xerox, $13.75. (hint Cost-S164,220) 3. Prepare an adjusting entry, if necessary, to record the year-end fair value adjustment for the portfolio of short-term investments in the available-for-sale securities. (hint Dr. Unrealized Loss-Equity $4,470) 4. How do these short-term investments affect Targett's (a) income statement for year 2017 and (b) the equity section of its balance sheet at year-end 2017

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started