Question

TASCA Bhd is principally engaged as a total logistics solution provider commencement on 1 January 2016 and listed on the Main Market of Bursa Malaysia

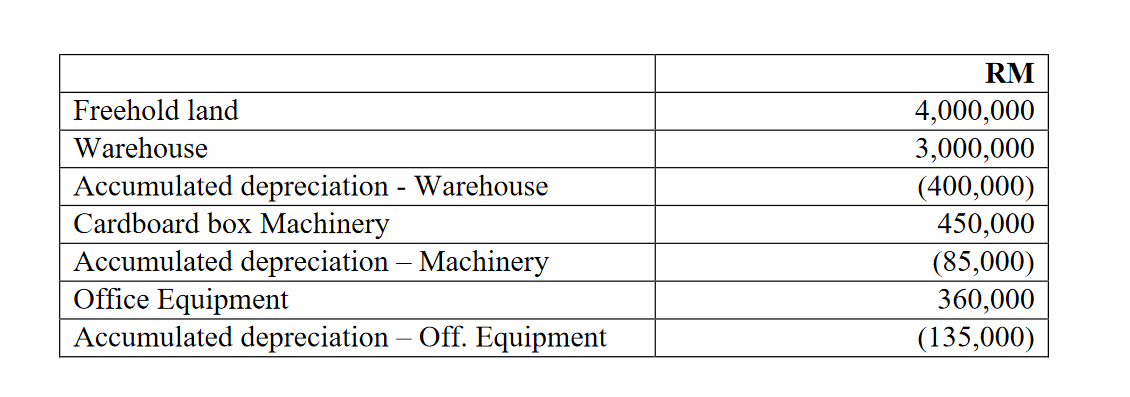

TASCA Bhd is principally engaged as a total logistics solution provider commencement on 1 January 2016 and listed on the Main Market of Bursa Malaysia in the category of Trading/Services. The company closes its accounts on 31 December every year. Information about TASCA Bhds property, plant, and equipment on 31 December 2019 is summarised in the table below.

Additional information:

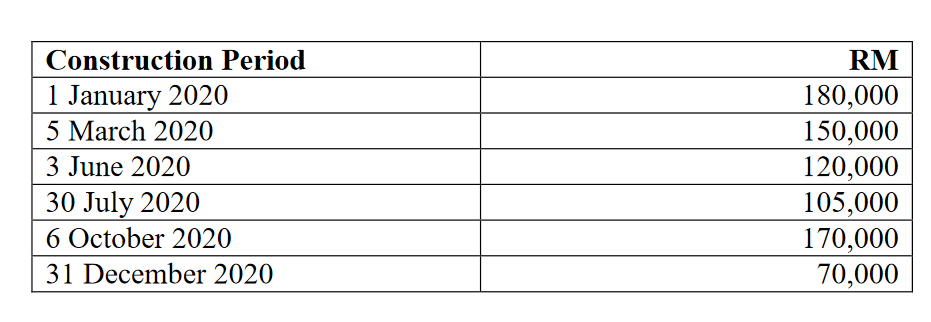

1)TASCA Bhd incurredthe following costs from1January 2020to 31 December 2020 in relation to the construction of a new officebuilding and the introduction of its services of the supply chain includingwarehouse management, order fulfillment, and shipping orders products to thelocal market. The company borrowedspecific loanof RM400,000 at a 6% interest rate from Aksari Bankon1 January2020. Moreover, the company has an existing bank loan of RM800,000 at 8% on 1 January2020.

2)The land and warehouse were revalued to RM4,400,000 and RM2,350,000, respectivelyon31 December 2020.

3)On 1 July2020, TASCA Bhd exchanged the old office equipment and RM150,000 for new office equipment. The old office equipment was estimated to have a 5-year life. Depreciation on the old office equipment has been recorded through 31 December 2019. It is estimated that the fair value of the old office equipment is RM120,000 on 1 July 2020

4)On 31 December2019, TASCA Bhdconducted an impairment test for cardboard box manufacturing machineryand found that there is an indication of impairment. However, the2management anticipatesthe present value of future net cash flow from cardboard box manufacturing machinery to be RM341,200 and its fair value to RM343,000. The estimated selling cost to be 4% of its fair value.

5)TASCA Bhdexpecting that the demand for cardboard box manufacturing machinery would increase in the foreseeable future,the entity did not dispose of its machine.On 31December2020, itfurther estimated the present value of future net cash flow from cardboard box manufacturing machinery to be RM304,600 and its fair value to RM320,000. The estimated selling cost to be 4%.

6)The accounting policies related to the depreciation of the assets are as follows:

Warehouse 6%

Cardboard Box Machinery15%

Office Equipment20%

REQUIRED:(Round your answer to the whole number)

(a)Calculate the amount of interest to be capitalised for the financial year 2020 and prepare the journal entries related to the interest capitalisation.(10Marks)(b)Prepare the journal entries to record revaluation of land and warehouse for the financial year 2020.(2Marks)

(c)Prepare the journal entries to record the exchangeand depreciation of the office equipment on 1 July2020.(3Marks)

(d)Prepare the journal entries to record the impairmentand depreciationof the Cardboard Box Machineryon 31 December2019 and 31 December2020. (5Marks)

Freehold land Warehouse Accumulated depreciation - Warehouse Cardboard box Machinery Accumulated depreciation - Machinery Office Equipment Accumulated depreciation - Off. Equipment RM 4,000,000 3,000,000 (400,000) 450,000 (85,000) 360,000 (135,000) Construction Period 1 January 2020 5 March 2020 3 June 2020 30 July 2020 6 October 2020 31 December 2020 RM 180,000 150,000 120,000 105,000 170,000 70,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started