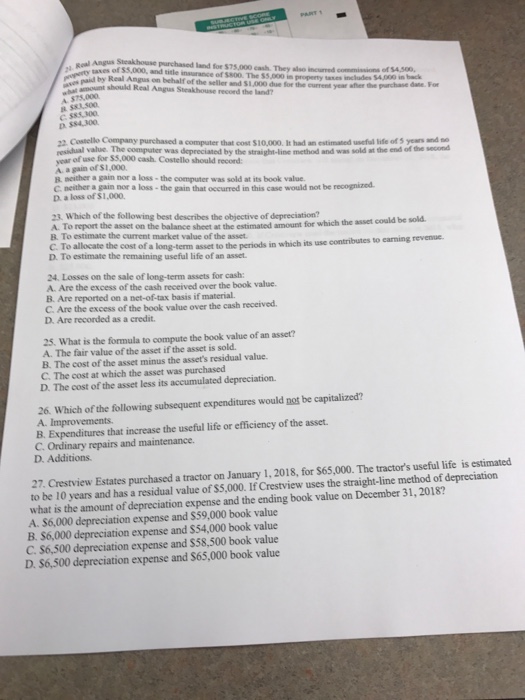

tases of SN000, and title insurance of SR00 The sSA00 Property tanes includes s in id by Real Angus on behalf of seller and sl 000 due for the eurrent year aner should Real Angus Steakhouse record the 22 Costello Company purchased a computer that cost slo 000. It had an estimated useful lise of years and residual value. The computer was depreciated by the straight-line method and was sold at the end of e second of use for SS 000 cash. Costello should record: of SI,000. A again B, neither a gain nor a loss-the computer was sold at its book value. c neither a gain nor a loss the gain that occurred in this case would not be recognize D a loss of SI,000. 23, which of the following best describes the objective of depreciation? the asset could be sold. A To report the asset on the balance sheet at the estimated amount for B. To estimate the current market value of the asset. contributes to eaming revenue. C. To allocate the cost of long-term assetto the periods in which its use D. To estimate the remaining useful life of an asset. 24. Losses on the sale of long-term assets for cash: A. Are the excess of the cash received over the book value. B. Are reported on a net-oftax basis if material. C Are the excess of the book value over the cash received. D. Are recorded as a credit. 25. What is the formula to compute the book value of an asset? A. The fair value of the asset if the asset is sold. B. The cost of the asset minus the assets residual value. C. The cost at which the asset was purchased D. The cost of the asset less accumulated depreciation. 26 which of the following subsequent expenditures would not be capitalized? B. Expenditures that increase the useful life or efficiency of the asset. C Ordinary repairs and maintenance. D. Additions. estimated 27. Crestview Estates purchased a tractor on January 1,2018, for tractors useful life is to be 10 years and has a residual value ofS5,000. IfCrestview uses the strai method of depreciation what is the amount of depreciation expense and the ending book value on 31, 2018? December A S6,000 depreciation expense and S59,000 book value B. S6,000 depreciation expense and S54,000 book value C S6,500 depreciation expense and S58,500 book value D. S6,500 depreciation expense and S65,000 book value