Task 1: Financial Analysis

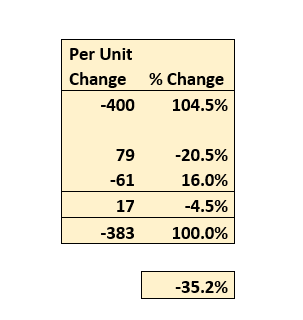

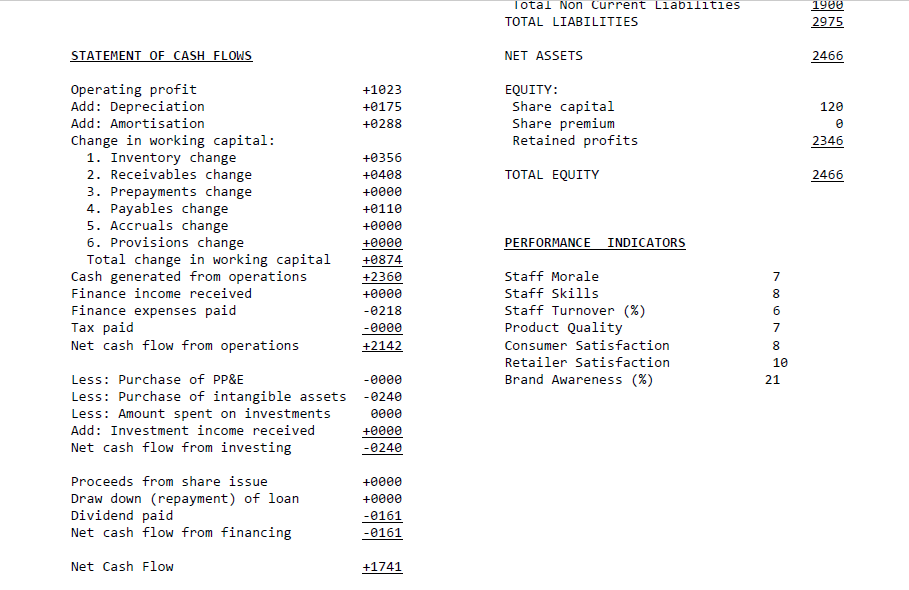

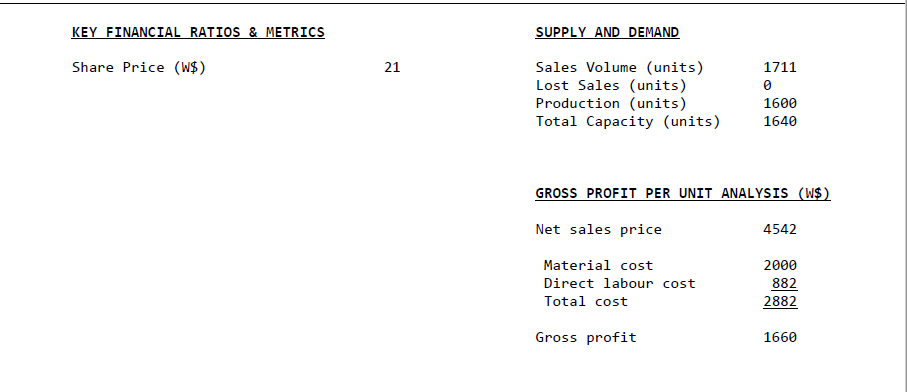

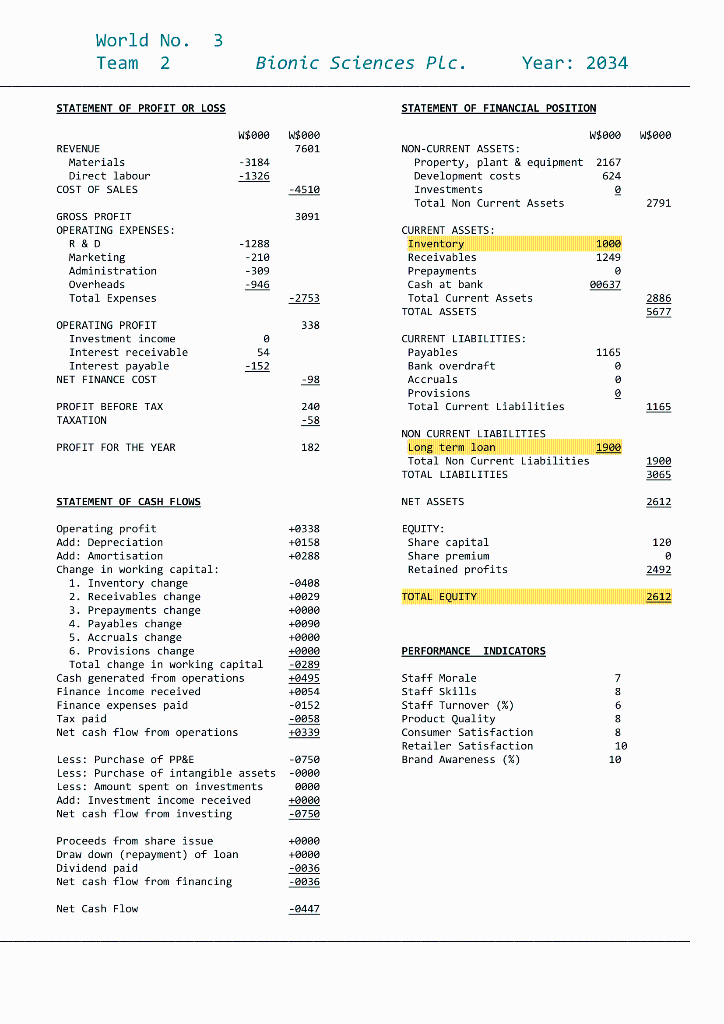

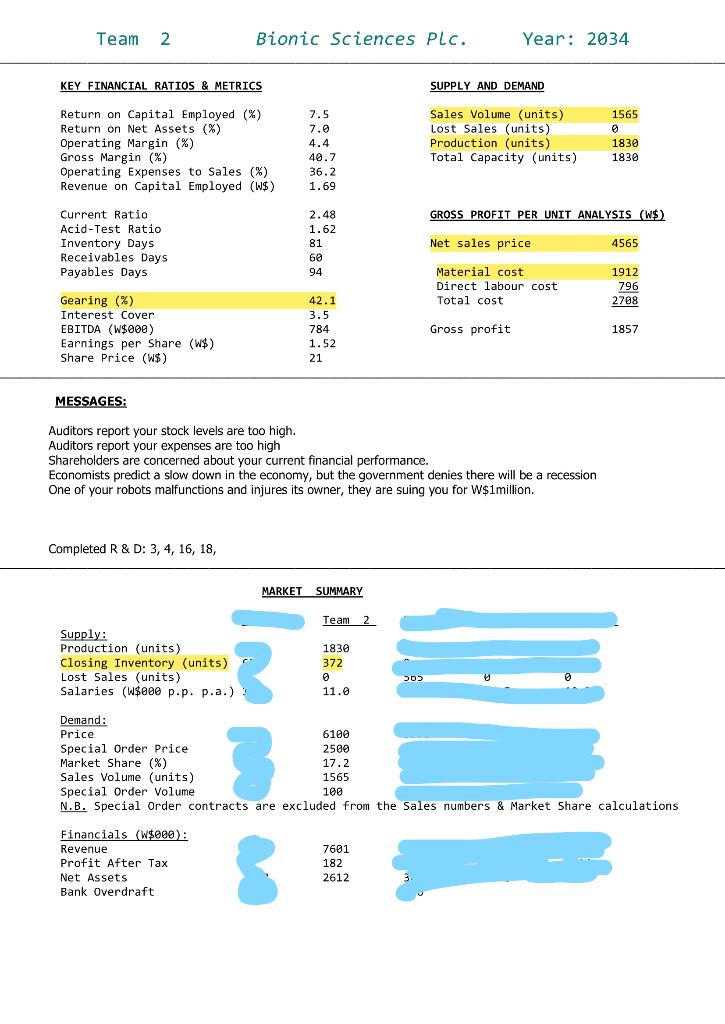

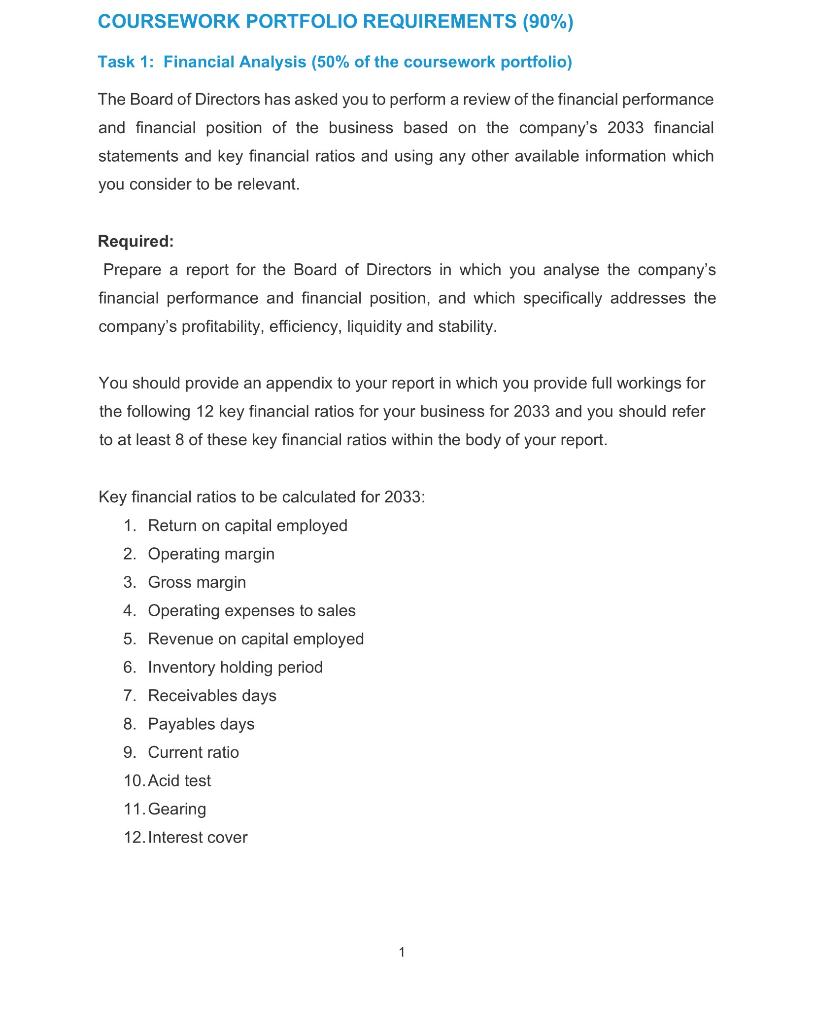

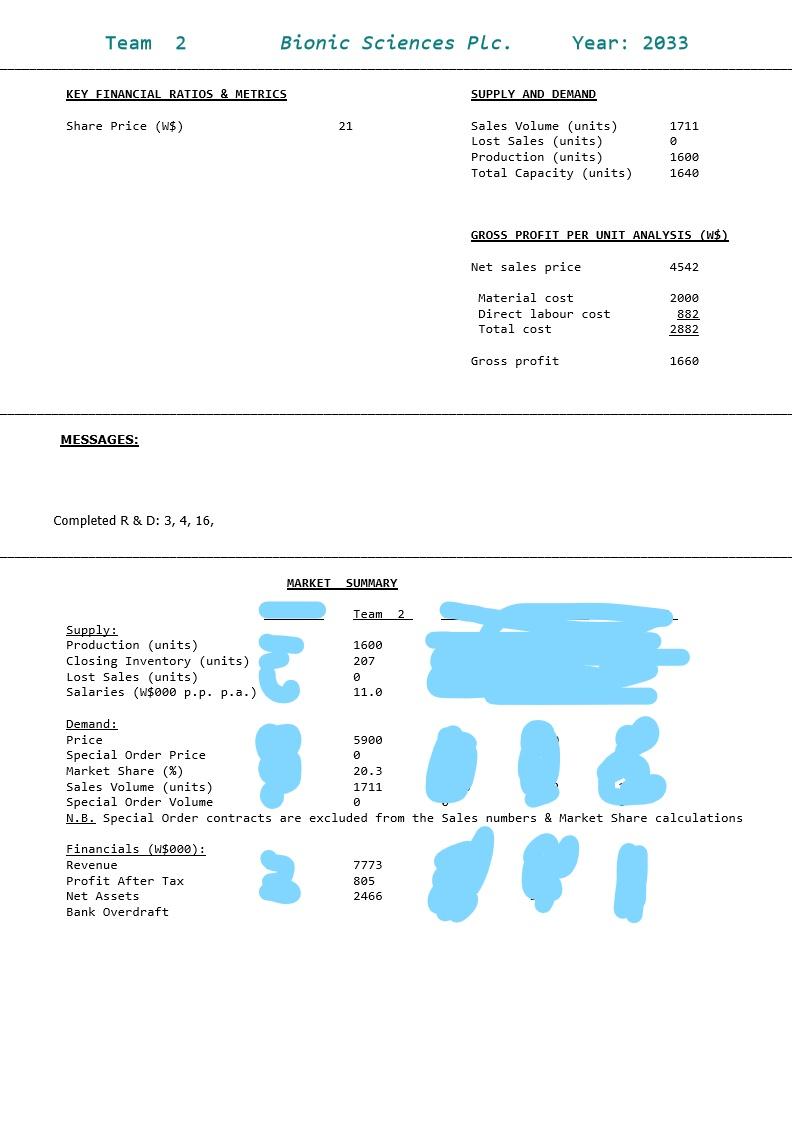

The Board of Directors has asked you to perform a review of the financial performance and financial position of the business based on the companys 2033 financial statements and key financial ratios and using any other available information which you consider to be relevant. Required: Prepare a report for the Board of Directors in which you analyse the companys financial performance and financial position, and which specifically addresses the companys profitability, efficiency, liquidity and stability. You should provide an appendix to your report in which you provide full workings for the following 12 key financial ratios for your business for 2033 and you should refer to at least 8 of these key financial ratios within the body of your report. Key financial ratios to be calculated for 2033: 1. Return on capital employed 2. Operating margin 3. Gross margin 4. Operating expenses to sales 5. Revenue on capital employed 6. Inventory holding period 7. Receivables days 8. Payables days 9. Current ratio 10.Acid test 11.Gearing 12.Interest cover 2 Note: The majority of members of the Board of Directors do not have a finance background so your report will need to include clear and appropriate explanations of the methods and concepts you use within your report.

Task 2: Evaluation of Big Store Inc. Export Opportunity

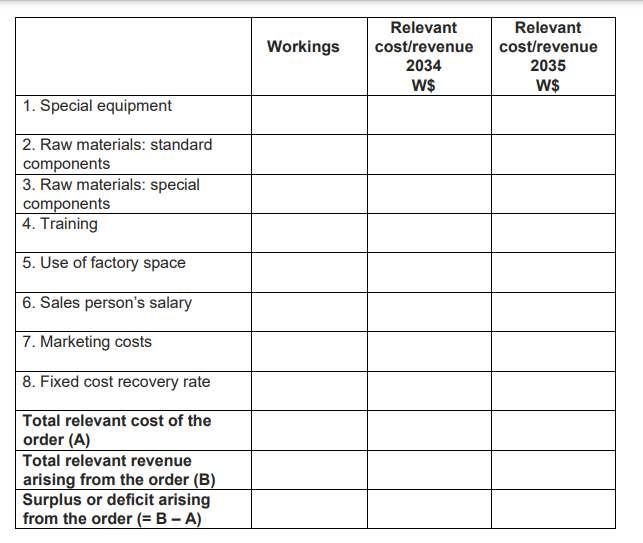

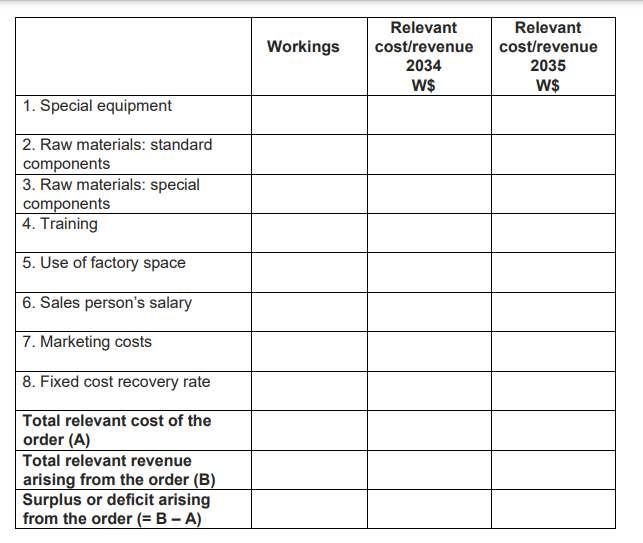

Assume todays date is 1 January 2034. The Board of Directors has asked you to evaluate an opportunity to export robots to a potential new overseas retail customer, Big Store Inc.. Big Store Inc. would like to run a trial promotion of your robots. The company would like to buy 100 robots from your company in 2034 at a special net sales price of W$2,500 per robot. If the 2034 trial is successful, the company has indicated it is likely to double the order quantity and would be prepared to match the net price you charge to your home customers in 2035. Further information is provided below: 1. Special Equipment The robots for this contract with Big Store Inc. will require some modifications from the standard robot which your company produces and this will involve additional annual fixed production overheads of W$25,000 to cover the cost of hiring the special equipment required for this purpose. 2. Raw Materials: Standard Components The robots manufactured for this order contract will require the same standard raw material components used in your business regular production process. 3. Raw Materials: Special Components The robots required for this contract will also require some special component materials. The company has a stock of 150 units of these special components in inventory which were purchased some years ago but which have been regarded as surplus to requirements and have been fully written off in the accounts. These special components originally cost W$500 per unit and they currently cost W$600 per unit to purchase. If not used for this project, the inventory of special components will be sold in 2034 for sales proceeds of W$400 per unit. One special component will be required per robot. 4 4. Staff Training Also, an extra W$12,000 as a one-off cost for staff training will be required to ensure that production staff are able to use the special equipment required for this contract. 5. Use of Factory Space The project will require the use of some of the companys factory space which is currently surplus to requirements and would otherwise be sub-let, which would bring in income of W$16,000 in 2034. 6. Sales Staff Time One of your companys sales staff estimates she spent 20% of her working hours in 2033 on this project which included travelling for meetings with Big Store Inc. executives. 7. Marketing Costs Big Store Inc. will run a special advertising campaign in 2034 to support this trial which will cost W$80,000 but requires your company to pay for 50% of these costs. 8. Fixed Cost Recovery Rate For costing special projects such as this, your company has in the past applied a rate of 10% of net revenues arising when evaluating new orders in order to recover the business recurring fixed costs (including admin expenses, overheads and direct labour costs).

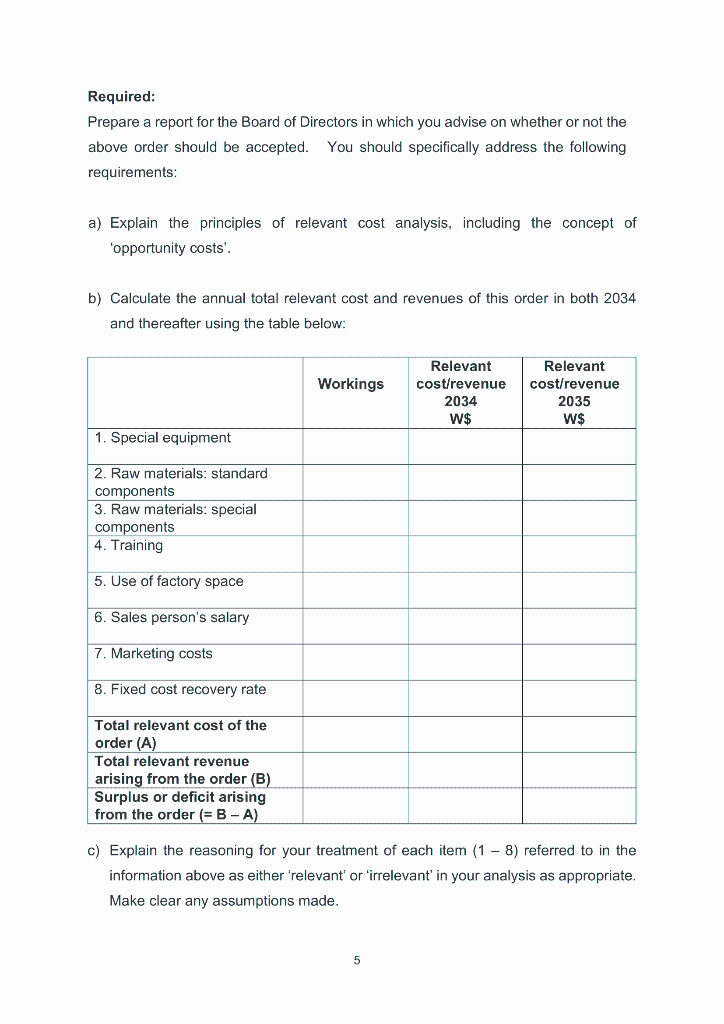

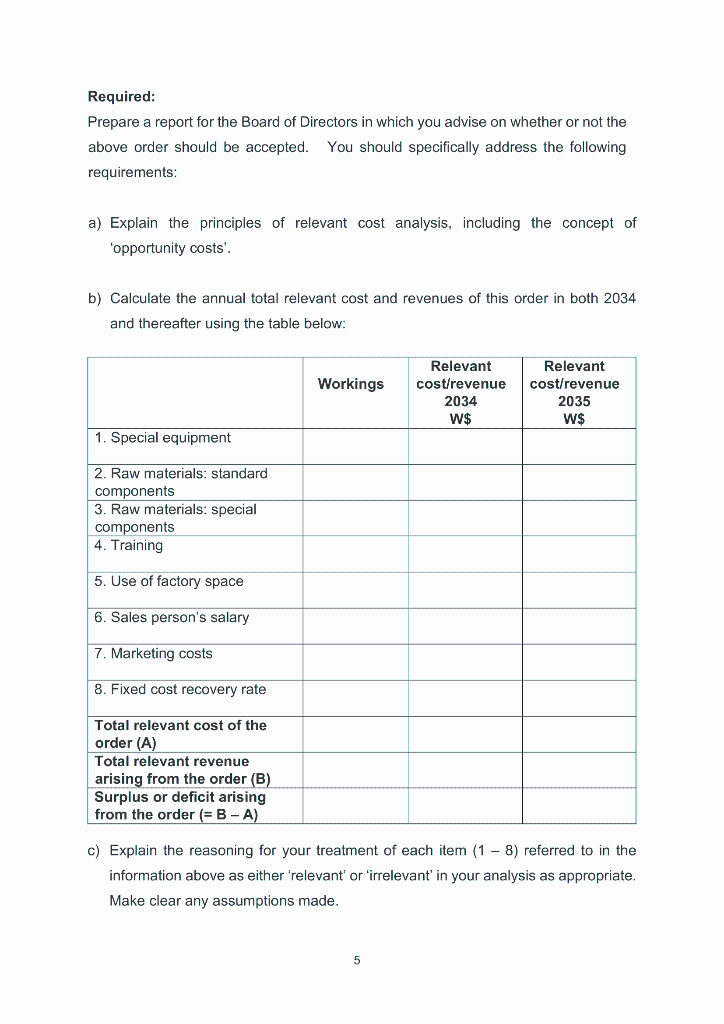

Required: Prepare a report for the Board of Directors in which you advise on whether or not the above order should be accepted. You should specifically address the following requirements: a) Explain the principles of relevant cost analysis, including the concept of opportunity costs. b) Calculate the annual total relevant cost and revenues of this order in both 2034 and thereafter using the table below:

c) Explain the reasoning for your treatment of each item (1 8) referred to in the information above as either relevant or irrelevant in your analysis as appropriate. Make clear any assumptions made

d) Discuss two further considerations beyond the relevant cost analysis you have performed which you believe should be taken into account before a final decision is made. e) Advise management on whether the order should be accepted. Please note that in completing this task, you may if you wish disregard any previous analysis and recommendation already made to your senior management colleagues during the business simulation activity for 2034.

Task 3: Critical Reflection

Drawing on specific examples and events arising during the module, paying particular attention to the business simulation exercise, critically reflect on two key learnings from the module from the following list: 1. the limitations of accounting information 2. the limitations of a specific management accounting technique of your choice 3. the difference between profit and cash flow performance 4. the difference between profit and value creation 5. the effective presentation and communication of financial information

Update-(all question aligned)

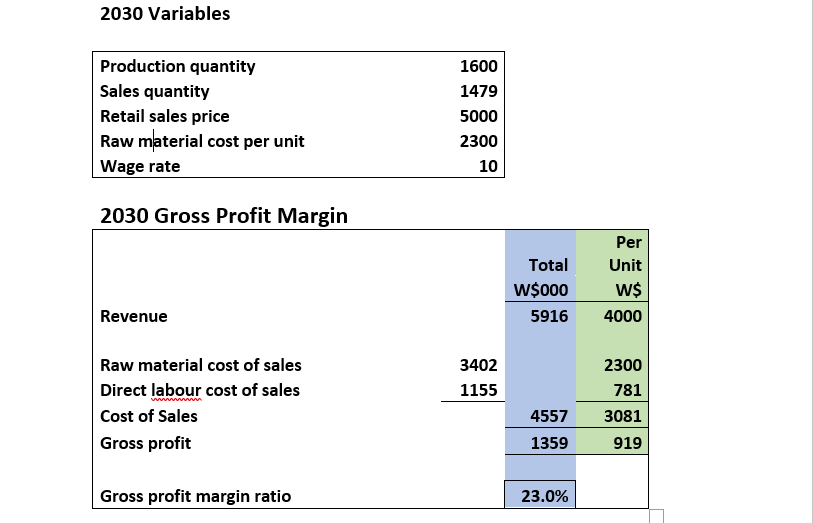

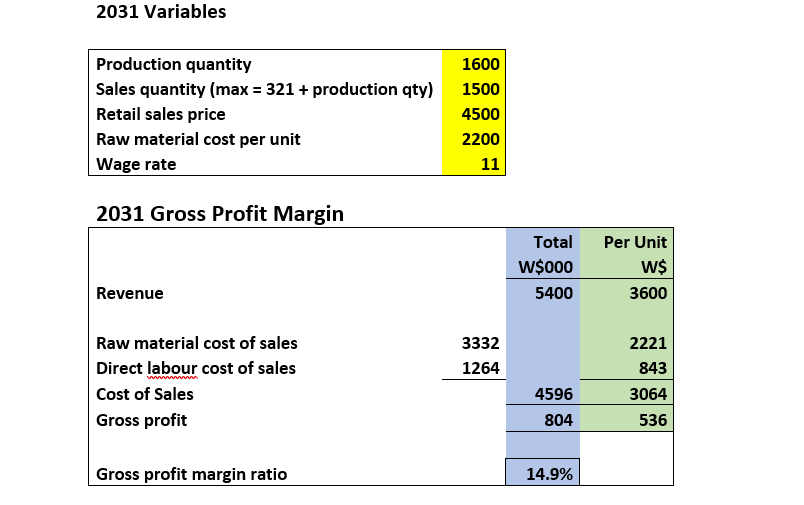

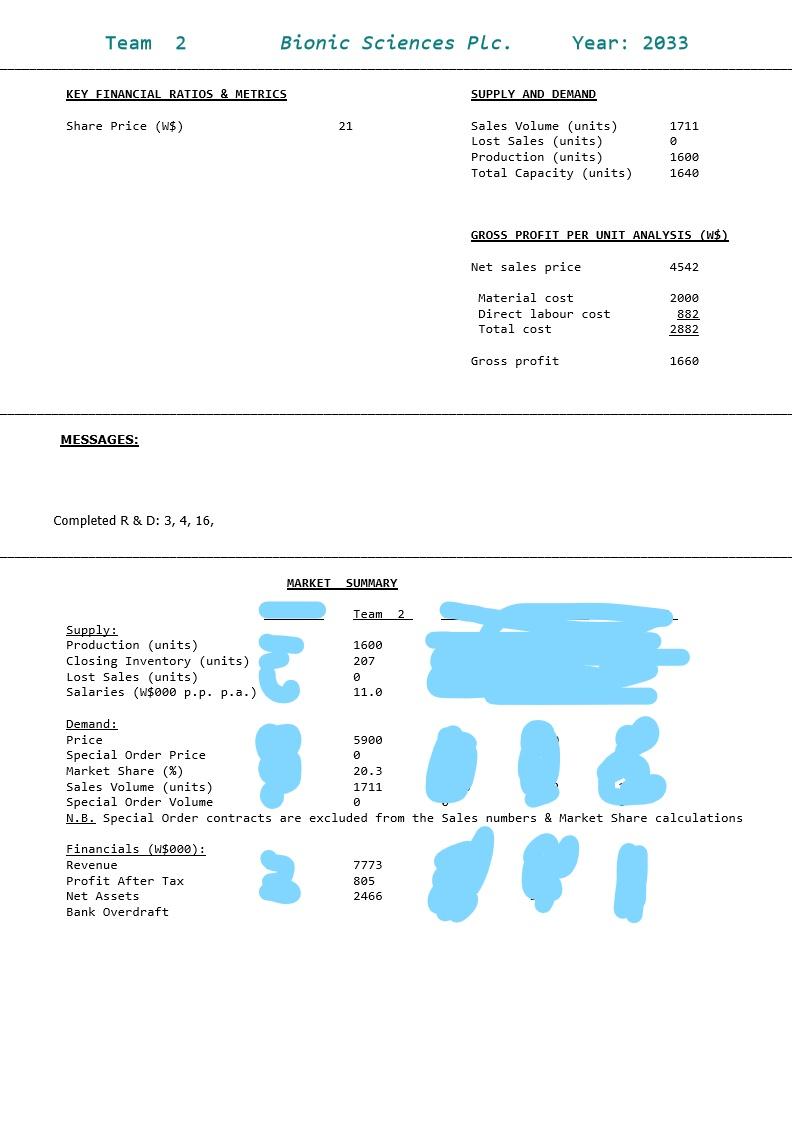

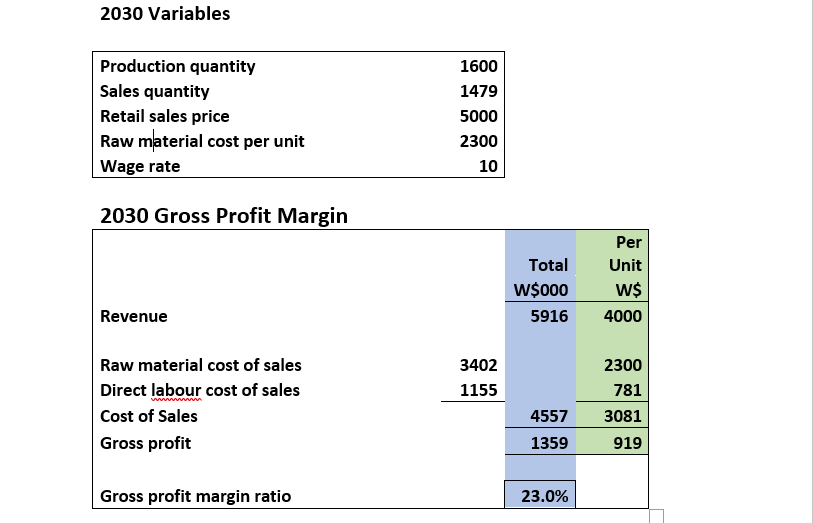

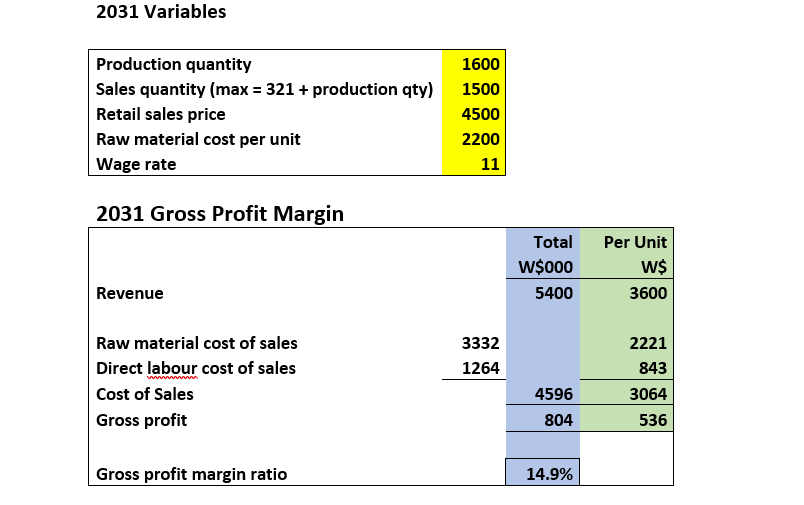

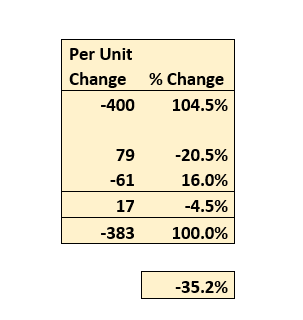

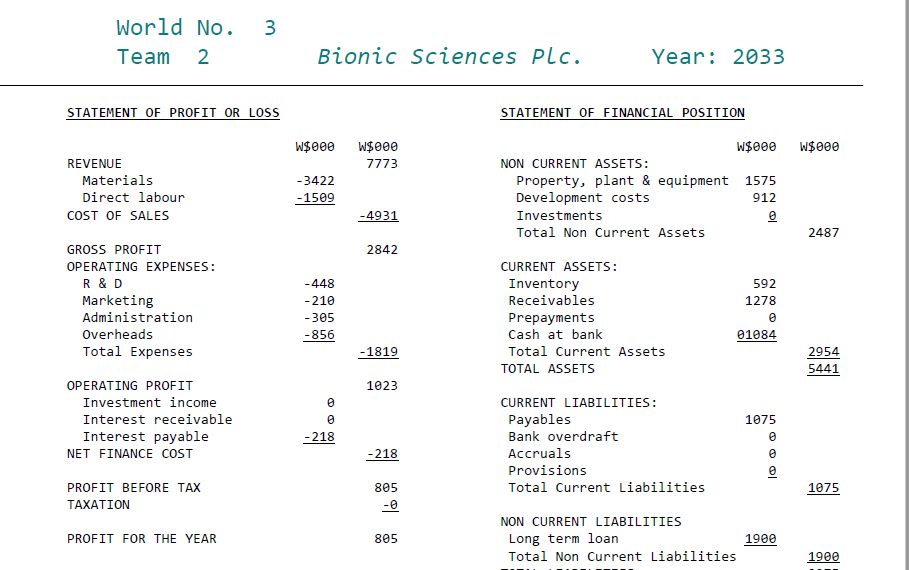

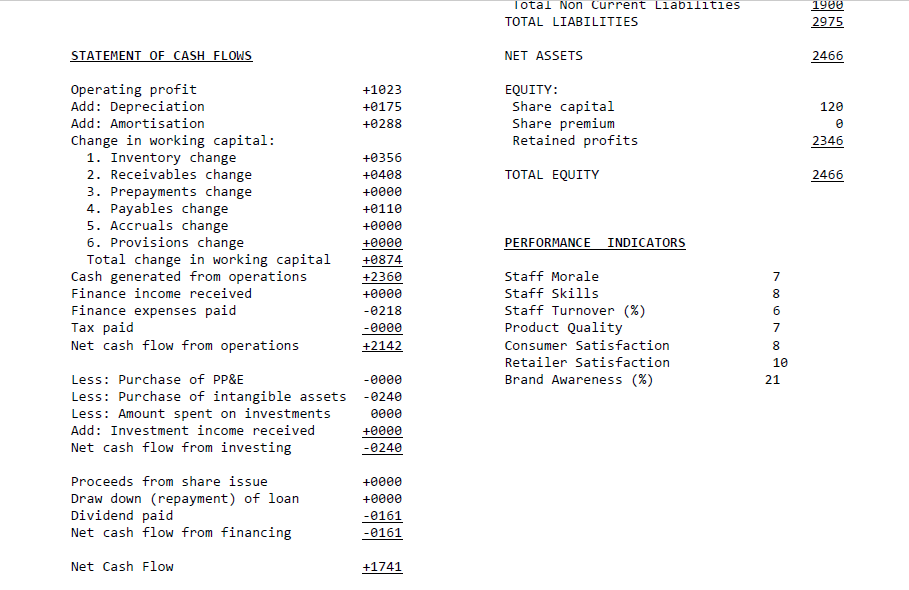

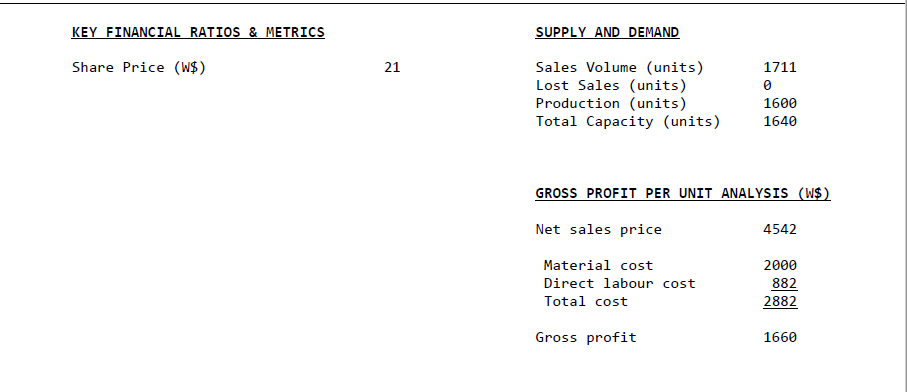

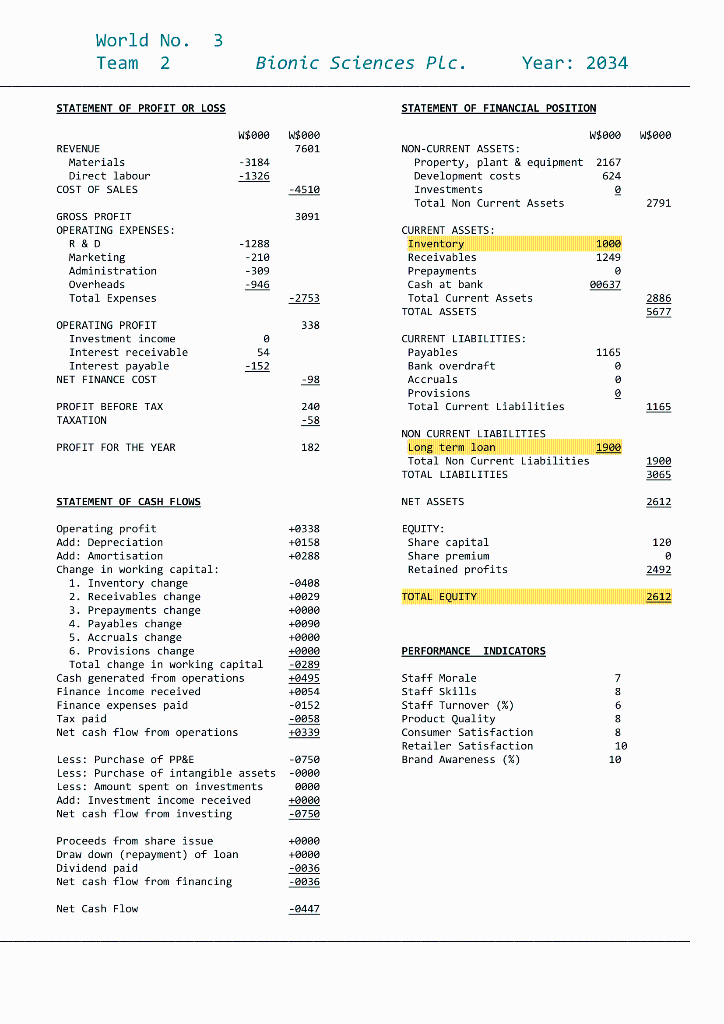

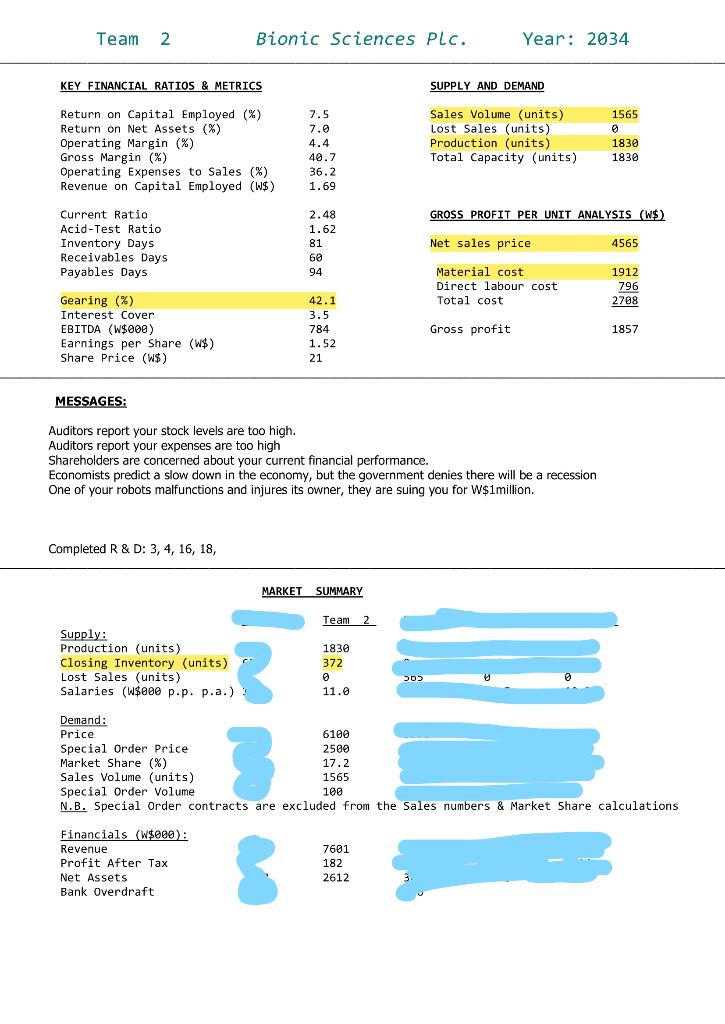

2030 Variables Production quantity Sales quantity Retail sales price Raw material cost per unit Wage rate 1600 1479 5000 2300 10 2030 Gross Profit Margin Total W$000 5916 Per Unit w$ 4000 Revenue 3402 1155 Raw material cost of sales Direct labour cost of sales Cost of Sales Gross profit 2300 781 3081 4557 1359 919 Gross profit margin ratio 23.0% 2031 Variables Production quantity Sales quantity (max = 321 + production qty) Retail sales price Raw material cost per unit Wage rate 1600 1500 4500 2200 11 2031 Gross Profit Margin Total W$000 5400 Per Unit W$ 3600 Revenue 3332 1264 Raw material cost of sales Direct labour cost of sales Cost of Sales Gross profit 2221 843 3064 536 4596 804 Gross profit margin ratio 14.9% Per Unit Change % Change -400 104.5% 79 -61 17 -20.5% 16.0% -4.5% 100.0% -383 -35.2% KEY FINANCIAL RATIOS & METRICS SUPPLY AND DEMAND Share Price (W$) 21 1711 Sales Volume (units) Lost Sales (units) Production (units) Total Capacity (units) 1600 1640 GROSS PROFIT PER UNIT ANALYSIS (W$) Net sales price 4542 Material cost Direct labour cost Total cost 2000 882 2882 Gross profit 1660 Team 2. Bionic Sciences Plc. Year: 2033 KEY FINANCIAL RATIOS & METRICS SUPPLY AND DEMAND Share Price (W$) 21 Sales Volume (units) Lost Sales (units) Production (units) Total Capacity (units) 1711 0 1600 1640 GROSS PROFIT PER UNIT ANALYSIS (W$) Net sales price 4542 Material cost Direct labour cost Total cost 2000 882 2882 Gross profit 1660 MESSAGES: Completed R & D: 3, 4, 16, MARKET SUMMARY Team 2 Supply: Production (units) Closing Inventory (units) Lost Sales (units) Salaries (W$000 p.p. p.a.) 1600 207 0 11.0 Demand: Price 5900 Special Order Price Market Share (%) 20.3 Sales Volume (units) 1711 Special Order Volume 0 N.B. Special Order contracts are excluded from the Sales numbers & Market Share calculations 13 Financials (W$000): Revenue Profit After Tax Net Assets Bank Overdraft 7773 805 2466 Workings Relevant cost/revenue 2034 W$ Relevant cost/revenue 2035 W$ 1. Special equipment 2. Raw materials: standard components 3. Raw materials: special components 4. Training 5. Use of factory space 6. Sales person's salary 7. Marketing costs 8. Fixed cost recovery rate Total relevant cost of the order (A) Total relevant revenue arising from the order (B) Surplus or deficit arising from the order (= B - A) 3 World No. Team 2 Bionic Sciences Plc. Year: 2034 STATEMENT OF PROFIT OR LOSS STATEMENT OF FINANCIAL POSITION W$ 000 W$000 W$ 000 7601 REVENUE Materials Direct labour COST OF SALES -3184 - 1326 W$ 000 NON-CURRENT ASSETS: Property, plant & equipment 2167 Development costs 624 Investments Total Non Current Assets -4510 2791 3091 GROSS PROFIT OPERATING EXPENSES: R&D Marketing Administration Overheads Total Expenses 1009 1249 - 1288 -210 -309 -946 CURRENT ASSETS: Inventory Receivables Prepayments Cash at bank Total Current Assets TOTAL ASSETS 08637 -2753 2886 5677 338 OPERATING PROFIT Investment income Interest receivable Interest payable NET FINANCE COST 1165 54 - 152 CURRENT LIABILITIES: Payables Bank overdraft Accruals Provisions Total Current Liabilities -98 3 1165 PROFIT BEFORE TAX TAXATION 240 -58 PROFIT FOR THE YEAR 182 1900 NON CURRENT LIABILITIES Long term loan Total Non Current Liabilities TOTAL LIABILITIES 1900 3065 STATEMENT OF CASH FLOWS NET ASSETS 2612 +9338 +0158 +0288 EQUITY: Share capital Share premium Retained profits 120 0 2492 TOTAL EQUITY 2612 Operating profit Add: Depreciation Add: Amortisation Change in working capital: 1. Inventory change 2. Receivables change 3. Prepayments change 4. Payables change 5. Accruals change 6. Provisions change Total change in working capital Cash generated from operations Finance income received Finance expenses paid Tax paid Net cash flow from operations PERFORMANCE INDICATORS -0408 +0029 +0000 +0090 +0000 +opee -289 +0495 +9054 -0152 -9058 +0339 Staff Morale Staff Skills Staff Turnover (%) Product Quality Consumer Satisfaction Retailer Satisfaction Brand Awareness (%) 7 8 6 8 8 10 19 Less: Purchase of PP&E Less: Purchase of intangible assets Less: Amount spent on investments Add: Investment income received Net cash flow from investing -75e -0000 0000 +0000 -0750 Proceeds from share issue Draw down (repayment) of loan Dividend paid Net cash flow from financing +0000 +0000 -0036 -8036 Net Cash Flow -9447 Team 2 Bionic Sciences Plc. Year: 2034 KEY FINANCIAL RATIOS & METRICS SUPPLY AND DEMAND Return on Capital Employed (%) Return on Net Assets (%) Operating Margin (%) Gross Margin (%) Operating Expenses to Sales (%) Revenue on Capital Employed (W$) 7.5 7.0 4.4 40.7 36.2 1.69 Sales Volume (units) Lost Sales (units) Production (units) Total Capacity (units) 1565 0 1830 1830 GROSS PROFIT PER UNIT ANALYSIS (W$) Current Ratio Acid-Test Ratio Inventory Days Receivables Days Payables Days 2.48 1.62 81 60 94 Net sales price 4565 Material cost Direct labour cost Total cost 1912 796 2708 Gearing (%) Interest Cover EBITDA (W$000) Earnings per Share ($) Share Price (W$) 42.1 3.5 784 1.52 21 Gross profit 1857 MESSAGES: Auditors report your stock levels are too high. Auditors report your expenses are too high Shareholders are concerned about your current financial performance. Economists predict a slow down in the economy, but the government denies there will be a recession One of your robots malfunctions and injures its owner, they are suing you for W$1million. Completed R & D: 3, 4, 16, 18, MARKET SUMMARY u Team 2 Supply: Production (units) 1830 Closing Inventory (units) 372 Lost Sales (units) 0 Salaries (W$200 p.p. p.a.) 11.0 Demand: Price 6106 Special Order Price 2500 Market Share (%) 17.2 Sales Volume (units) 1565 Special Order Volume 100 N.B. Special Order contracts are excluded from the Sales numbers & Market Share calculations Financials (W$000): Revenue Profit After Tax Net Assets Bank Overdraft 3 7601 182 2612 COURSEWORK PORTFOLIO REQUIREMENTS (90%) Task 1: Financial Analysis (50% of the coursework portfolio) The Board of Directors has asked you to perform a review of the financial performance and financial position of the business based on the company's 2033 financial statements and key financial ratios and using any other available information which you consider to be relevant. Required: Prepare a report for the Board of Directors in which you analyse the company's financial performance and financial position, and which specifically addresses the company's profitability, efficiency, liquidity and stability, You should provide an appendix to your report in which you provide full workings for the following 12 key financial ratios for your business for 2033 and you should refer to at least 8 of these key financial ratios within the body of your report. Key financial ratios to be calculated for 2033: 1. Return on capital employed 2. Operating margin 3. Gross margin 4. Operating expenses to sales 5. Revenue on capital employed 6. Inventory holding period 7. Receivables days 8. Payables days 9. Current ratio 10.Acid test 11. Gearing 12. Interest cover COURSEWORK PORTFOLIO REQUIREMENTS (90%) Task 1: Financial Analysis (50% of the coursework portfolio) The Board of Directors has asked you to perform a review of the financial performance and financial position of the business based on the company's 2033 financial statements and key financial ratios and using any other available information which you consider to be relevant. Required: Prepare a report for the Board of Directors in which you analyse the company's financial performance and financial position, and which specifically addresses the company's profitability, efficiency, liquidity and stability, You should provide an appendix to your report in which you provide full workings for the following 12 key financial ratios for your business for 2033 and you should refer to at least 8 of these key financial ratios within the body of your report. Key financial ratios to be calculated for 2033: 1. Return on capital employed 2. Operating margin 3. Gross margin 4. Operating expenses to sales 5. Revenue on capital employed 6. Inventory holding period 7. Receivables days 8. Payables days 9. Current ratio 10.Acid test 11. Gearing 12. Interest cover Note: The majority of members of the Board of Directors do not have a finance background so your report will need to include clear and appropriate explanations of the methods and concepts you use within your report. Word limit: 1,200 words (excluding headings, sub-headings, tables and appendices); Font Size: 12; Line Spacing: 112 2 Task 2: Evaluation of Big Store Inc. Export Opportunity (25% of the coursework portfolio) Assume today's date is 1 January 2034. The Board of Directors has asked you to evaluate an opportunity to export robots to a potential new overseas retail customer, 'Big Store Inc.'. 'Big Store Inc.' would like to run a trial promotion of your robots. The company would like to buy 100 robots from your company in 2034 at a special net sales price of W$2,500 per robot. If the 2034 trial is successful, the company has indicated it is likely to double the order quantity and would be prepared to match the net price you charge to your home customers in 2035 Further information is provided below: 1. Special Equipment The robots for this contract with 'Big Store Inc.' will require some modifications from the standard robot which your company produces and this will involve additional annual fixed production overheads of W$25,000 to cover the cost of hiring the special equipment required for this purpose. 2. Raw Materials: Standard Components The robots manufactured for this order contract will require the same standard raw material components used in your business' regular production process. 3. Raw Materials: Special Components The robots required for this contract will also require some special component materials. The company has a stock of 150 units of these special components' in inventory which were purchased some years ago but which have been regarded as surplus to requirements and have been fully written off in the accounts. These 'special components' originally cost W$500 per unit and they currently cost W$600 per unit to purchase. If not used for this project, the inventory of 'special components' will be sold in 2034 for sales proceeds of W$400 per unit. One 'special component will be required per robot. 3 Required: Prepare a report for the Board of Directors in which you advise on whether or not the above order should be accepted. You should specifically address the following requirements: a) Explain the principles of relevant cost analysis, including the concept of 'opportunity costs! b) Calculate the annual total relevant cost and revenues of this order in both 2034 and thereafter using the table below: Workings Relevant cost/revenue 2034 w$ Relevant cost/revenue 2035 w$ 1. Special equipment 2. Raw materials: standard components 3. Raw materials: special components 4. Training 5. Use of factory space 6. Sales person's salary 7. Marketing costs 8. Fixed cost recovery rate Total relevant cost of the order (A) Total relevant revenue arising from the order (B) Surplus or deficit arising from the order (=B-A) c) Explain the reasoning for your treatment of each item (1 - 8) referred to in the information above as either relevant' or 'irrelevant' in your analysis as appropriate. Make clear any assumptions made. 5 d) Discuss two further considerations beyond the relevant cost analysis you have performed which you believe should be taken into account before a final decision is made e) Advise management on whether the order should be accepted. Please note that in completing this task, you may if you wish disregard any previous analysis and recommendation already made to your senior management colleagues during the business simulation activity for 2034. Word limit: 600 words (excluding headings, sub-headings, tables and appendices) | Font Size: 12 Line Spacing: 1/2 6 Task 3: Critical Reflection (25% of the coursework portfolio) Drawing on specific examples and events arising during the module, paying particular attention to the business simulation exercise, critically reflect on two key learnings from the module from the following list: 1. the limitations of accounting information 2. the limitations of a specific management accounting technique of your choice 3. the difference between profit and cash flow performance 4. the difference between profit and value creation 5. the effective presentation and communication of financial information Word limit: 600 words including citations (but excluding headings, sub-headings and the list of references at the end)| Font Size: 12 Line Spacing: 112 7 2030 Variables Production quantity Sales quantity Retail sales price Raw material cost per unit Wage rate 1600 1479 5000 2300 10 2030 Gross Profit Margin Total W$000 5916 Per Unit w$ 4000 Revenue 3402 1155 Raw material cost of sales Direct labour cost of sales Cost of Sales Gross profit 2300 781 3081 4557 1359 919 Gross profit margin ratio 23.0% 2031 Variables Production quantity Sales quantity (max = 321 + production qty) Retail sales price Raw material cost per unit Wage rate 1600 1500 4500 2200 11 2031 Gross Profit Margin Total W$000 5400 Per Unit W$ 3600 Revenue 3332 1264 Raw material cost of sales Direct labour cost of sales Cost of Sales Gross profit 2221 843 3064 536 4596 804 Gross profit margin ratio 14.9% Per Unit Change % Change -400 104.5% 79 -61 17 -20.5% 16.0% -4.5% 100.0% -383 -35.2% KEY FINANCIAL RATIOS & METRICS SUPPLY AND DEMAND Share Price (W$) 21 1711 Sales Volume (units) Lost Sales (units) Production (units) Total Capacity (units) 1600 1640 GROSS PROFIT PER UNIT ANALYSIS (W$) Net sales price 4542 Material cost Direct labour cost Total cost 2000 882 2882 Gross profit 1660 Team 2. Bionic Sciences Plc. Year: 2033 KEY FINANCIAL RATIOS & METRICS SUPPLY AND DEMAND Share Price (W$) 21 Sales Volume (units) Lost Sales (units) Production (units) Total Capacity (units) 1711 0 1600 1640 GROSS PROFIT PER UNIT ANALYSIS (W$) Net sales price 4542 Material cost Direct labour cost Total cost 2000 882 2882 Gross profit 1660 MESSAGES: Completed R & D: 3, 4, 16, MARKET SUMMARY Team 2 Supply: Production (units) Closing Inventory (units) Lost Sales (units) Salaries (W$000 p.p. p.a.) 1600 207 0 11.0 Demand: Price 5900 Special Order Price Market Share (%) 20.3 Sales Volume (units) 1711 Special Order Volume 0 N.B. Special Order contracts are excluded from the Sales numbers & Market Share calculations 13 Financials (W$000): Revenue Profit After Tax Net Assets Bank Overdraft 7773 805 2466 Workings Relevant cost/revenue 2034 W$ Relevant cost/revenue 2035 W$ 1. Special equipment 2. Raw materials: standard components 3. Raw materials: special components 4. Training 5. Use of factory space 6. Sales person's salary 7. Marketing costs 8. Fixed cost recovery rate Total relevant cost of the order (A) Total relevant revenue arising from the order (B) Surplus or deficit arising from the order (= B - A) 3 World No. Team 2 Bionic Sciences Plc. Year: 2034 STATEMENT OF PROFIT OR LOSS STATEMENT OF FINANCIAL POSITION W$ 000 W$000 W$ 000 7601 REVENUE Materials Direct labour COST OF SALES -3184 - 1326 W$ 000 NON-CURRENT ASSETS: Property, plant & equipment 2167 Development costs 624 Investments Total Non Current Assets -4510 2791 3091 GROSS PROFIT OPERATING EXPENSES: R&D Marketing Administration Overheads Total Expenses 1009 1249 - 1288 -210 -309 -946 CURRENT ASSETS: Inventory Receivables Prepayments Cash at bank Total Current Assets TOTAL ASSETS 08637 -2753 2886 5677 338 OPERATING PROFIT Investment income Interest receivable Interest payable NET FINANCE COST 1165 54 - 152 CURRENT LIABILITIES: Payables Bank overdraft Accruals Provisions Total Current Liabilities -98 3 1165 PROFIT BEFORE TAX TAXATION 240 -58 PROFIT FOR THE YEAR 182 1900 NON CURRENT LIABILITIES Long term loan Total Non Current Liabilities TOTAL LIABILITIES 1900 3065 STATEMENT OF CASH FLOWS NET ASSETS 2612 +9338 +0158 +0288 EQUITY: Share capital Share premium Retained profits 120 0 2492 TOTAL EQUITY 2612 Operating profit Add: Depreciation Add: Amortisation Change in working capital: 1. Inventory change 2. Receivables change 3. Prepayments change 4. Payables change 5. Accruals change 6. Provisions change Total change in working capital Cash generated from operations Finance income received Finance expenses paid Tax paid Net cash flow from operations PERFORMANCE INDICATORS -0408 +0029 +0000 +0090 +0000 +opee -289 +0495 +9054 -0152 -9058 +0339 Staff Morale Staff Skills Staff Turnover (%) Product Quality Consumer Satisfaction Retailer Satisfaction Brand Awareness (%) 7 8 6 8 8 10 19 Less: Purchase of PP&E Less: Purchase of intangible assets Less: Amount spent on investments Add: Investment income received Net cash flow from investing -75e -0000 0000 +0000 -0750 Proceeds from share issue Draw down (repayment) of loan Dividend paid Net cash flow from financing +0000 +0000 -0036 -8036 Net Cash Flow -9447 Team 2 Bionic Sciences Plc. Year: 2034 KEY FINANCIAL RATIOS & METRICS SUPPLY AND DEMAND Return on Capital Employed (%) Return on Net Assets (%) Operating Margin (%) Gross Margin (%) Operating Expenses to Sales (%) Revenue on Capital Employed (W$) 7.5 7.0 4.4 40.7 36.2 1.69 Sales Volume (units) Lost Sales (units) Production (units) Total Capacity (units) 1565 0 1830 1830 GROSS PROFIT PER UNIT ANALYSIS (W$) Current Ratio Acid-Test Ratio Inventory Days Receivables Days Payables Days 2.48 1.62 81 60 94 Net sales price 4565 Material cost Direct labour cost Total cost 1912 796 2708 Gearing (%) Interest Cover EBITDA (W$000) Earnings per Share ($) Share Price (W$) 42.1 3.5 784 1.52 21 Gross profit 1857 MESSAGES: Auditors report your stock levels are too high. Auditors report your expenses are too high Shareholders are concerned about your current financial performance. Economists predict a slow down in the economy, but the government denies there will be a recession One of your robots malfunctions and injures its owner, they are suing you for W$1million. Completed R & D: 3, 4, 16, 18, MARKET SUMMARY u Team 2 Supply: Production (units) 1830 Closing Inventory (units) 372 Lost Sales (units) 0 Salaries (W$200 p.p. p.a.) 11.0 Demand: Price 6106 Special Order Price 2500 Market Share (%) 17.2 Sales Volume (units) 1565 Special Order Volume 100 N.B. Special Order contracts are excluded from the Sales numbers & Market Share calculations Financials (W$000): Revenue Profit After Tax Net Assets Bank Overdraft 3 7601 182 2612 COURSEWORK PORTFOLIO REQUIREMENTS (90%) Task 1: Financial Analysis (50% of the coursework portfolio) The Board of Directors has asked you to perform a review of the financial performance and financial position of the business based on the company's 2033 financial statements and key financial ratios and using any other available information which you consider to be relevant. Required: Prepare a report for the Board of Directors in which you analyse the company's financial performance and financial position, and which specifically addresses the company's profitability, efficiency, liquidity and stability, You should provide an appendix to your report in which you provide full workings for the following 12 key financial ratios for your business for 2033 and you should refer to at least 8 of these key financial ratios within the body of your report. Key financial ratios to be calculated for 2033: 1. Return on capital employed 2. Operating margin 3. Gross margin 4. Operating expenses to sales 5. Revenue on capital employed 6. Inventory holding period 7. Receivables days 8. Payables days 9. Current ratio 10.Acid test 11. Gearing 12. Interest cover COURSEWORK PORTFOLIO REQUIREMENTS (90%) Task 1: Financial Analysis (50% of the coursework portfolio) The Board of Directors has asked you to perform a review of the financial performance and financial position of the business based on the company's 2033 financial statements and key financial ratios and using any other available information which you consider to be relevant. Required: Prepare a report for the Board of Directors in which you analyse the company's financial performance and financial position, and which specifically addresses the company's profitability, efficiency, liquidity and stability, You should provide an appendix to your report in which you provide full workings for the following 12 key financial ratios for your business for 2033 and you should refer to at least 8 of these key financial ratios within the body of your report. Key financial ratios to be calculated for 2033: 1. Return on capital employed 2. Operating margin 3. Gross margin 4. Operating expenses to sales 5. Revenue on capital employed 6. Inventory holding period 7. Receivables days 8. Payables days 9. Current ratio 10.Acid test 11. Gearing 12. Interest cover Note: The majority of members of the Board of Directors do not have a finance background so your report will need to include clear and appropriate explanations of the methods and concepts you use within your report. Word limit: 1,200 words (excluding headings, sub-headings, tables and appendices); Font Size: 12; Line Spacing: 112 2 Task 2: Evaluation of Big Store Inc. Export Opportunity (25% of the coursework portfolio) Assume today's date is 1 January 2034. The Board of Directors has asked you to evaluate an opportunity to export robots to a potential new overseas retail customer, 'Big Store Inc.'. 'Big Store Inc.' would like to run a trial promotion of your robots. The company would like to buy 100 robots from your company in 2034 at a special net sales price of W$2,500 per robot. If the 2034 trial is successful, the company has indicated it is likely to double the order quantity and would be prepared to match the net price you charge to your home customers in 2035 Further information is provided below: 1. Special Equipment The robots for this contract with 'Big Store Inc.' will require some modifications from the standard robot which your company produces and this will involve additional annual fixed production overheads of W$25,000 to cover the cost of hiring the special equipment required for this purpose. 2. Raw Materials: Standard Components The robots manufactured for this order contract will require the same standard raw material components used in your business' regular production process. 3. Raw Materials: Special Components The robots required for this contract will also require some special component materials. The company has a stock of 150 units of these special components' in inventory which were purchased some years ago but which have been regarded as surplus to requirements and have been fully written off in the accounts. These 'special components' originally cost W$500 per unit and they currently cost W$600 per unit to purchase. If not used for this project, the inventory of 'special components' will be sold in 2034 for sales proceeds of W$400 per unit. One 'special component will be required per robot. 3 Required: Prepare a report for the Board of Directors in which you advise on whether or not the above order should be accepted. You should specifically address the following requirements: a) Explain the principles of relevant cost analysis, including the concept of 'opportunity costs! b) Calculate the annual total relevant cost and revenues of this order in both 2034 and thereafter using the table below: Workings Relevant cost/revenue 2034 w$ Relevant cost/revenue 2035 w$ 1. Special equipment 2. Raw materials: standard components 3. Raw materials: special components 4. Training 5. Use of factory space 6. Sales person's salary 7. Marketing costs 8. Fixed cost recovery rate Total relevant cost of the order (A) Total relevant revenue arising from the order (B) Surplus or deficit arising from the order (=B-A) c) Explain the reasoning for your treatment of each item (1 - 8) referred to in the information above as either relevant' or 'irrelevant' in your analysis as appropriate. Make clear any assumptions made. 5 d) Discuss two further considerations beyond the relevant cost analysis you have performed which you believe should be taken into account before a final decision is made e) Advise management on whether the order should be accepted. Please note that in completing this task, you may if you wish disregard any previous analysis and recommendation already made to your senior management colleagues during the business simulation activity for 2034. Word limit: 600 words (excluding headings, sub-headings, tables and appendices) | Font Size: 12 Line Spacing: 1/2 6 Task 3: Critical Reflection (25% of the coursework portfolio) Drawing on specific examples and events arising during the module, paying particular attention to the business simulation exercise, critically reflect on two key learnings from the module from the following list: 1. the limitations of accounting information 2. the limitations of a specific management accounting technique of your choice 3. the difference between profit and cash flow performance 4. the difference between profit and value creation 5. the effective presentation and communication of financial information Word limit: 600 words including citations (but excluding headings, sub-headings and the list of references at the end)| Font Size: 12 Line Spacing: 112 7