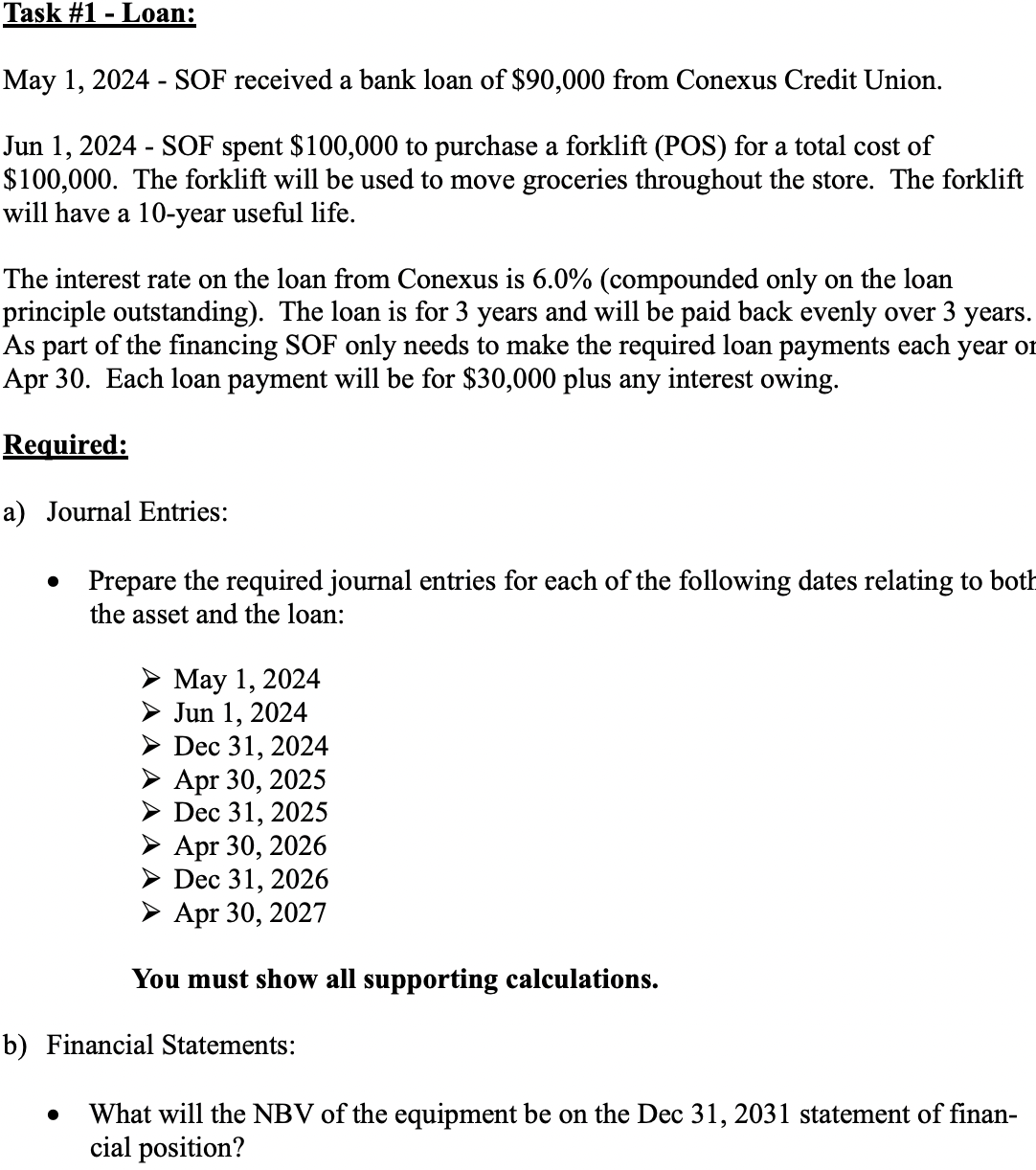

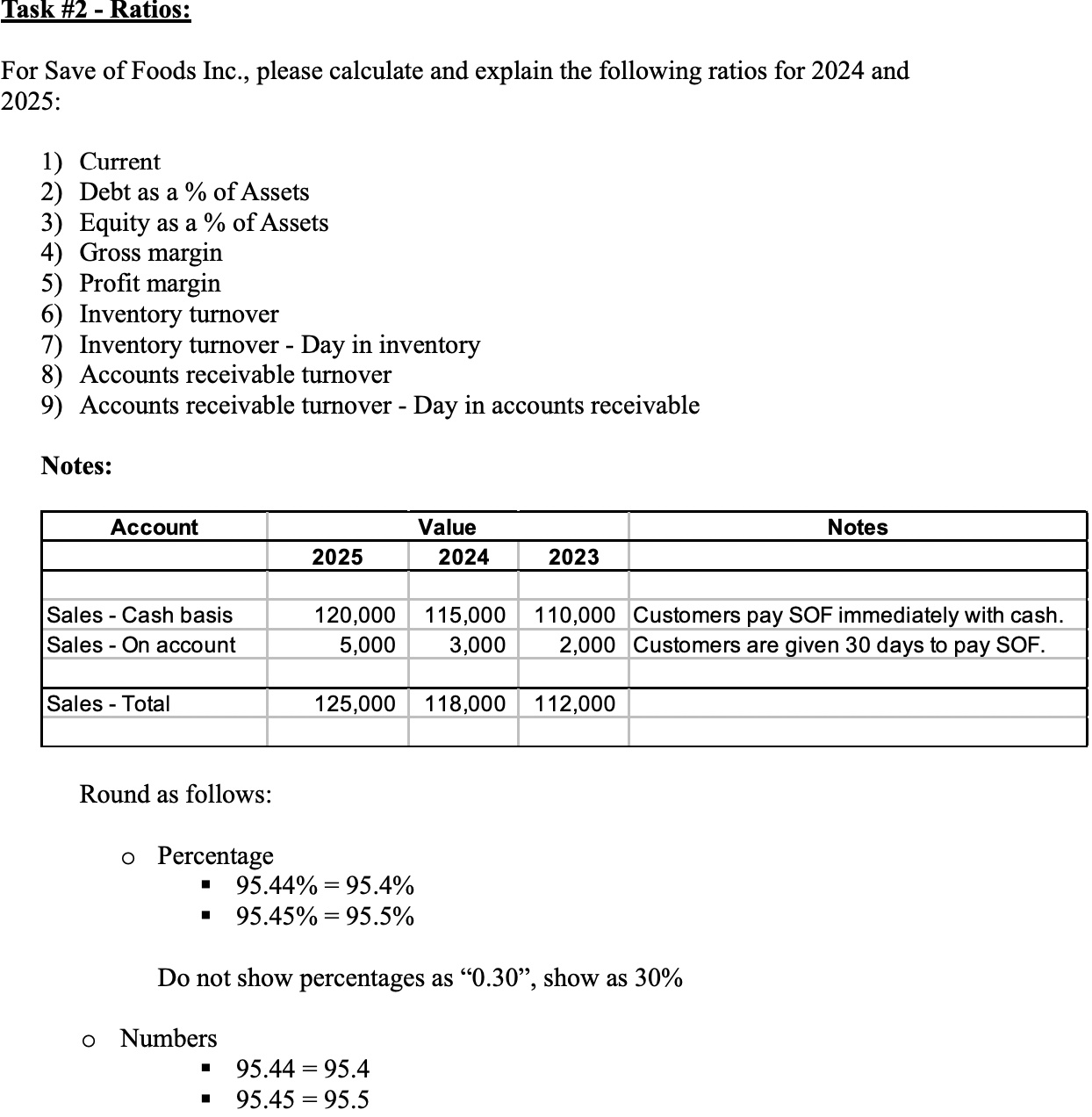

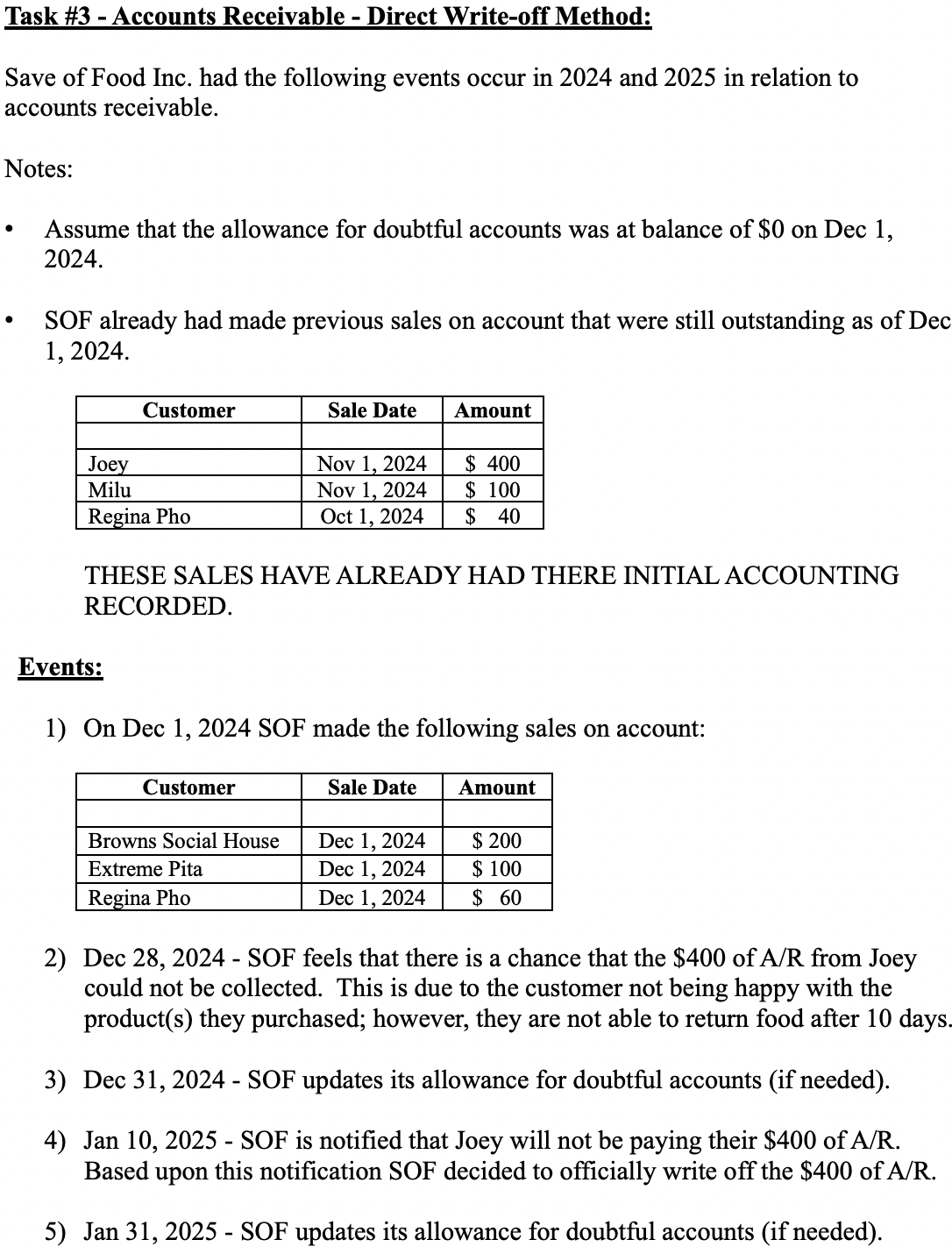

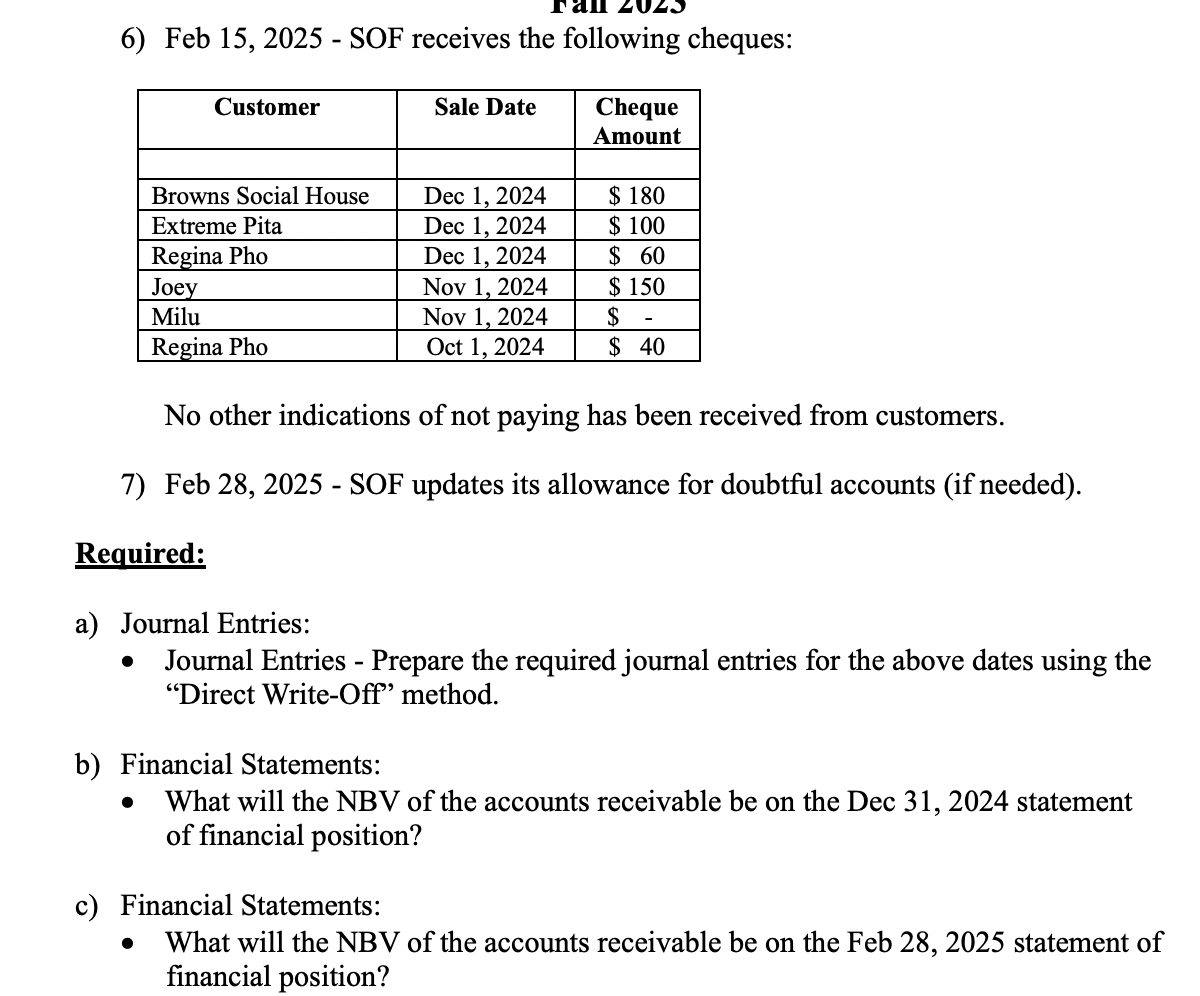

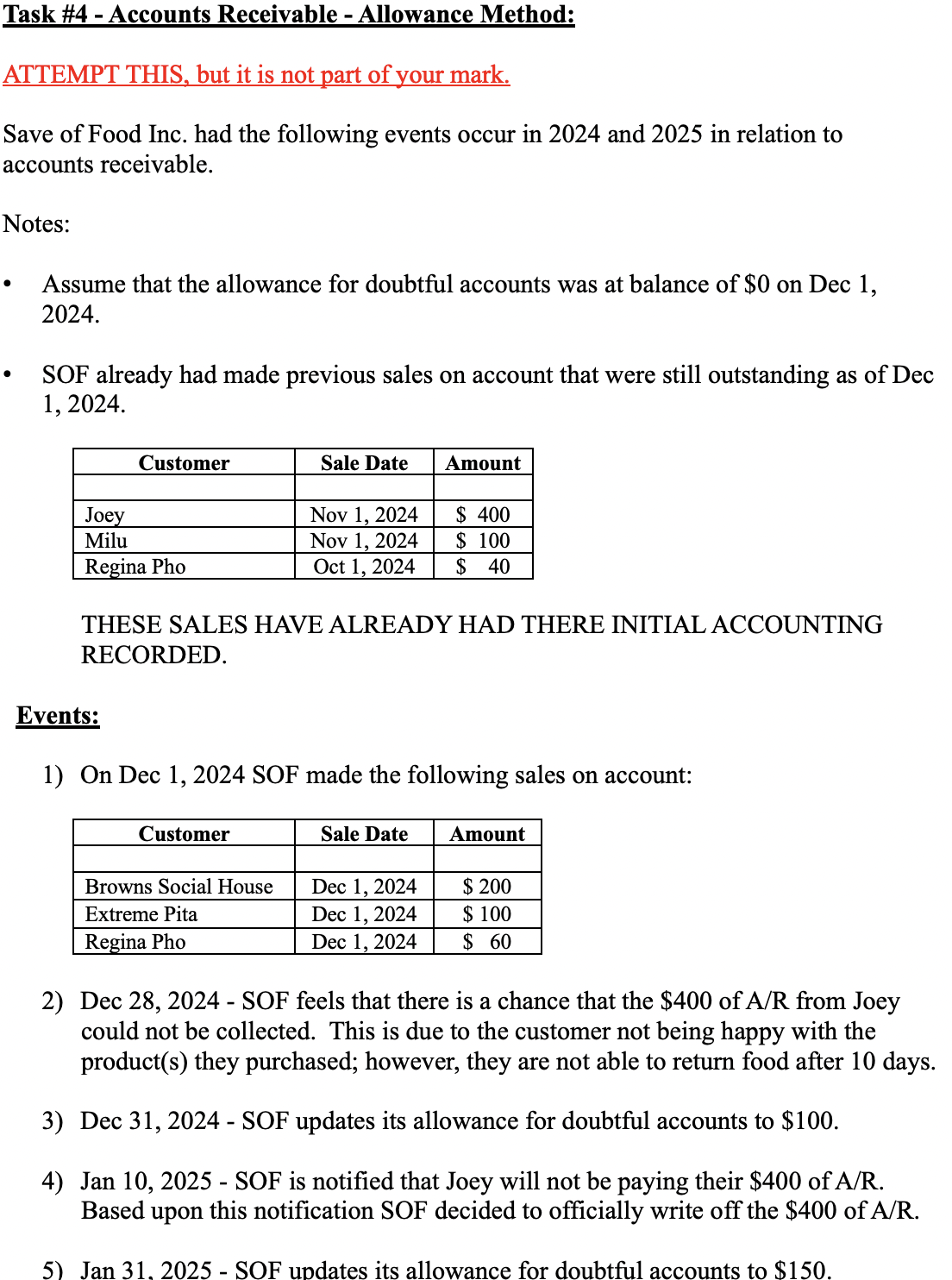

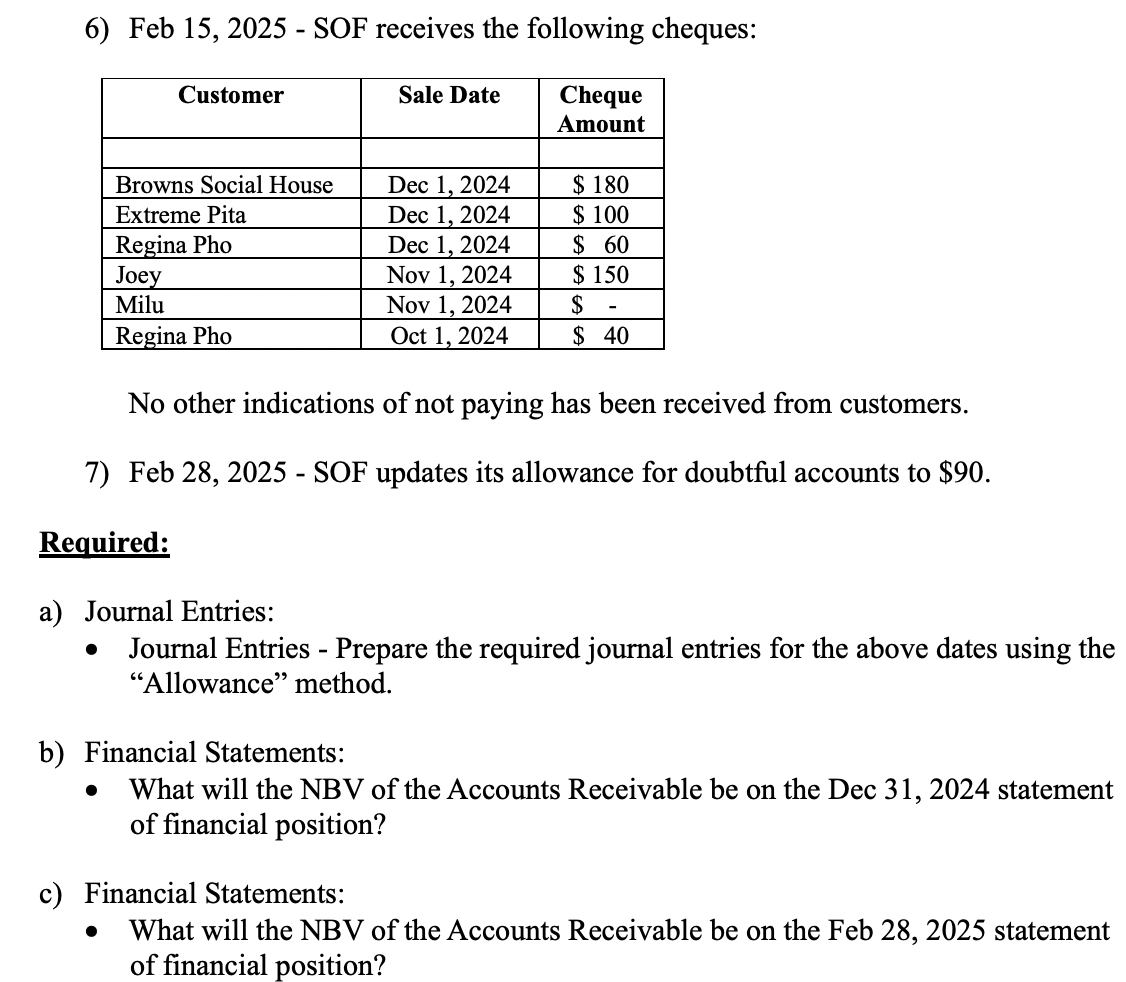

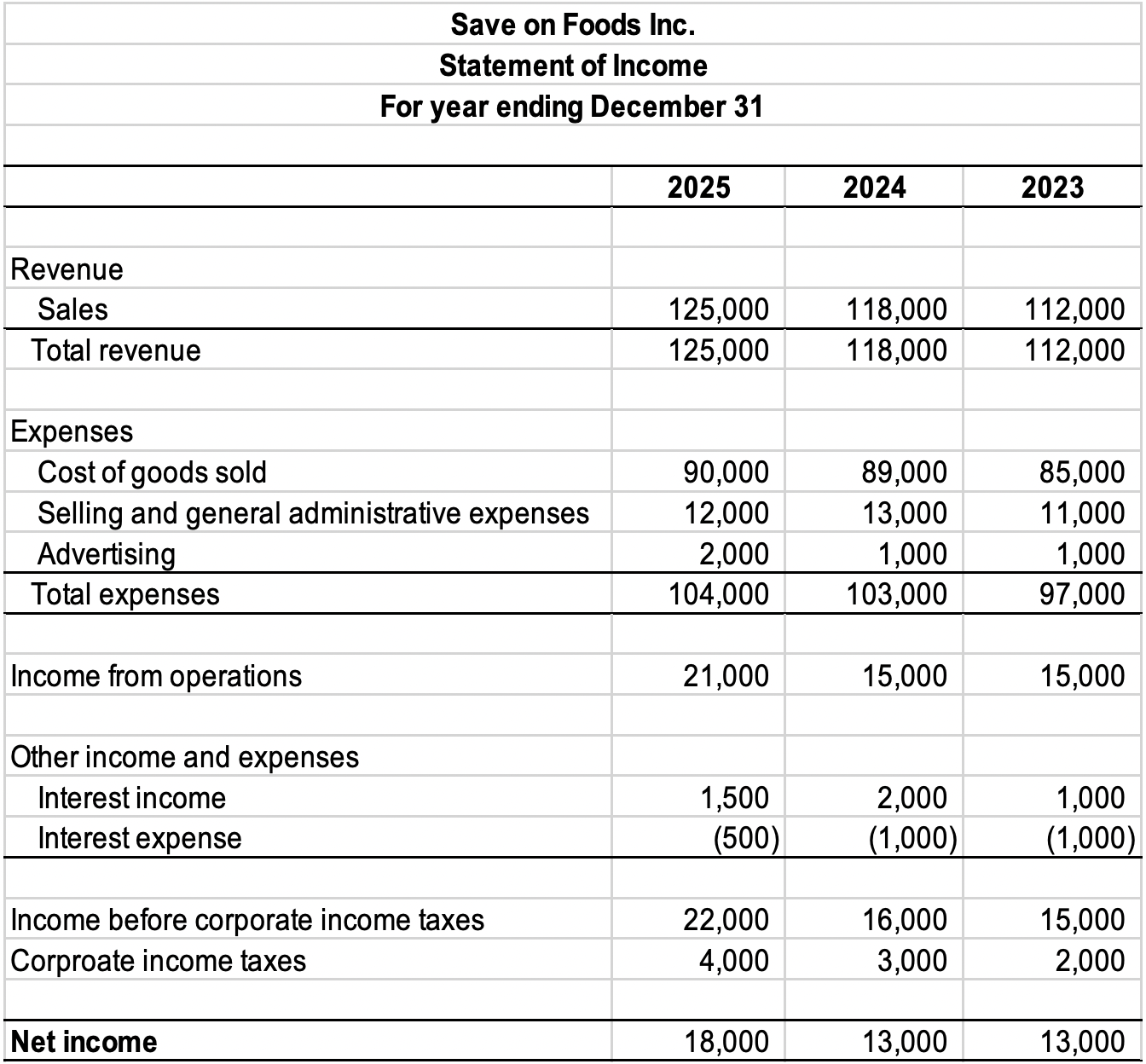

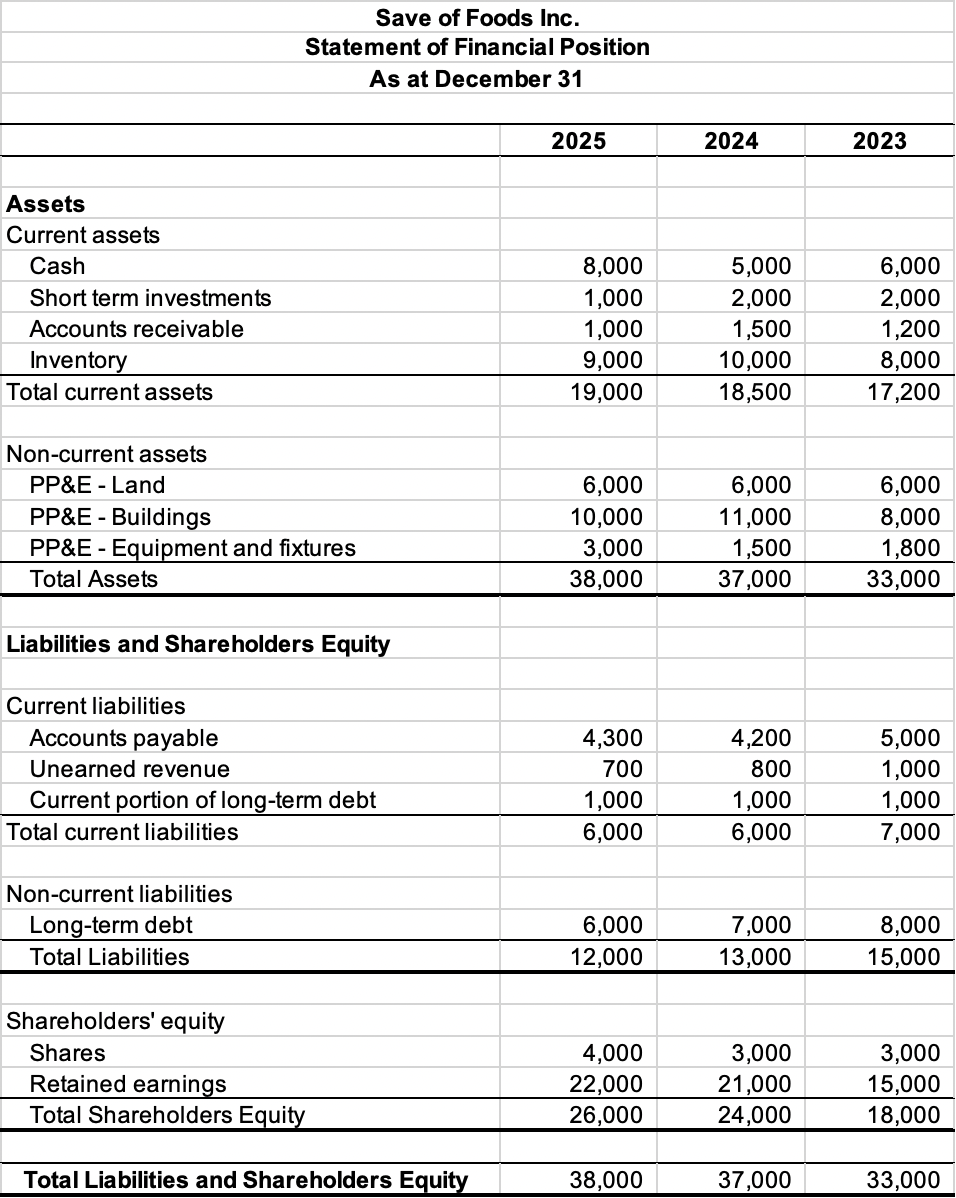

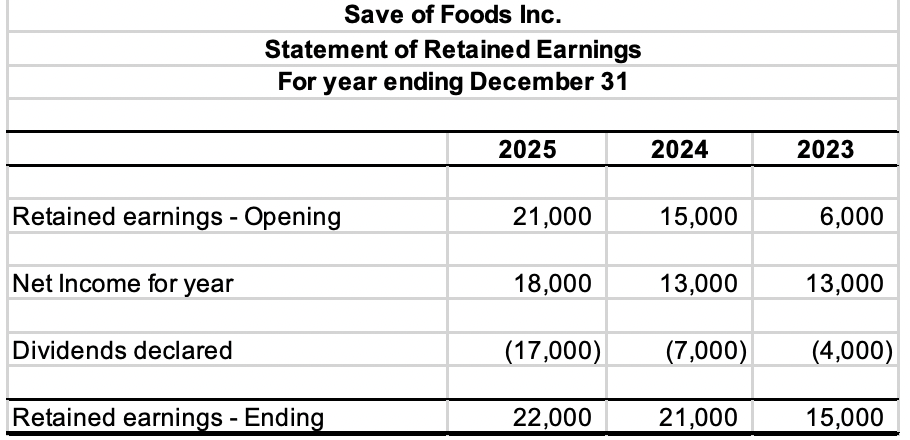

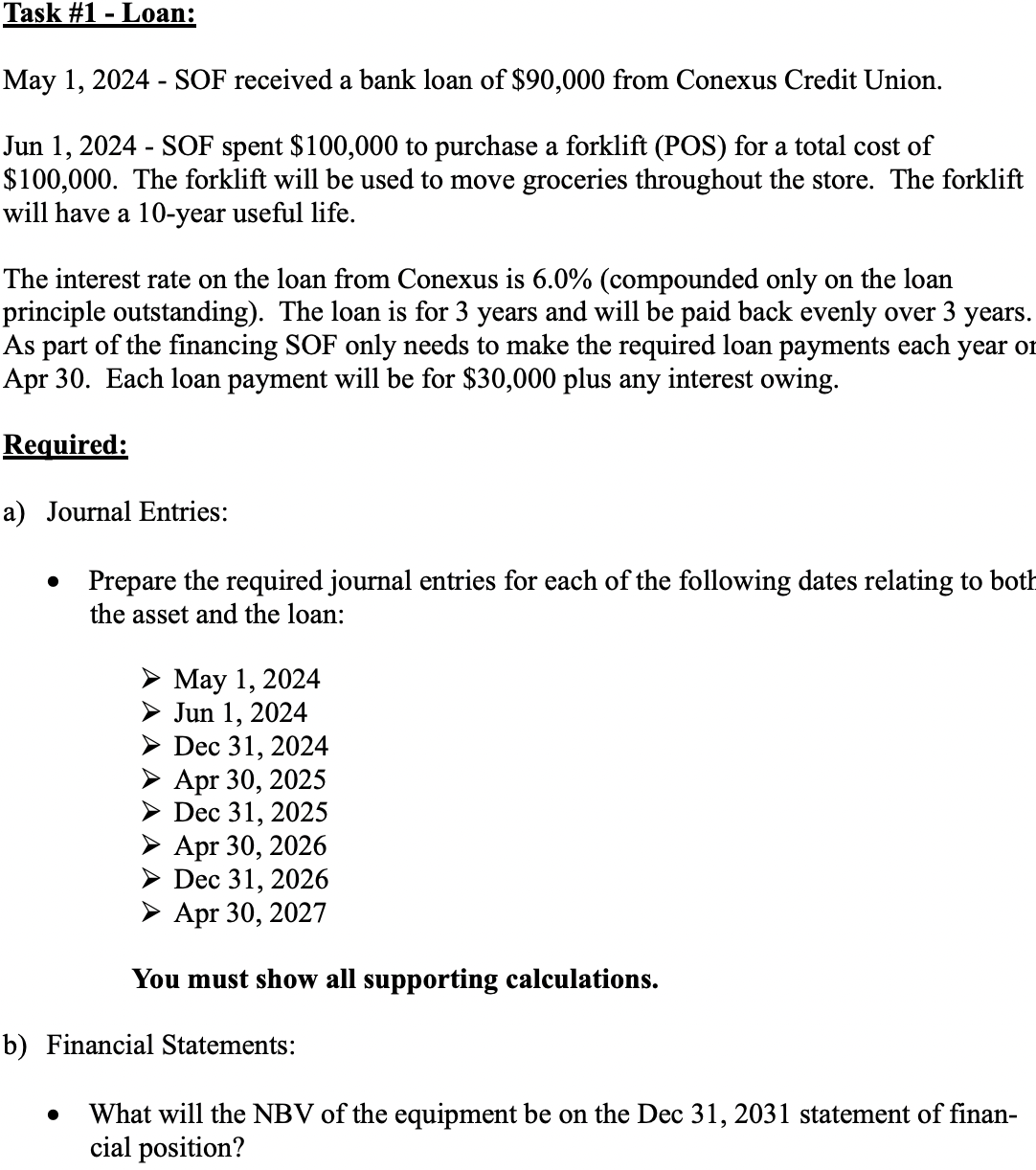

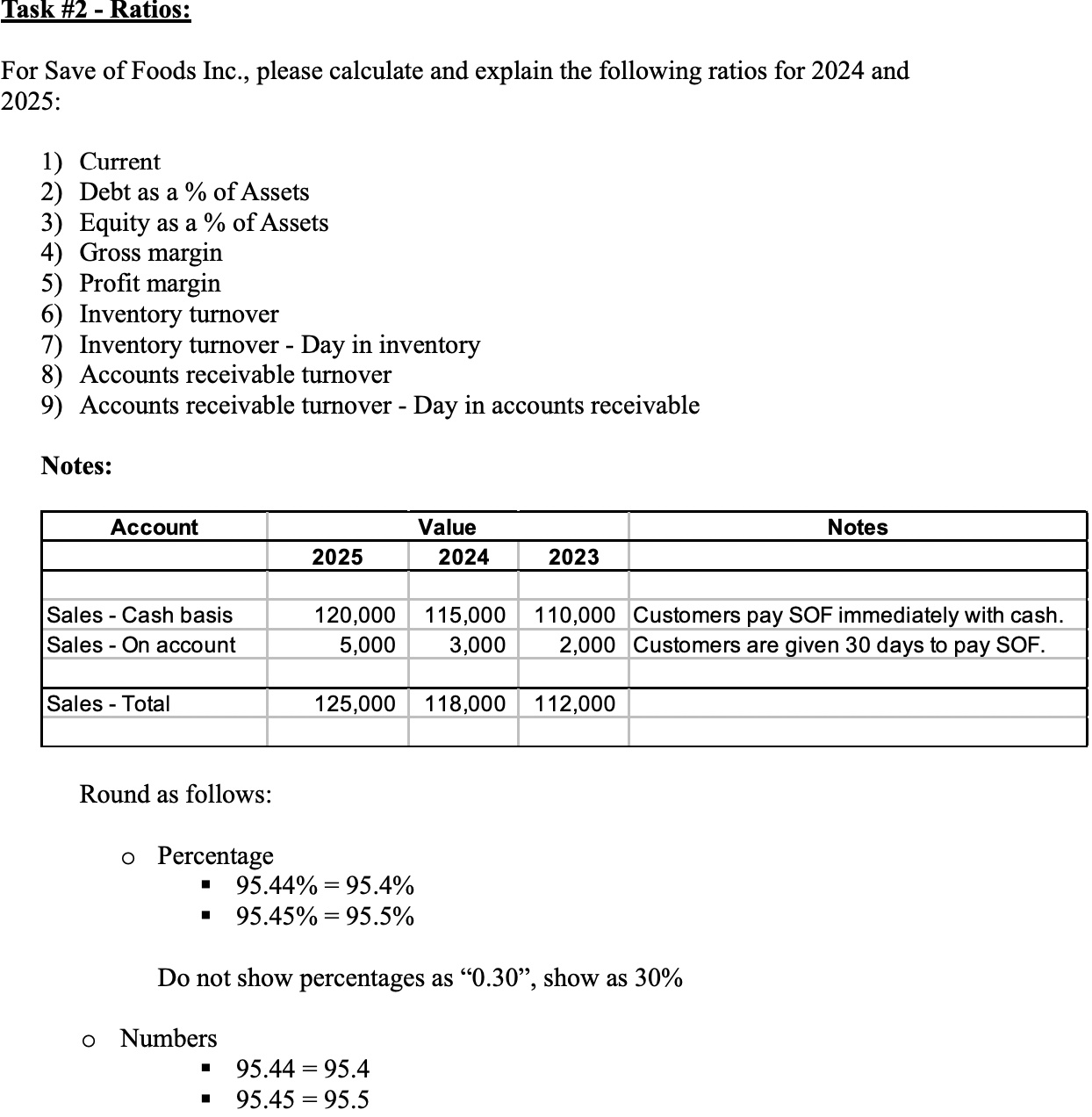

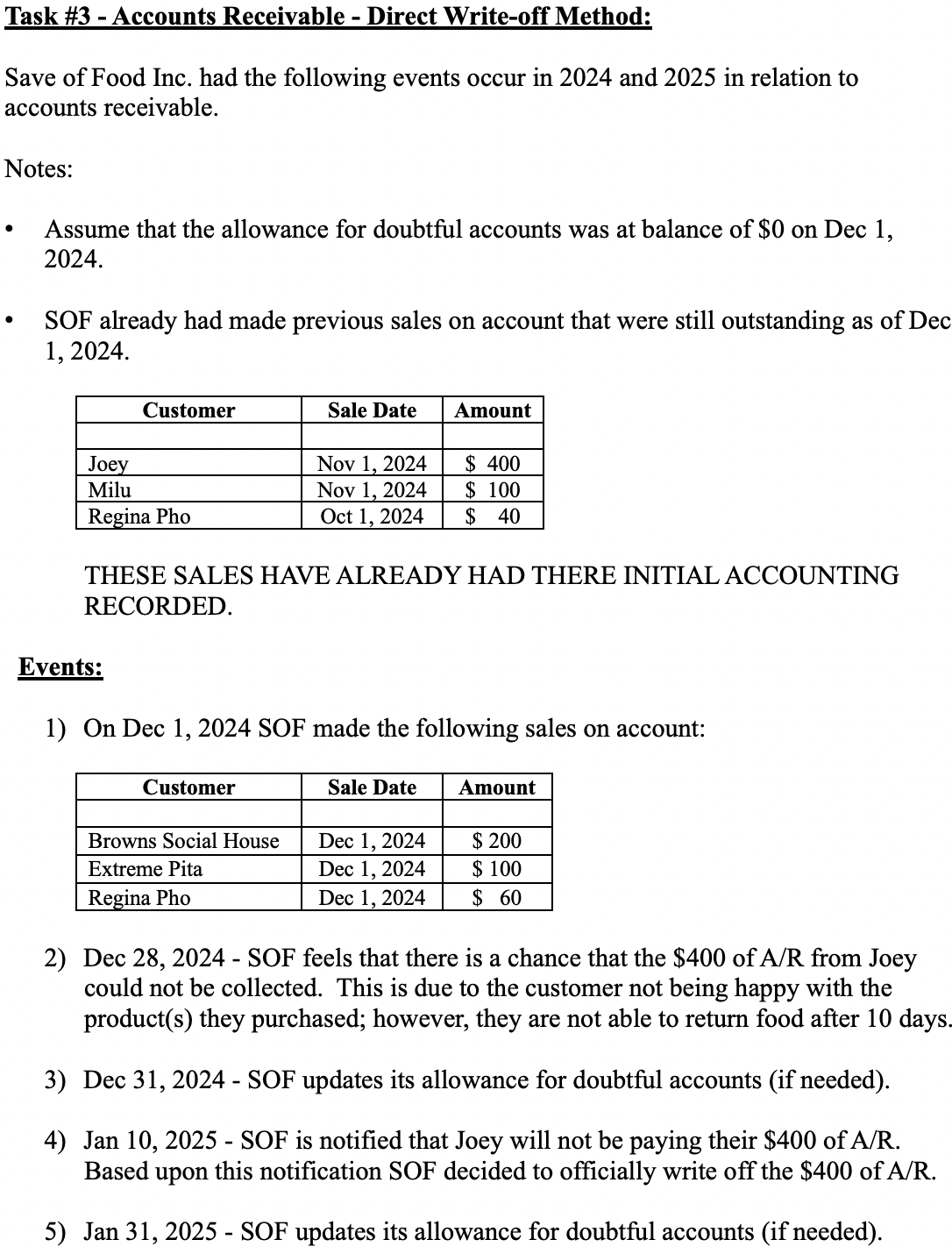

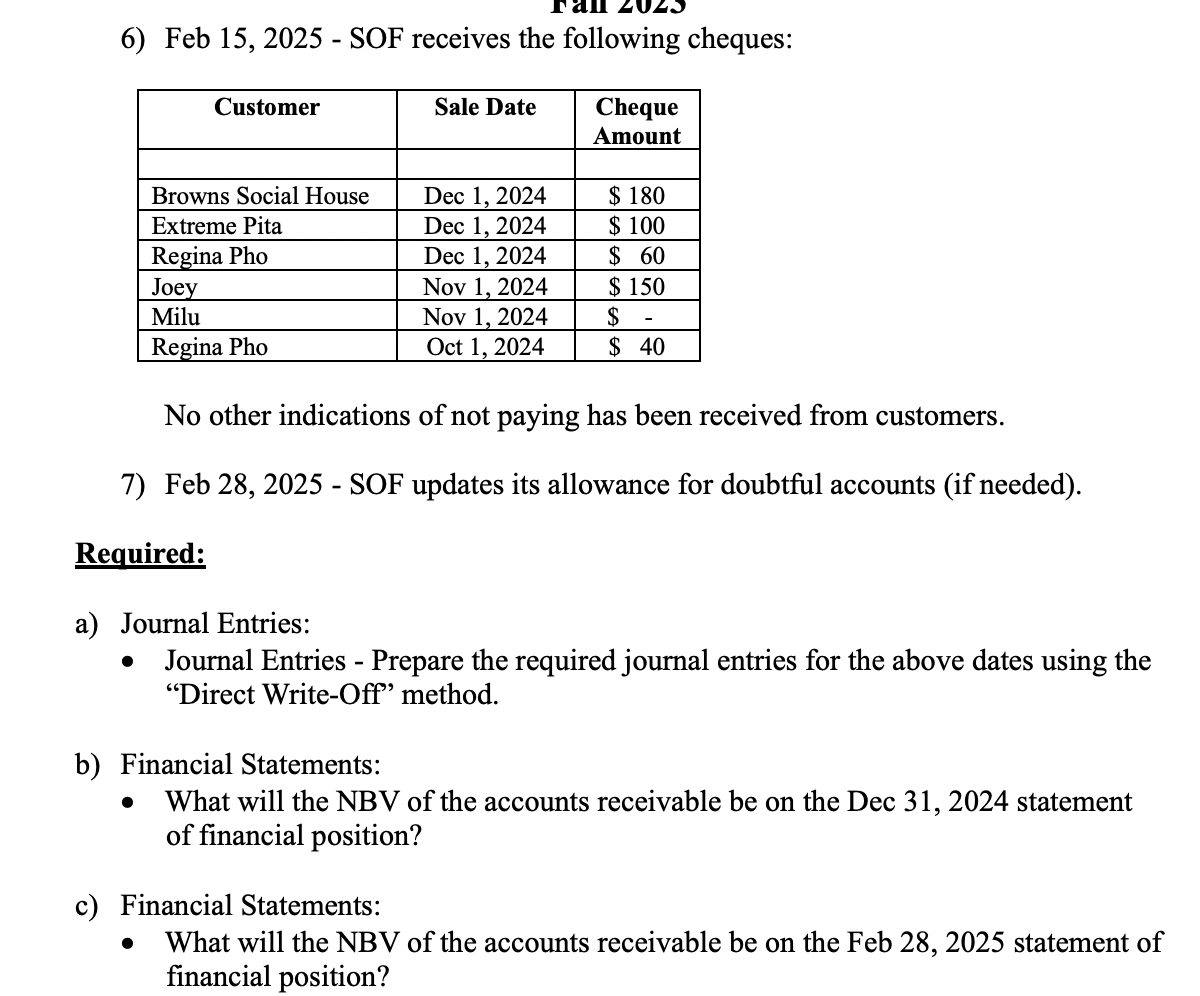

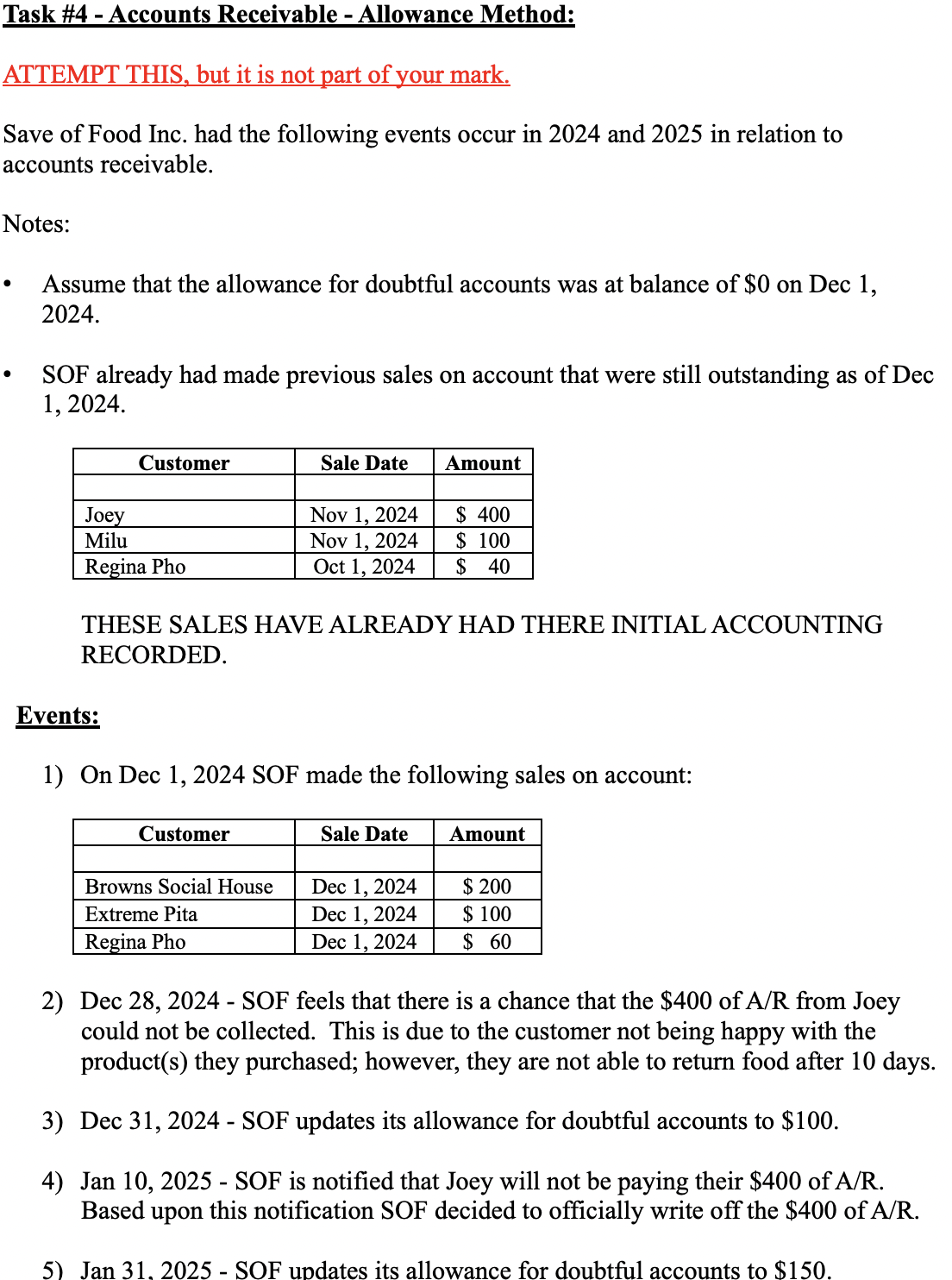

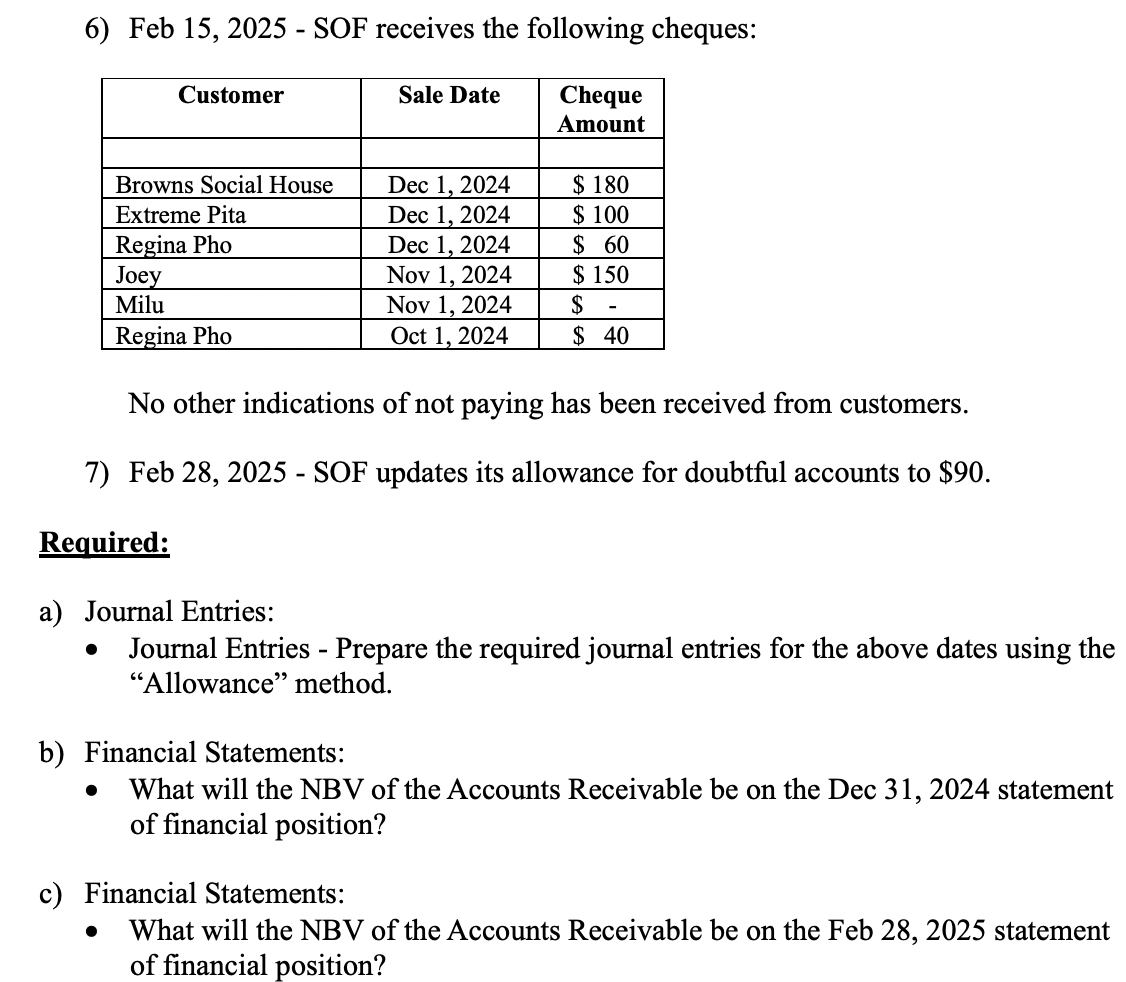

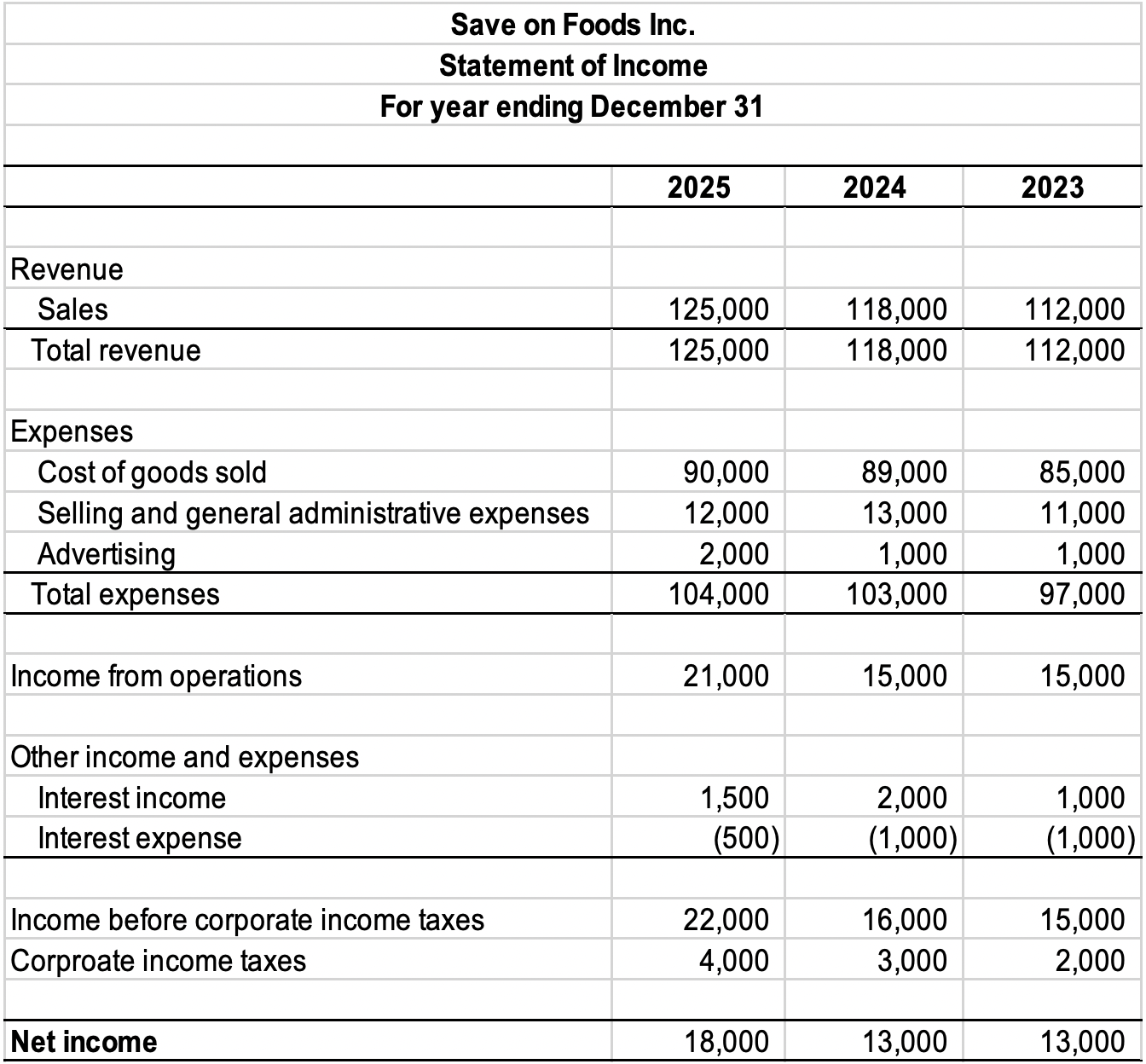

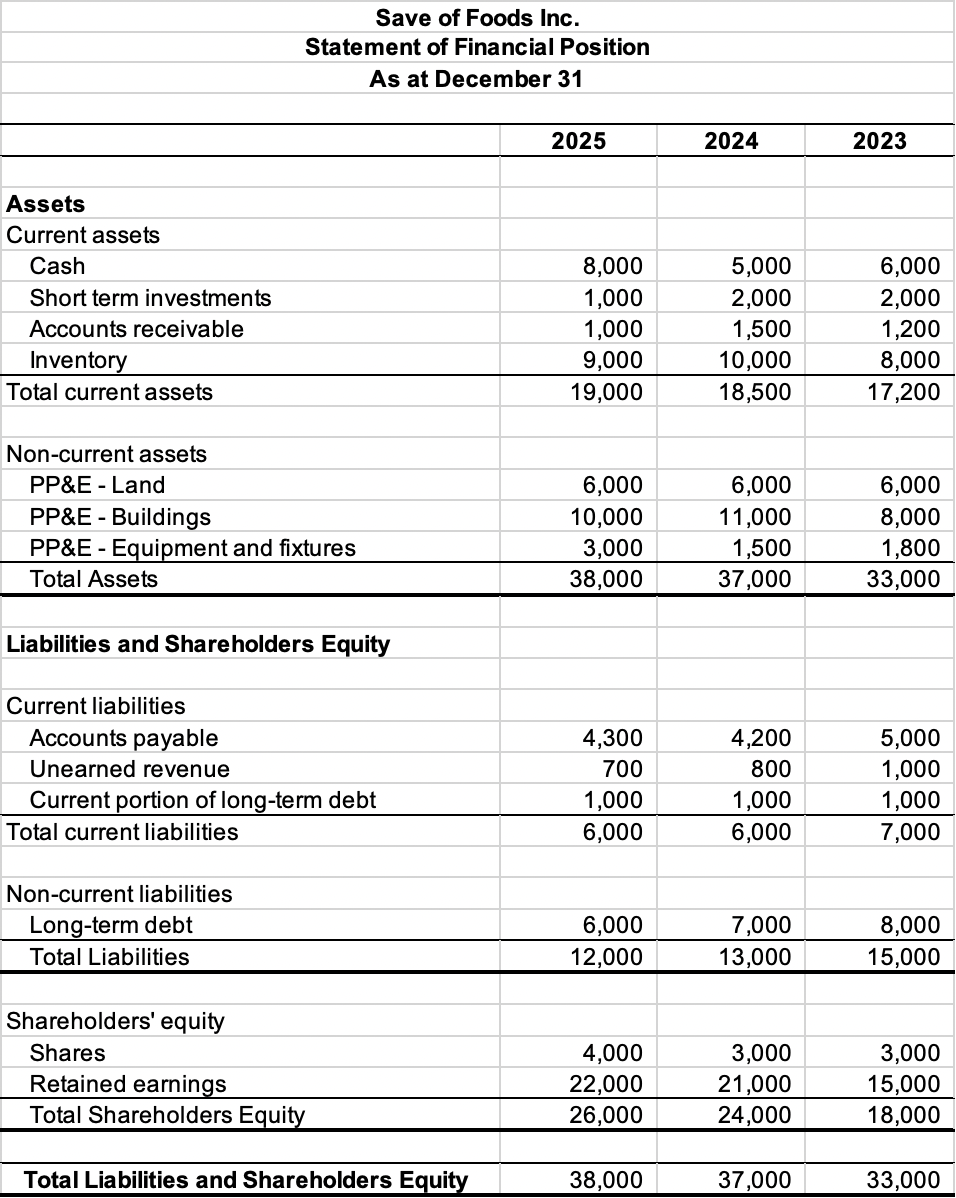

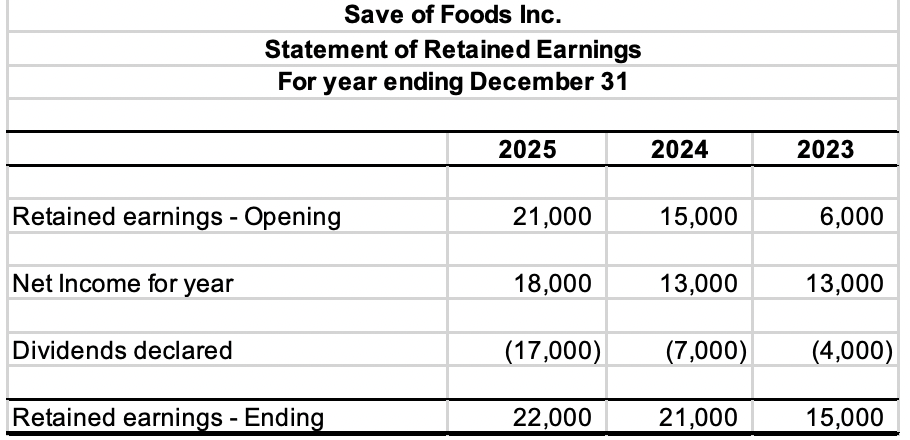

Task \#1 - Loan: May 1, 2024 - SOF received a bank loan of $90,000 from Conexus Credit Union. Jun 1, 2024 - SOF spent $100,000 to purchase a forklift (POS) for a total cost of $100,000. The forklift will be used to move groceries throughout the store. The forklift will have a 10-year useful life. The interest rate on the loan from Conexus is 6.0% (compounded only on the loan principle outstanding). The loan is for 3 years and will be paid back evenly over 3 years. As part of the financing SOF only needs to make the required loan payments each year or Apr 30. Each loan payment will be for $30,000 plus any interest owing. Required: a) Journal Entries: - Prepare the required journal entries for each of the following dates relating to both the asset and the loan: > May 1,2024 > Jun 1,2024 > Dec 31, 2024 > Apr 30, 2025 > Dec 31, 2025 Apr 30, 2026 >Dec31,2026 > Apr 30, 2027 You must show all supporting calculations. b) Financial Statements: - What will the NBV of the equipment be on the Dec 31, 2031 statement of financial position? Save of Foods Inc. Statement of Financial Position As at December 31 \begin{tabular}{|c|c|c|c|} \hline & 2025 & 2024 & 2023 \\ \hline \multicolumn{4}{|l|}{ Assets } \\ \hline \multicolumn{4}{|l|}{ Current assets } \\ \hline Cash & 8,000 & 5,000 & 6,000 \\ \hline Short term investments & 1,000 & 2,000 & 2,000 \\ \hline Accounts receivable & 1,000 & 1,500 & 1,200 \\ \hline Inventory & 9,000 & 10,000 & 8,000 \\ \hline Total current assets & 19,000 & 18,500 & 17,200 \\ \hline \multicolumn{4}{|l|}{ Non-current assets } \\ \hline PP\&E - Land & 6,000 & 6,000 & 6,000 \\ \hline PP\&E - Buildings & 10,000 & 11,000 & 8,000 \\ \hline PP\&E - Equipment and fixtures & 3,000 & 1,500 & 1,800 \\ \hline Total Assets & 38,000 & 37,000 & 33,000 \\ \hline \multicolumn{4}{|l|}{ Liabilities and Shareholders Equity } \\ \hline \multicolumn{4}{|l|}{ Current liabilities } \\ \hline Accounts payable & 4,300 & 4,200 & 5,000 \\ \hline Unearned revenue & 700 & 800 & 1,000 \\ \hline Current portion of long-term debt & 1,000 & 1,000 & 1,000 \\ \hline Total current liabilities & 6,000 & 6,000 & 7,000 \\ \hline \multicolumn{4}{|l|}{ Non-current liabilities } \\ \hline Long-term debt & 6,000 & 7,000 & 8,000 \\ \hline Total Liabilities & 12,000 & 13,000 & 15,000 \\ \hline \multicolumn{4}{|l|}{ Shareholders' equity } \\ \hline Shares & 4,000 & 3,000 & 3,000 \\ \hline Retained earnings & 22,000 & 21,000 & 15,000 \\ \hline Total Shareholders Equity & 26,000 & 24,000 & 18,000 \\ \hline Total Liabilities and Shareholders & 38,000 & 37,000 & 33,000 \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|} \hline \multicolumn{4}{|c|}{ Save on Foods Inc. } \\ \hline Statement of & ome & & \\ \hline \multicolumn{4}{|c|}{ For year ending December 31} \\ \hline & 2025 & 2024 & 2023 \\ \hline \multicolumn{4}{|l|}{ Revenue } \\ \hline Sales & 125,000 & 118,000 & 112,000 \\ \hline Total revenue & 125,000 & 118,000 & 112,000 \\ \hline \multicolumn{4}{|l|}{ Expenses } \\ \hline Cost of goods sold & 90,000 & 89,000 & 85,000 \\ \hline Selling and general administrative expenses & 12,000 & 13,000 & 11,000 \\ \hline Advertising & 2,000 & 1,000 & 1,000 \\ \hline Total expenses & 104,000 & 103,000 & 97,000 \\ \hline Income from operations & 21,000 & 15,000 & 15,000 \\ \hline \multicolumn{4}{|l|}{ Other income and expenses } \\ \hline Interest income & 1,500 & 2,000 & 1,000 \\ \hline Interest expense & (500) & (1,000) & (1,000) \\ \hline Income before corporate income taxes & 22,000 & 16,000 & 15,000 \\ \hline Corproate income taxes & 4,000 & 3,000 & 2,000 \\ \hline Net income & 18,000 & 13,000 & 13,000 \\ \hline \end{tabular} 6) Feb 15, 2025 - SOF receives the following cheques: No other indications of not paying has been received from customers. 7) Feb 28, 2025 - SOF updates its allowance for doubtful accounts (if needed). Required: a) Journal Entries: - Journal Entries - Prepare the required journal entries for the above dates using the "Direct Write-Off" method. b) Financial Statements: - What will the NBV of the accounts receivable be on the Dec 31, 2024 statement of financial position? c) Financial Statements: - What will the NBV of the accounts receivable be on the Feb 28, 2025 statement of financial position? For Save of Foods Inc., please calculate and explain the following ratios for 2024 and 2025: 1) Current 2) Debt as a \% of Assets 3) Equity as a \% of Assets 4) Gross margin 5) Profit margin 6) Inventory turnover 7) Inventory turnover - Day in inventory 8) Accounts receivable turnover 9) Accounts receivable turnover - Day in accounts receivable Notes: Round as follows: Percentage - 95.44%=95.4% - 95.45%=95.5% Do not show percentages as " 0.30 ", show as 30% Numbers - 95.44=95.4 - 95.45=95.5 Task \#4 - Accounts Receivable - Allowance Method: ATTEMPT THIS, but it is not part of your mark. Save of Food Inc. had the following events occur in 2024 and 2025 in relation to accounts receivable. Notes: - Assume that the allowance for doubtful accounts was at balance of $0 on Dec 1, 2024. - SOF already had made previous sales on account that were still outstanding as of Dec 1,2024. THESE SALES HAVE ALREADY HAD THERE INITIAL ACCOUNTING RECORDED. Events: 1) On Dec 1, 2024 SOF made the following sales on account: 2) Dec 28, 2024 - SOF feels that there is a chance that the $400 of A/R from Joey could not be collected. This is due to the customer not being happy with the product(s) they purchased; however, they are not able to return food after 10 days. 3) Dec 31, 2024 - SOF updates its allowance for doubtful accounts to $100. 4) Jan 10, 2025 - SOF is notified that Joey will not be paying their $400 of A/R. Based upon this notification SOF decided to officially write off the $400 of A/R. Task \#3 - Accounts Receivable - Direct Write-off Method: Save of Food Inc. had the following events occur in 2024 and 2025 in relation to accounts receivable. Notes: - Assume that the allowance for doubtful accounts was at balance of $0 on Dec 1, 2024. - SOF already had made previous sales on account that were still outstanding as of Dec 1,2024. THESE SALES HAVE ALREADY HAD THERE INITIAL ACCOUNTING RECORDED. Events: 1) On Dec 1, 2024 SOF made the following sales on account: 2) Dec 28, 2024 - SOF feels that there is a chance that the $400 of A/R from Joey could not be collected. This is due to the customer not being happy with the product(s) they purchased; however, they are not able to return food after 10 days. 3) Dec 31, 2024 - SOF updates its allowance for doubtful accounts (if needed). 4) Jan 10, 2025 - SOF is notified that Joey will not be paying their $400 of A/R. Based upon this notification SOF decided to officially write off the $400 of A/R. 5) Jan 31,2025 - SOF updates its allowance for doubtful accounts (if needed). Save of Foods Inc. Statement of Retained Earnings For year ending December 31 \begin{tabular}{|l|r|r|r|} \hline & \multicolumn{1}{|c|}{2025} & \multicolumn{1}{|c|}{2024} & \multicolumn{1}{c|}{2023} \\ \hline & & & \\ \hline Retained earnings - Opening & 21,000 & 15,000 & 6,000 \\ \hline & & & \\ \hline Net Income for year & 18,000 & 13,000 & 13,000 \\ \hline & (17,000) & (7,000) & (4,000) \\ \hline Dividends declared & & & \\ \hline & 22,000 & 21,000 & 15,000 \\ \hline Retained earnings - Ending & & & \\ \hline \end{tabular} 6) Feb 15, 2025 - SOF receives the following cheques: No other indications of not paying has been received from customers. 7) Feb 28, 2025 - SOF updates its allowance for doubtful accounts to $90. Required: a) Journal Entries: - Journal Entries - Prepare the required journal entries for the above dates using the "Allowance" method. b) Financial Statements: - What will the NBV of the Accounts Receivable be on the Dec 31, 2024 statement of financial position? c) Financial Statements: - What will the NBV of the Accounts Receivable be on the Feb 28, 2025 statement of financial position