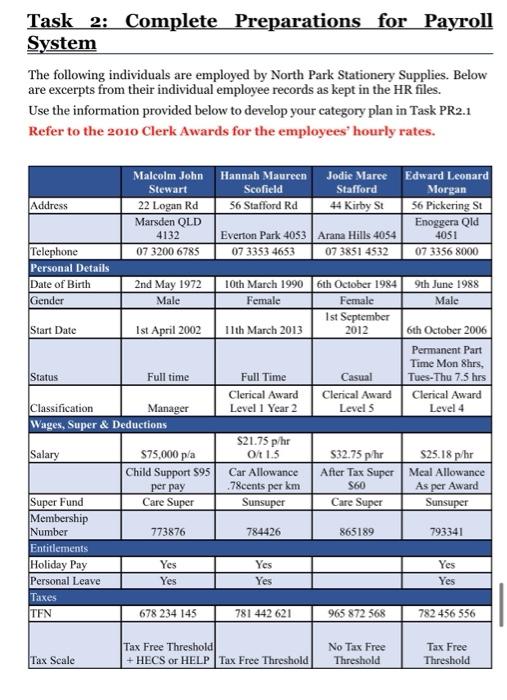

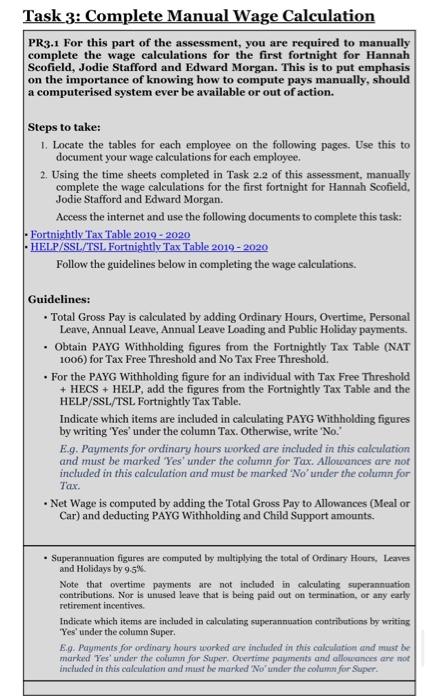

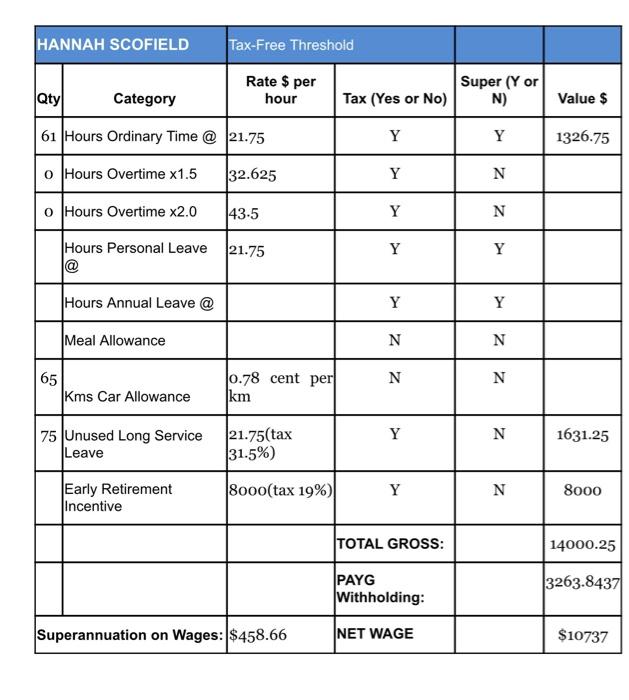

Task 2: Complete Preparations for Payroll System The following individuals are employed by North Park Stationery Supplies. Below are excerpts from their individual employee records as kept in the HR files. Use the information provided below to develop your category plan in Task PR2.1 Refer to the 2010 Clerk Awards for the employees' hourly rates. Address Malcolm John Hannah Maureen Jodie Maree Edward Leonard Stewart Scofield Stafford Morgan 22 Logan Rd 56 Stafford Rd 44 Kirby St 56 Pickering St Marsden QLD Enoggera Old 4132 Everton Park 4053 Arana Hills 4054 4051 07 3200 6785 07 3353 4653 07 3851 4532 07 3356 8000 Telephone Personal Details Date of Birth Gender 9th June 1988 Male 2nd May 1972 10th March 1990 6th October 1984 Male Female Female Ist September Ist April 2002 11th March 2013 2012 Start Date 6th October 2006 Permanent Part Time Mon 8hrs, Tues-Thu 7.5 hrs Clerical Award Level 4 Status Full time Full Time Clerical Award Level 1 Year 2 Casual Clerical Award Level 5 Classification Manager Wages, Super & Deductions Salary $75,000 pa Child Support 595 per pay Care Super $21.75 phr Ot 1.5 Car Allowance .78cents per km Sunsuper S32.75 phr After Tax Super S60 Care Super S25.18 phr Meal Allowance As per Award Sunsuper 773876 784426 865189 793341 Super Fund Membership Number Entitlements Holiday Pay Personal Leave Taxes TEN Yes Yes Yes Yes Yes Yes 678 234 145 781 442 621 965 872 568 782 456 556 Tax Free Threshold + HECS or HELP Tax Free Threshold No Tax Free Threshold Tax Free Threshold Tax Scale Task 3: Complete Manual Wage Calculation PR3.1 For this part of the assessment, you are required to manually complete the wage calculations for the first fortnight for Hannah Scofield, Jodie Stafford and Edward Morgan. This is to put emphasis on the importance of knowing how to compute pays manually, should a computerised system ever be available or out of action. Steps to take: 1. Locate the tables for each employee on the following pages. Use this to document your wage calculations for each employee. 2. Using the time sheets completed in Task 2.2 of this assessment, manually complete the wage calculations for the first fortnight for Hannah Scofield, Jodie Stafford and Edward Morgan. Access the internet and use the following documents to complete this task: - Fortnightly Tax Table 2019-2020 HELP/SSL/TSL Fortnightly Tax Table 2019-2020 Follow the guidelines below in completing the wage calculations. Guidelines: Total Gross Pay is calculated by adding Ordinary Hours, Overtime, Personal Leave, Annual Leave, Annual Leave Loading and Public Holiday payments. Obtain PAYG Withholding figures from the Fortnightly Tax Table (NAT 1006) for Tax Free Threshold and No Tax Free Threshold. . For the PAYG Withholding figure for an individual with Tax Free Threshold + HECS + HELP, add the figures from the Fortnightly Tax Table and the HELP/SSL./TSL Fortnightly Tax Table. Indicate which items are included in calculating PAYG Withholding figures by writing 'Yes' under the column Tax. Otherwise, write 'No.' Eg. Payments for ordinary hours worked are included in this calculation and must be marked 'Yes' under the column for Tax. Allowances are not included in this calculation and must be marked No' under the column for Tax. Net Wage is computed by adding the Total Gross Pay to Allowances (Meal or Car) and deducting PAYG Withholding and Child Support amounts. Superannuation figures are computed by multiplying the total of Ordinary Hours, leaves and Holidays by 9.5% Note that overtime payments are not included in calculating superannuation contributions. Nor is unused leave that is being paid out on termination, or any early retirement incentives. Indicate which items are included in calculating superannuation contributions by writing 'Yes' under the column Super. E.g. Payments for ordinary hours worked are included in this calculation and must be marked 'Yes' under the column for Super Overtime payments and allowances are not included in this calculation and must be marked 'No' under the column for Super. HANNAH SCOFIELD Tax-Free Threshold Rate $ per hour Qty Category Tax (Yes or No) Super (Y or N) Value $ 61 Hours Ordinary Time @ 21.75 Y Y 1326.75 o Hours Overtime x1.5 32.625 Y N o Hours Overtime x2.0 43-5 Y N Hours Personal Leave 21.75 Y Y Hours Annual Leave @ Y Y Meal Allowance N N N N 65 Kms Car Allowance 0.78 cent per km Y N 1631.25 75 Unused Long Service Leave 21.75(tax 31.5%) Early Retirement Incentive 8000(tax 19%) Y N 8000 TOTAL GROSS: 14000.25 PAYG Withholding: 3263.8437 Superannuation on Wages: $458.66 NET WAGE $10737 Task 2: Complete Preparations for Payroll System The following individuals are employed by North Park Stationery Supplies. Below are excerpts from their individual employee records as kept in the HR files. Use the information provided below to develop your category plan in Task PR2.1 Refer to the 2010 Clerk Awards for the employees' hourly rates. Address Malcolm John Hannah Maureen Jodie Maree Edward Leonard Stewart Scofield Stafford Morgan 22 Logan Rd 56 Stafford Rd 44 Kirby St 56 Pickering St Marsden QLD Enoggera Old 4132 Everton Park 4053 Arana Hills 4054 4051 07 3200 6785 07 3353 4653 07 3851 4532 07 3356 8000 Telephone Personal Details Date of Birth Gender 9th June 1988 Male 2nd May 1972 10th March 1990 6th October 1984 Male Female Female Ist September Ist April 2002 11th March 2013 2012 Start Date 6th October 2006 Permanent Part Time Mon 8hrs, Tues-Thu 7.5 hrs Clerical Award Level 4 Status Full time Full Time Clerical Award Level 1 Year 2 Casual Clerical Award Level 5 Classification Manager Wages, Super & Deductions Salary $75,000 pa Child Support 595 per pay Care Super $21.75 phr Ot 1.5 Car Allowance .78cents per km Sunsuper S32.75 phr After Tax Super S60 Care Super S25.18 phr Meal Allowance As per Award Sunsuper 773876 784426 865189 793341 Super Fund Membership Number Entitlements Holiday Pay Personal Leave Taxes TEN Yes Yes Yes Yes Yes Yes 678 234 145 781 442 621 965 872 568 782 456 556 Tax Free Threshold + HECS or HELP Tax Free Threshold No Tax Free Threshold Tax Free Threshold Tax Scale Task 3: Complete Manual Wage Calculation PR3.1 For this part of the assessment, you are required to manually complete the wage calculations for the first fortnight for Hannah Scofield, Jodie Stafford and Edward Morgan. This is to put emphasis on the importance of knowing how to compute pays manually, should a computerised system ever be available or out of action. Steps to take: 1. Locate the tables for each employee on the following pages. Use this to document your wage calculations for each employee. 2. Using the time sheets completed in Task 2.2 of this assessment, manually complete the wage calculations for the first fortnight for Hannah Scofield, Jodie Stafford and Edward Morgan. Access the internet and use the following documents to complete this task: - Fortnightly Tax Table 2019-2020 HELP/SSL/TSL Fortnightly Tax Table 2019-2020 Follow the guidelines below in completing the wage calculations. Guidelines: Total Gross Pay is calculated by adding Ordinary Hours, Overtime, Personal Leave, Annual Leave, Annual Leave Loading and Public Holiday payments. Obtain PAYG Withholding figures from the Fortnightly Tax Table (NAT 1006) for Tax Free Threshold and No Tax Free Threshold. . For the PAYG Withholding figure for an individual with Tax Free Threshold + HECS + HELP, add the figures from the Fortnightly Tax Table and the HELP/SSL./TSL Fortnightly Tax Table. Indicate which items are included in calculating PAYG Withholding figures by writing 'Yes' under the column Tax. Otherwise, write 'No.' Eg. Payments for ordinary hours worked are included in this calculation and must be marked 'Yes' under the column for Tax. Allowances are not included in this calculation and must be marked No' under the column for Tax. Net Wage is computed by adding the Total Gross Pay to Allowances (Meal or Car) and deducting PAYG Withholding and Child Support amounts. Superannuation figures are computed by multiplying the total of Ordinary Hours, leaves and Holidays by 9.5% Note that overtime payments are not included in calculating superannuation contributions. Nor is unused leave that is being paid out on termination, or any early retirement incentives. Indicate which items are included in calculating superannuation contributions by writing 'Yes' under the column Super. E.g. Payments for ordinary hours worked are included in this calculation and must be marked 'Yes' under the column for Super Overtime payments and allowances are not included in this calculation and must be marked 'No' under the column for Super. HANNAH SCOFIELD Tax-Free Threshold Rate $ per hour Qty Category Tax (Yes or No) Super (Y or N) Value $ 61 Hours Ordinary Time @ 21.75 Y Y 1326.75 o Hours Overtime x1.5 32.625 Y N o Hours Overtime x2.0 43-5 Y N Hours Personal Leave 21.75 Y Y Hours Annual Leave @ Y Y Meal Allowance N N N N 65 Kms Car Allowance 0.78 cent per km Y N 1631.25 75 Unused Long Service Leave 21.75(tax 31.5%) Early Retirement Incentive 8000(tax 19%) Y N 8000 TOTAL GROSS: 14000.25 PAYG Withholding: 3263.8437 Superannuation on Wages: $458.66 NET WAGE $10737