Answered step by step

Verified Expert Solution

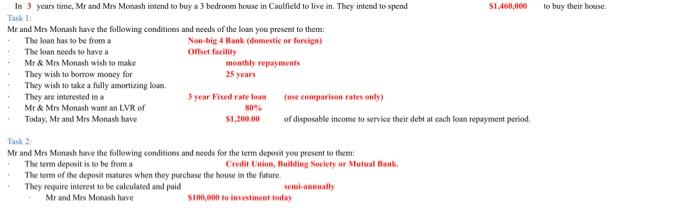

Question

1 Approved Answer

Task 2. Given the deposit Mr and Mrs Monash must pay in the future, they also task you with finding a good investment to help

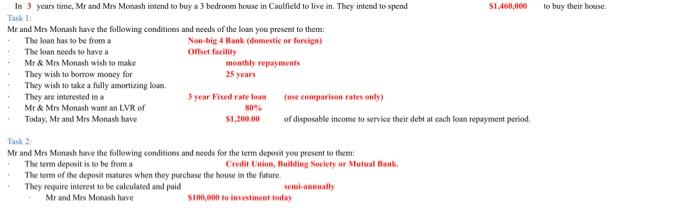

Task 2.

Given the deposit Mr and Mrs Monash must pay in the future, they also task you with finding a good investment to help them save. Find and present in your business report the best (highest interest rate) term deposit available in the market that meets Mr and Mrs Monashs conditions specified in your team data. You are required to show evidence of your comparison.

a) Given what Mr and Mrs Monash have to invest today, apply financial math and calculate the future value of investing in your recommended term deposit today, for when Mr and Mrs Monash need to buy their house. (show your formula, substitution and working, missing financial math will result in a penalty of -1.5 marks)

b) Do Mr. and Mrs. have enough now to pay for their deposit in the future? If yes, by what percentage are they over their deposit. If not, with the term deposit investment, will they saved enough to pay for their deposit in the future? If not, by what percentage are they under their deposit.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started