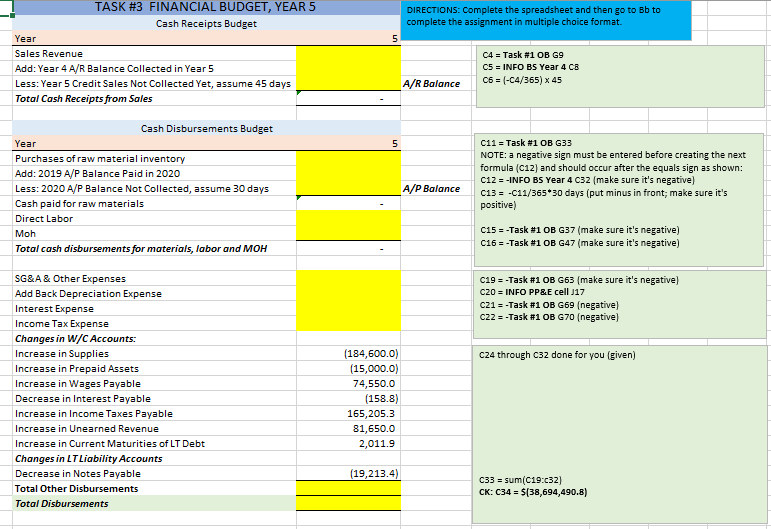

TASK #3 FINANCIAL BUDGET, YEAR 5 DIRECTIONS: Complete the spreadsheet and then go to Bb to complete the assignment in multiple choice format. Cash Receipts Budget Year Sales Revenue Add: Year 4 A/R Balance Collected in Year 5 Less: Year 5 Credit Sales Not Collected Yet, assume 45 days Total Cash Receipts from Sales C4 = Task #1 OB Gg C5 INFO BS Year 4 CR C6-(-C4/365) x 45 A/R Balance Cash Disbursements Budget Year Purchases of raw material inventory Add: 2019 A/P Balance Paid in 2020 Less: 2020 A/P Balance Not Collected, assume 30 days Cash paid for raw materials Direct Labor C11-Task #1 OB G33 NOTE: a negative sign must be entered before creating the next formula (C12) and should occur after the equals sign as shown: C12 -INFO BS Year 4 C32 (make sure it's negative] C13--C11/365*30 days (put minus in front, make sure it's positive) A/P Balance c15--Task #1 OB G37 (make sure it's negative) C162-Task #1 OB G47(make sure it's negative) Total cash disbursements for materials, labor and MOH SG&A & Other Expenses Add Back Depreciation Expense Interest Expense Income Tax Expense Changes in W/C Accounts: Increase in Supplies Increase in Prepaid Assets Increase in Wages Payable Decrease in Interest Payable Increase in Income Taxes Payable Increase in Unearned Revenue Increase in Current Maturities of LT Debt Changes in LTLiability Accounts Decrease in Notes Payable Total Other Disbursements Total Disbursements C19-Task #1 OB G63 {make sure it's negative) C20 INFO PP&E cell J17 C21-Task #1 OB G69(negative) C2:-Task #1 OB G70(negative) (184,600.0) (15,000.0) 74,550.0 (158.8) 165,205.3 81,650.0 2,011.9 C24 through C32 done for you (given) (19,213.4) C33 sum(C19:c32] CK: C34 $(38,694,490.8) TASK #3 FINANCIAL BUDGET, YEAR 5 DIRECTIONS: Complete the spreadsheet and then go to Bb to complete the assignment in multiple choice format. Cash Receipts Budget Year Sales Revenue Add: Year 4 A/R Balance Collected in Year 5 Less: Year 5 Credit Sales Not Collected Yet, assume 45 days Total Cash Receipts from Sales C4 = Task #1 OB Gg C5 INFO BS Year 4 CR C6-(-C4/365) x 45 A/R Balance Cash Disbursements Budget Year Purchases of raw material inventory Add: 2019 A/P Balance Paid in 2020 Less: 2020 A/P Balance Not Collected, assume 30 days Cash paid for raw materials Direct Labor C11-Task #1 OB G33 NOTE: a negative sign must be entered before creating the next formula (C12) and should occur after the equals sign as shown: C12 -INFO BS Year 4 C32 (make sure it's negative] C13--C11/365*30 days (put minus in front, make sure it's positive) A/P Balance c15--Task #1 OB G37 (make sure it's negative) C162-Task #1 OB G47(make sure it's negative) Total cash disbursements for materials, labor and MOH SG&A & Other Expenses Add Back Depreciation Expense Interest Expense Income Tax Expense Changes in W/C Accounts: Increase in Supplies Increase in Prepaid Assets Increase in Wages Payable Decrease in Interest Payable Increase in Income Taxes Payable Increase in Unearned Revenue Increase in Current Maturities of LT Debt Changes in LTLiability Accounts Decrease in Notes Payable Total Other Disbursements Total Disbursements C19-Task #1 OB G63 {make sure it's negative) C20 INFO PP&E cell J17 C21-Task #1 OB G69(negative) C2:-Task #1 OB G70(negative) (184,600.0) (15,000.0) 74,550.0 (158.8) 165,205.3 81,650.0 2,011.9 C24 through C32 done for you (given) (19,213.4) C33 sum(C19:c32] CK: C34 $(38,694,490.8)