Answered step by step

Verified Expert Solution

Question

1 Approved Answer

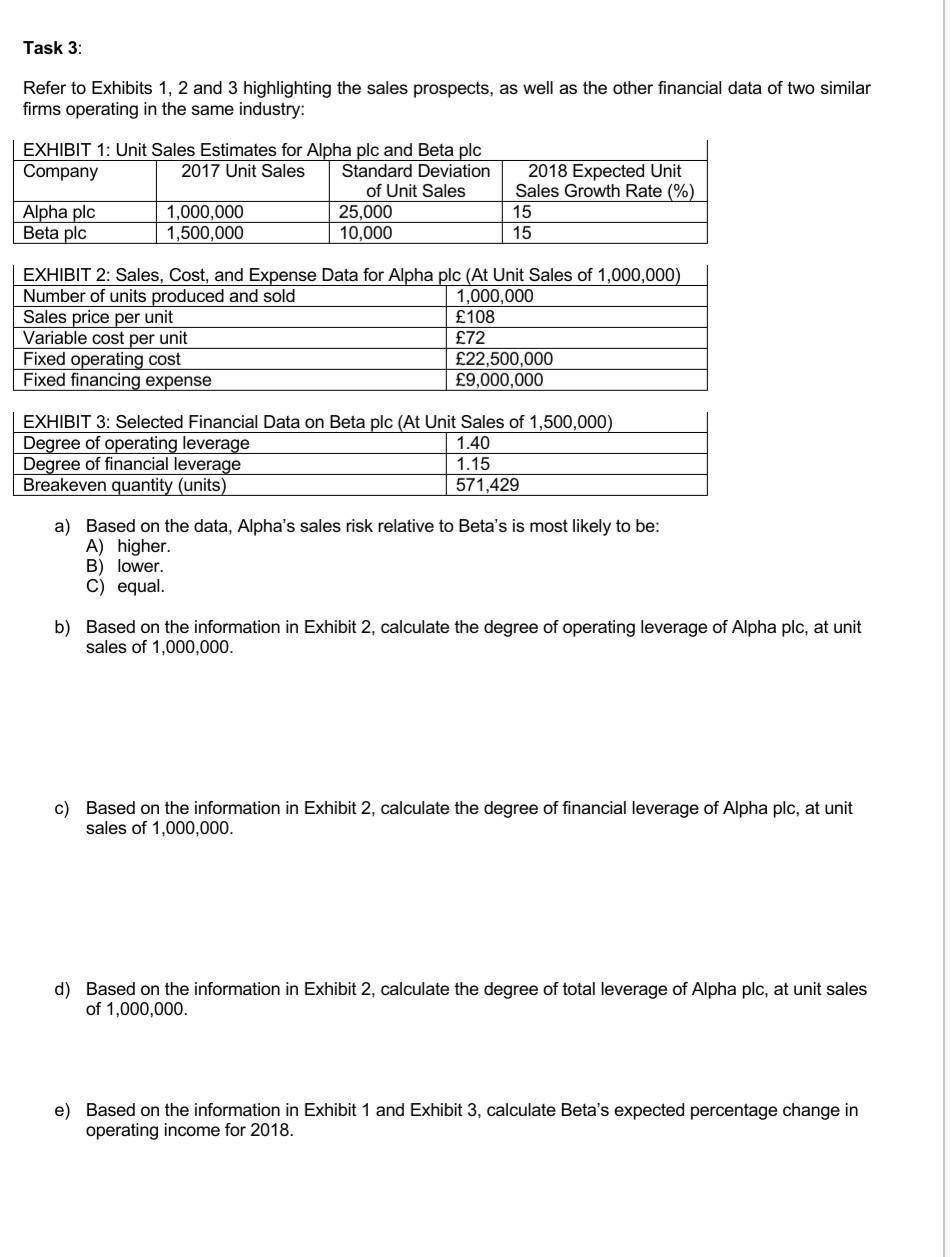

Task 3: Refer to Exhibits 1, 2 and 3 highlighting the sales prospects, as well as the other financial data of two similar firms operating

Task 3: Refer to Exhibits 1, 2 and 3 highlighting the sales prospects, as well as the other financial data of two similar firms operating in the same industry: EXHIBIT 1: Unit Sales Estimates for Alpha plc and Beta plc Company 2017 Unit Sales Standard Deviation of Unit Sales Alpha plc 1,000,000 25,000 Beta plc 1,500,000 10,000 2018 Expected Unit Sales Growth Rate (%) 15 15 EXHIBIT 2: Sales, Cost, and Expense Data for Alpha plc (At Unit Sales of 1,000,000) Number of units produced and sold 1,000,000 Sales price per unit 108 Variable cost per unit 72 Fixed operating cost 22,500,000 Fixed financing expense 9,000,000 EXHIBIT 3: Selected Financial Data on Beta plc (At Unit Sales of 1,500,000) Degree of operating leverage 1.40 Degree of financial leverage 1.15 Breakeven quantity (units) 571,429 a) Based on the data, Alpha's sales risk relative to Beta's is most likely to be: A) higher. B) lower. C) equal. b) Based on the information in Exhibit 2, calculate the degree of operating leverage of Alpha plc, at unit sales of 1,000,000. c) Based on the information in Exhibit 2, calculate the degree of financial leverage of Alpha plc, at unit sales of 1,000,000. d) Based on the information in Exhibit 2, calculate the degree of total leverage of Alpha plc, at unit sales of 1,000,000 e) Based on the information in Exhibit 1 and Exhibit 3, calculate Beta's expected percentage change in operating income for 2018

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started