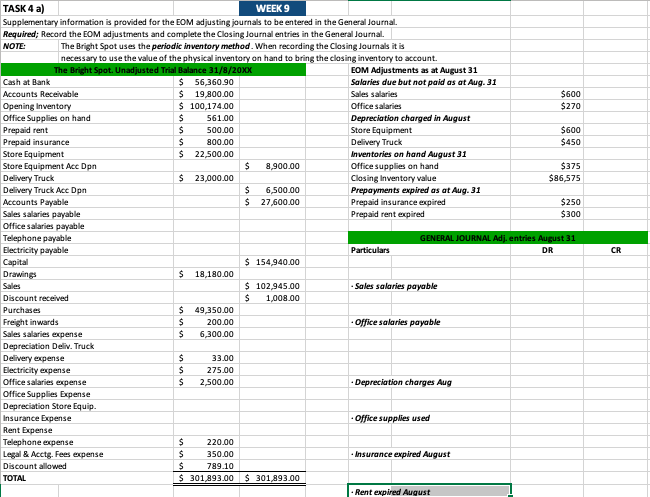

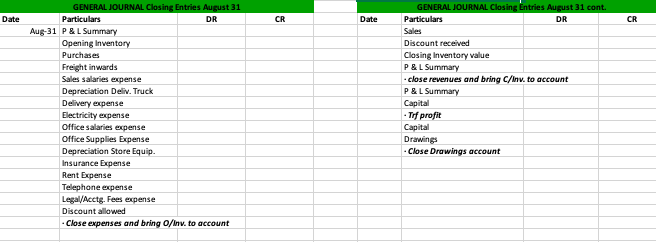

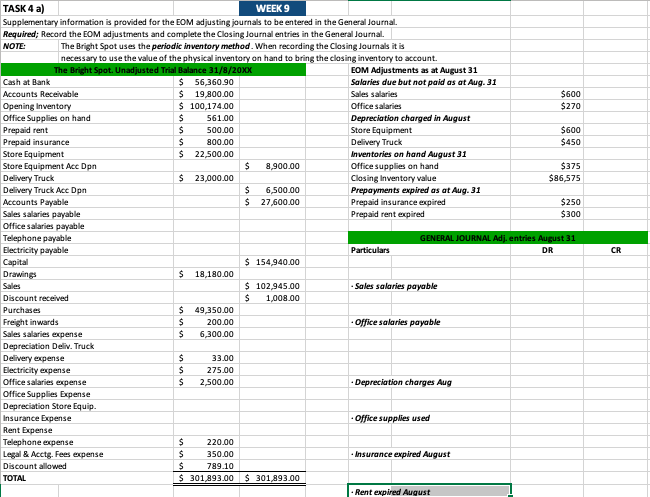

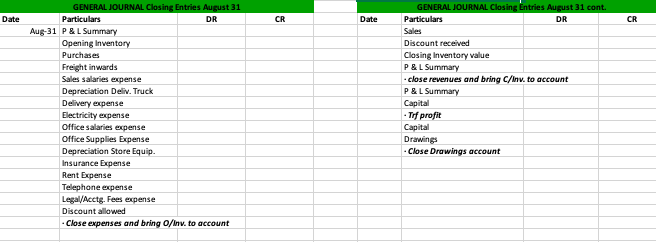

TASK 4 a) WEEK 9 Supplementary information is provided for the EOM adjusting journals to be entered in the General Journal. Required; Record the EOM adjustments and complete the Closing Journal entries in the General Journal. NOTE: The Bright Spot uses the periodic inventory method. When recording the Closing Journals it is necessary to use the value of the physical inventory on hand to bring the closing inventory to account. The Bright Spot. Unadjusted Trial Balance 31/8/20xx EOM Adjustments as at August 31 Cash at Bank $ 56,360.90 Salaries due but not paid as at Aug. 31 Accounts Receivable $ 19,800.00 Sales salaries $600 Opening Inventory $ 100,174.00 Office salaries $270 Office Supplies on hand $ 561.00 Depreciation charged in August Prepaid rent $ 500.00 Store Equipment $600 Prepaid insurance $ 800.00 Delivery Truck $450 Store Equipment $ 22,500.00 Inventories on hand August 31 Store Equipment Acc Dpn $ 8,900.00 Office supplies on hand $375 Delivery Truck $ 23,000.00 Closing Inventory value $86,575 Delivery Truck Acc Dpn $ 6,500.00 Prepayments expired as at Aug. 31 Accounts Payable $ 27,600.00 Prepaid insurance expired $250 Sales salaries payable Prepaid rent expired $300 Office salaries payable Telephone payable GENERAL JOURNAL Adj. entries August 31 Electricity payable Particulars DR Capital $ 154,940.00 Drawings $ 18,180.00 Sales $ 102,945.00 - Sales salaries payable Discount received $ 1,008,00 Purchases $ 49,350.00 Freight inwards $ 200.00 - Office salaries payable Sales salaries expense $ 6,300.00 Depreciation Deliv. Truck Delivery expense $ 33.00 Electricity expense $ 275.00 Office salaries expense $ 2,500.00 - Depreciation charges Aug Office Supplies Expense Depreciation Store Equip. Insurance Expense Office supplies used Rent Expense Telephone expense $ 220.00 Legal & Acety. Fees expense $ 350.00 Insurance expired August Discount allowed $ 789.10 TOTAL $ 301 893.00 $ 301.893.00 Rent expired August CR Date CR Date CR GENERAL JOURNAL Closing Entries August 31 Particulars DR Aug 31 P&L Summary Opening Inventory Purchases Freight inwards Sales salaries expense Depreciation Deliv. Truck Delivery expense Electricity expense Office salaries expense Office Supplies Expense Depreciation Store Equip. Insurance Expense Rent Expense Telephone expense Legal/Acetig. Fees expense Discount allowed Close expenses and bring o/Inv. to account GENERAL JOURNAL Closing Entries August 31 cont. Particulars DR Sales Discount received Closing Inventory value P&L Summary . close revenues and bring C/Inv. to account P&L Summary Capital - Tof profit Capital Drawings Close Drawings account