Answered step by step

Verified Expert Solution

Question

1 Approved Answer

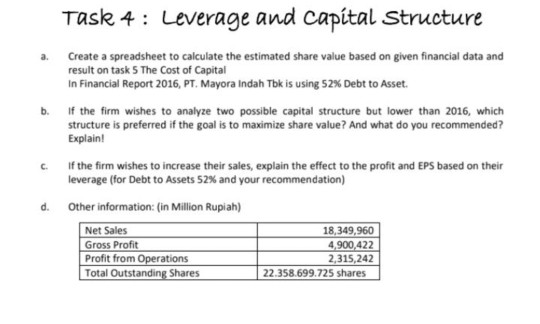

Task 4: Leverage and capital Structure Create a spreadsheet to calculate the estimated share value based on given financial data and result on task 5

Task 4: Leverage and capital Structure Create a spreadsheet to calculate the estimated share value based on given financial data and result on task 5 The Cost of Capital in Financial Report 2016, PT. Mayora Indah Tbk is using 52% Debt to Asset. a. If the firm wishes to analyze two possible capital structure but lower than 2016, which structure is preferred if the goal is to maximize share value? And what do you recommended? Explain! b. If the firm wishes to increase their sales, explain the effect to the profit and EPS based on their leverage (for Debt to Assets 52% and your recommendation) Other information: (in Million Rupiah) d. 18,349,960 4,900,422 Net Sales Gross Profit Profit from Operations Total Outstanding Shares 2.315,242 22.358.699.725 shares Task 4: Leverage and capital Structure Create a spreadsheet to calculate the estimated share value based on given financial data and result on task 5 The Cost of Capital in Financial Report 2016, PT. Mayora Indah Tbk is using 52% Debt to Asset. a. If the firm wishes to analyze two possible capital structure but lower than 2016, which structure is preferred if the goal is to maximize share value? And what do you recommended? Explain! b. If the firm wishes to increase their sales, explain the effect to the profit and EPS based on their leverage (for Debt to Assets 52% and your recommendation) Other information: (in Million Rupiah) d. 18,349,960 4,900,422 Net Sales Gross Profit Profit from Operations Total Outstanding Shares 2.315,242 22.358.699.725 shares

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started