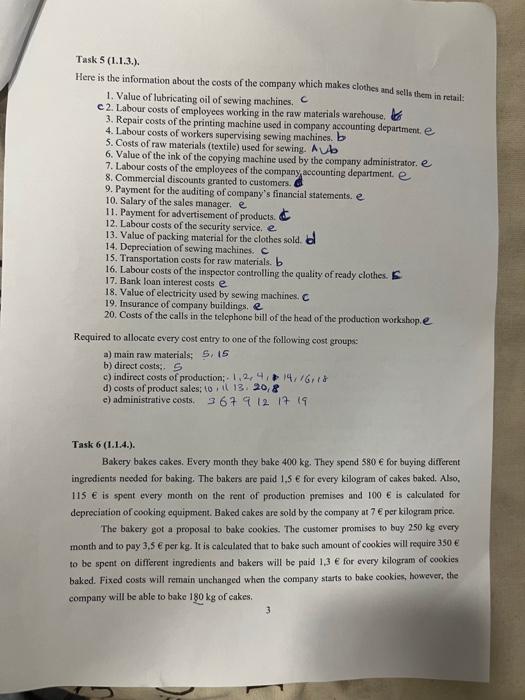

Task 5 (1.1.3.). Here is the infomation about the costs of the company which makes clothes and sells them in retail: 1. Value of lubricating oil of sewing machines. 2. Labour cests of employees working in the raw materials warebouse. 3. Repair costs of the printing machine used in company accounting department. 4. Labour costs of workers supervising sewing machines. 5. Costs of raw materials (textile) used for sewing. 6. Value of the ink of the copying machine used by the company administrator. 7. Labour costs of the employees of the company aconanting department. 8. Commercial discounts granted to customers. 9. Payment for the auditing of company's financial statements, 10. Salary of the sales manager. 11. Payment for advertisement of products. 12. Labour costs of the security service. 13. Value of packing material for the clothes sold. 14. Depreciation of sewing machines, 15. Trunsponation costs for raw materials. 16. Labour cosis of the inspector controlling the quality of ready clothes, 17. Bank loan interest costs 18. Value of electricity used by sewing machines. 19. Insurance of company buildings. 20. Costs of the calls in the telephone bill of the head of the production workshop. Required to allocate every cost entry to ene of the following cost groups: a) main raw materials; b) direct costs c) indiroet cons of production: d) conts of product sales; c) amministrative costs. Task 6 (1.1.4.). Bakery bakes cakes. Every month they bake 400kg. They spend 580 for buying different ingredients neoded for baking. The bakers are paid 1.5 for every kilogram of cakes baked. Also, 115E is spent every month on the rent of production premises and 100E is calculsited for depreciation of cooking equipment. Baked cakes are sold by the company at 7 per kilogram price. The bakery got a proposal to bake cookies. The custonner promises to bay 250kg every month and io pay 3,5 E per kg. If is calculated that to bake such amount of cookies will require 350 to be spent os different ingredients and bakers will be paid 1.3 for every kilogram of cookies baked. Fixed costs will remain unchanged when the company starts to bake cookies, however, the company will be able to bake 180kg of cakes. 3 Task 5 (1.1.3.). Here is the information about the costs of the company which makes clothes and sells them in reail: 1. Value of lubricating oil of sewing machines, C C 2. Labour costs of employees working in the raw materials warehouse, 3. Repair costs of the printing machine used in company accounting department, e. 4. Labour costs of workers supervising sewing machines. b 5. Costs of raw materials (textile) used for sewing. A A 6. Value of the ink of the copying machine used by the company administrator. e 7. Labour costs of the employees of the company accounting department. e 9. Payment for the auditing of company's financial statements. e 10. Salary of the sales manager. e 11. Payment for advertisement of products. \& 12. Labour costs of the security service, e. 13. Value of packing material for the clothes sold. bl 14. Depreciation of sewing machines. C 15. Transportation costs for raw materials. b 16. Labour costs of the inspector controlling the quality of ready clothes. E. 17. Bank loan interest costs e 18. Value of electricity used by sewing machines, C 19. Insurance of company buildings, e. 20. Casts of the calls in the telephone bill of the head of the production worksbop. Required to allocate every cost entry to one of the following cost groups: a) main raw materials; 5,15 b) direct costs: 5 c) indirect costs of production;- 1,2,4,14,16,18 d) costs of product sales; to , il 13,20,8 e) administrative costs, 3679121719 Task 6 (1.1.4.). Bakery bakes cakes. Every month they bake 400kg. They spend 580 for buying different ingredients needed for baking. The bakers are paid 1,5 for every kilogram of cakes baked. Also, 115 is spent every month on the rent of production premises and 100 is calculated for depreciation of cooking equipment. Baked cakes are sold by the company at 7 e per kilogram price. The bakery got a proposal to bake cookies. The customer promises to buy 250kg every month and to pay 3,5 e per kg. It is calculated that to bake such amount of cookies will require 350 to be spent on different ingredients and bakers will be paid 1,3 e for every kilogram of cookies baked. Fixed costs will remain unehanged when the company starts to bake cookies, however, the company will be able to bake 180kg of cakes. 3