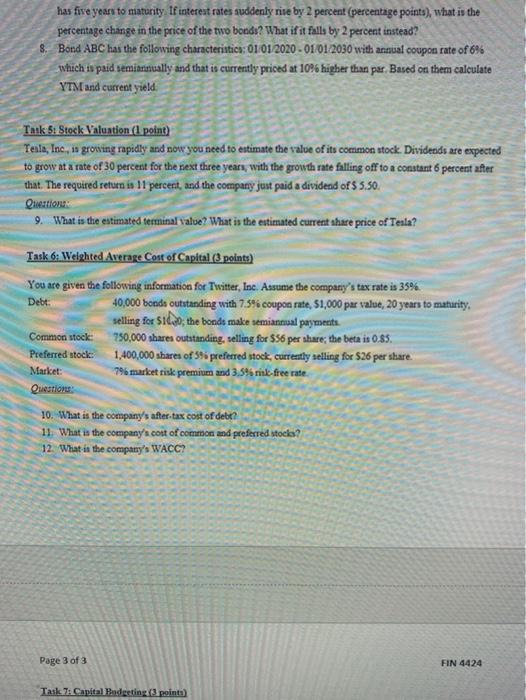

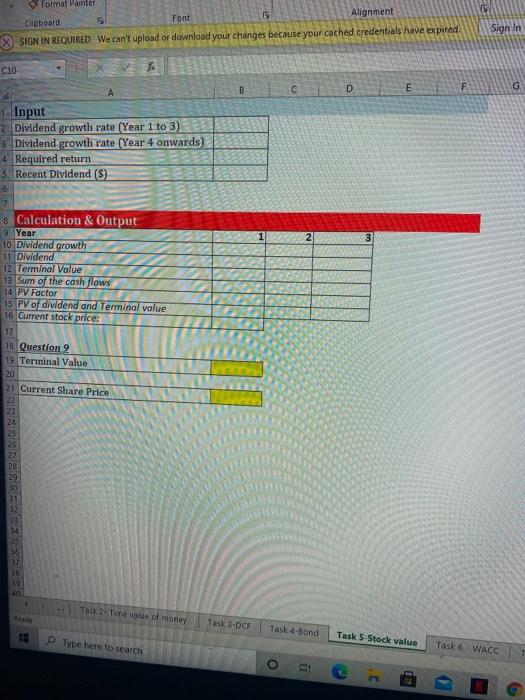

has five years to maturity. If interest rates suddenly rise by 2 percent (percentage points), what is the percentage change in the price of the two bonds? What if it falls by 2 percent instead? 8. Bond ABC has the following characteristica: 01/01/2020 - 01/01/2030 with annual coupon rate of 6% which is paid semitinually and that is currently priced at 10% higher than par. Based on them calculate YTM and current yield Task 5: Stock Valuation (1 point) Tesla, Inc., is growing rapidly and now you need to estimate the value of its common stock Dividends are expected to grow at a rate of 30 percent for the next three years, with the growth rate falling off to a constant 6 percent after that. The required return is 11 percent, and the company just paid a dividend of $ 5.50. Question: 9. What is the estimated terminal value? What is the estimated current share price of Tesla? Task 6: Welehted Average Cost of Capital (3 points) You are given the following information for Twitter, Inc. Assume the company's tax rate is 35% Debt 40,000 bonds outstanding with 7.5% coupon rate, 51,000 par value, 20 years to maturity. selling for $100; the bonds make semiannual payments Common stock 750,000 shares outstanding, selling for $56 per share the beta is 0.85. Preferred stock: 1,400,000 shares of 5preferred stock, currently selling for S26 per share. Market 7% market tisk premium and 3.5% mik-free rate. Question: 10. What is the company's after tax cost of debt? 11. What is the company's cost of common and preferred stocks? 12. What is the company's WACC? Page 3 of 3 FIN 4424 Task 7 Capital Badgeting points) Format Painter Clipboard Font Alignment SIGN IN REQUIRED We can't upload or download your changes because your cached credentials have expired Sign In CLO D B E G Input 2 Dividend growth rate (Year 1 to 3) Dividend growth rate (Year 4 onwards) A Required return 5 Recent Dividend (5) 6 2 8 Calculation & Output 9 Year 10 Dividend growth 11 Dividend 12 Terminal Value 13 Sum of the cash flows 14PV Factor 15 PV of dividend and Terminal value 16 Current stock price: 17 16 Question 9 19. Terminal Value 20 21 Current Share Price 22 23 24 25 26 27 28 29 30 TO Time value of money Task 3-DCF Task 4-Bond Task 5-Stock value Type here to search Task 6 WACC o