Answered step by step

Verified Expert Solution

Question

1 Approved Answer

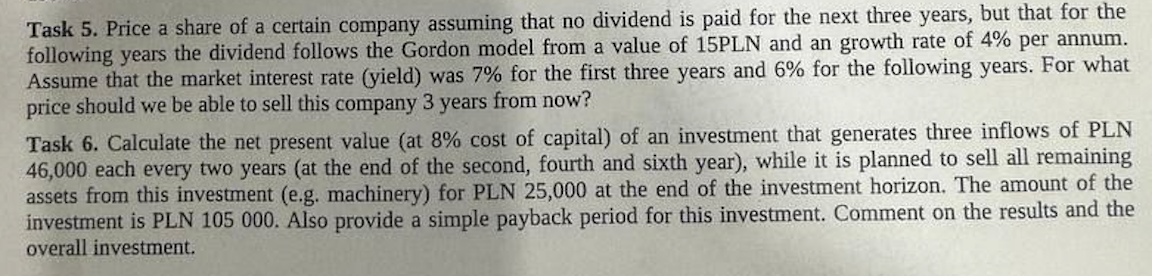

Task 5 . Price a share of a certain company assuming that no dividend is paid for the next three years, but that for the

Task Price a share of a certain company assuming that no dividend is paid for the next three years, but that for the

following years the dividend follows the Gordon model from a value of PLN and an growth rate of per annum.

Assume that the market interest rate yield was for the first three years and for the following years. For what

price should we be able to sell this company years from now?

Task Calculate the net present value at cost of capital of an investment that generates three inflowS of PLN

each every two years at the end of the second, fourth and sixth year while it is planned to sell all remaining

assets from this investment eg machinery for PLN at the end of the investment horizon. The amount of the

investment is PLN Also provide a simple payback period for this investment. Comment on the results and the

overall investment.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started