Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Task 8, 9, 10 and 11. out and see if you can spot a patter. You should get a sum z + z2+z3 +...+z in

Task 8, 9, 10 and 11.

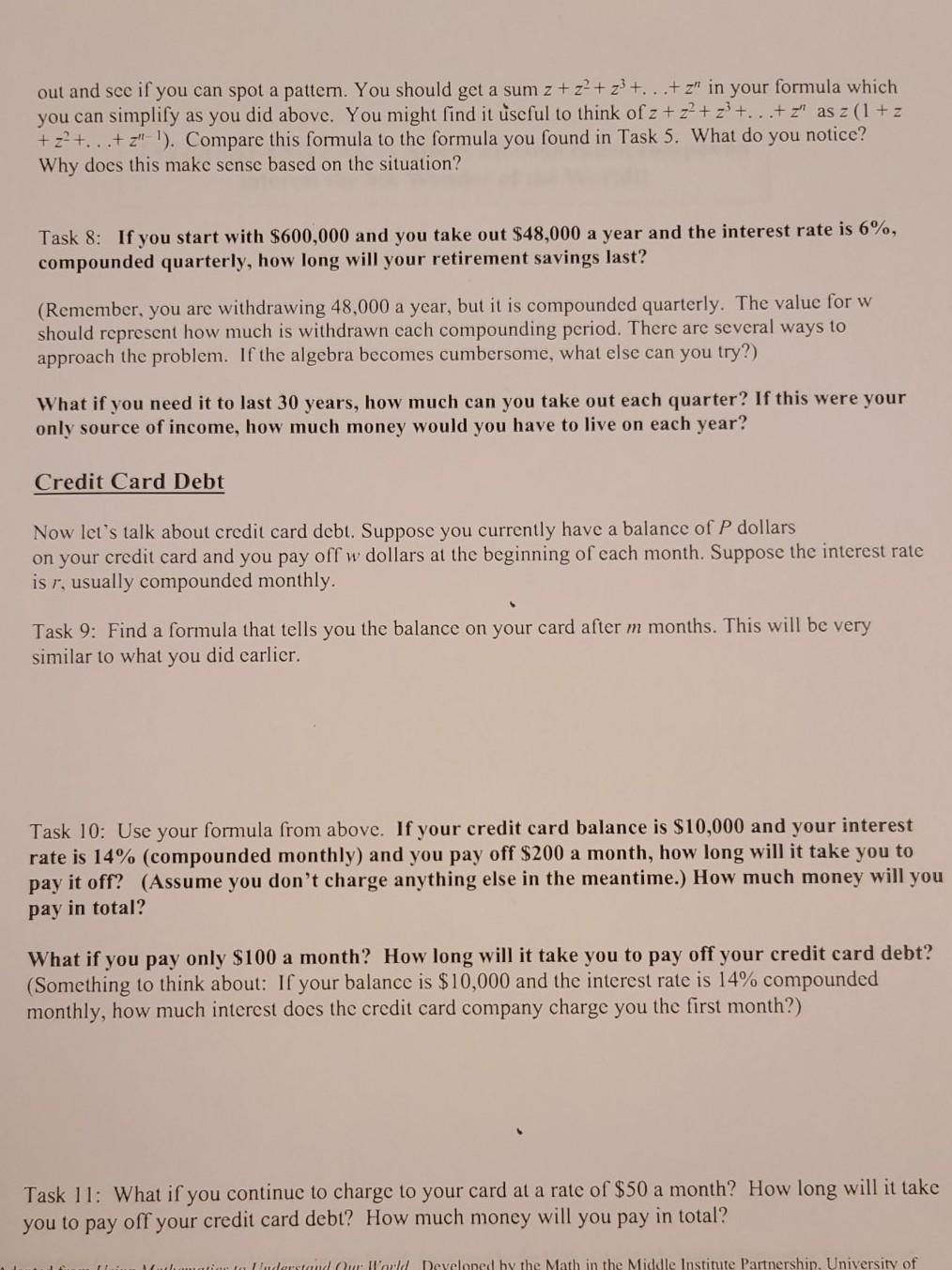

out and see if you can spot a patter. You should get a sum z + z2+z3 +...+z" in your formula which you can simplify as you did above. You might find it useful to think of z + z2+z3 +...+ z" as z (1 + z +z2+...+z"-'). Compare this formula to the formula you found in Task 5. What do you notice? Why does this make sense based on the situation? Task 8: If you start with $600,000 and you take out $48,000 a year and the interest rate is 6%, compounded quarterly, how long will your retirement savings last? (Remember, you are withdrawing 48,000 a year, but it is compounded quarterly. The value for w should represent how much is withdrawn cach compounding period. There are several ways to approach the problem. If the algebra becomes cumbersome, what else can you try?) What if you need it to last 30 years, how much can you take out each quarter? If this were your only source of income, how much money would you have to live on each year? Credit Card Debt Now let's talk about credit card debt. Suppose you currently have a balance of P dollars on your credit card and you pay off w dollars at the beginning of each month. Suppose the interest rate is r, usually compounded monthly. Task 9: Find a formula that tells you the balance on your card after m months. This will be very similar to what you did carlier. Task 10: Use your formula from above. If your credit card balance is $10,000 and your interest rate is 14% (compounded monthly) and you pay off $200 a month, how long will it take you to pay it off? (Assume you don't charge anything else in the meantime.) How much money will you pay in total? What if you pay only $100 a month? How long will it take you to pay off your credit card debt? (Something to think about: If your balance is $10,000 and the interest rate is 14% compounded monthly, how much interest does the credit card company charge you the first month?) Task 11: What if you continue to charge to your card at a rate of $50 a month? How long will it take you to pay off your credit card debt? How much money will you pay in total? tamation to luderstand Our Il'orld Develoned by the Math in the Middle Institute Partnership, University ofStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started