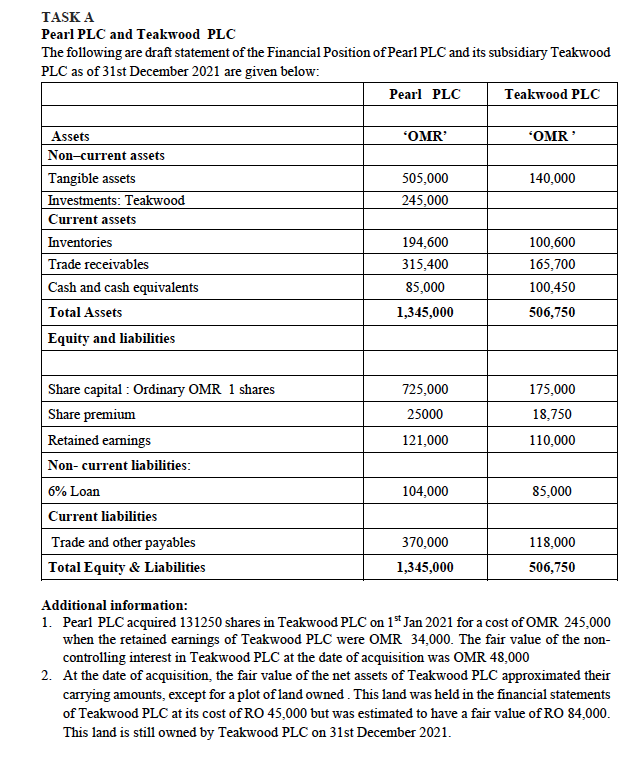

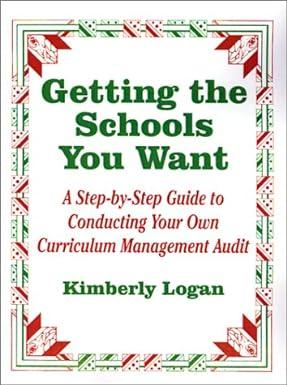

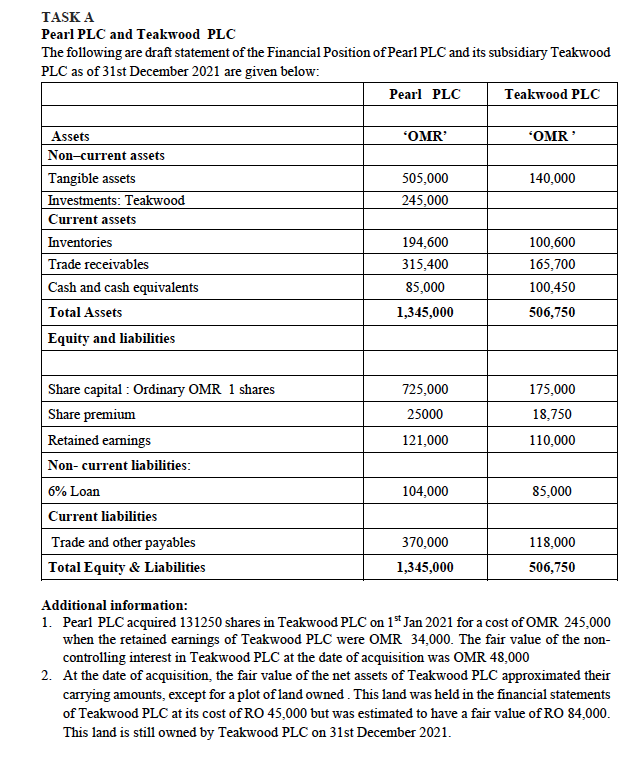

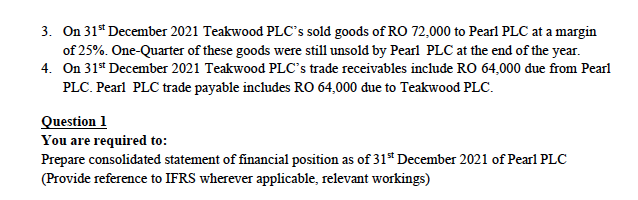

TASK A Pearl PLC and Teakwood PLC The following are draft statement of the Financial Position of Pearl PLC and its subsidiary Teakwood Additional information: 1. Pearl PLC acquired 131250 shares in Teakwood PLC on 1st Jan 2021 for a cost of OMR 245,000 when the retained earnings of Teakwood PLC were OMR 34,000. The fair value of the noncontrolling interest in Teakwood PLC at the date of acquisition was OMR 48,000 2. At the date of acquisition, the fair value of the net assets of Teakwood PLC approximated their carrying amounts, except for a plot of land owned. This land was held in the financial statements of Teakwood PLC at its cost of RO 45,000 but was estimated to have a fair value of RO 84,000. This land is still owned by Teakwood PLC on 31st December 2021. 3. On 311st December 2021 Teakwood PLC's sold goods of RO 72,000 to Pearl PLC at a margin of 25%. One-Quarter of these goods were still unsold by Pearl PLC at the end of the year. 4. On 31st December 2021 Teakwood PLC's trade receivables include RO 64,000 due from Pearl PLC. Pearl PLC trade payable includes RO 64,000 due to Teakwood PLC. Question 1 You are required to: Prepare consolidated statement of financial position as of 31st December 2021 of Pearl PLC (Provide reference to IFRS wherever applicable, relevant workings) TASK A Pearl PLC and Teakwood PLC The following are draft statement of the Financial Position of Pearl PLC and its subsidiary Teakwood Additional information: 1. Pearl PLC acquired 131250 shares in Teakwood PLC on 1st Jan 2021 for a cost of OMR 245,000 when the retained earnings of Teakwood PLC were OMR 34,000. The fair value of the noncontrolling interest in Teakwood PLC at the date of acquisition was OMR 48,000 2. At the date of acquisition, the fair value of the net assets of Teakwood PLC approximated their carrying amounts, except for a plot of land owned. This land was held in the financial statements of Teakwood PLC at its cost of RO 45,000 but was estimated to have a fair value of RO 84,000. This land is still owned by Teakwood PLC on 31st December 2021. 3. On 311st December 2021 Teakwood PLC's sold goods of RO 72,000 to Pearl PLC at a margin of 25%. One-Quarter of these goods were still unsold by Pearl PLC at the end of the year. 4. On 31st December 2021 Teakwood PLC's trade receivables include RO 64,000 due from Pearl PLC. Pearl PLC trade payable includes RO 64,000 due to Teakwood PLC. Question 1 You are required to: Prepare consolidated statement of financial position as of 31st December 2021 of Pearl PLC (Provide reference to IFRS wherever applicable, relevant workings)