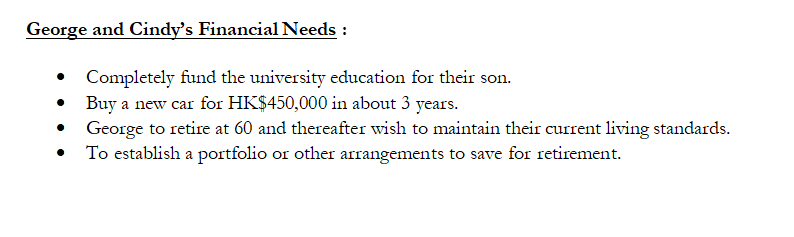

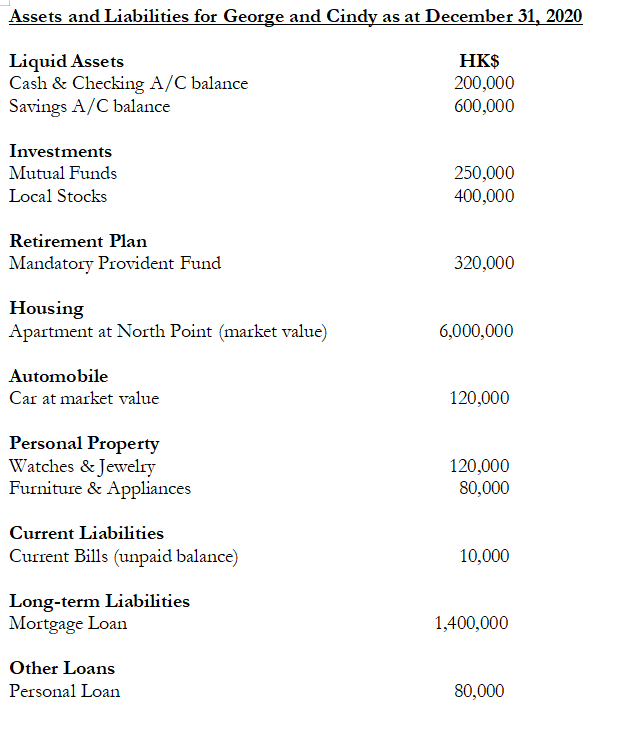

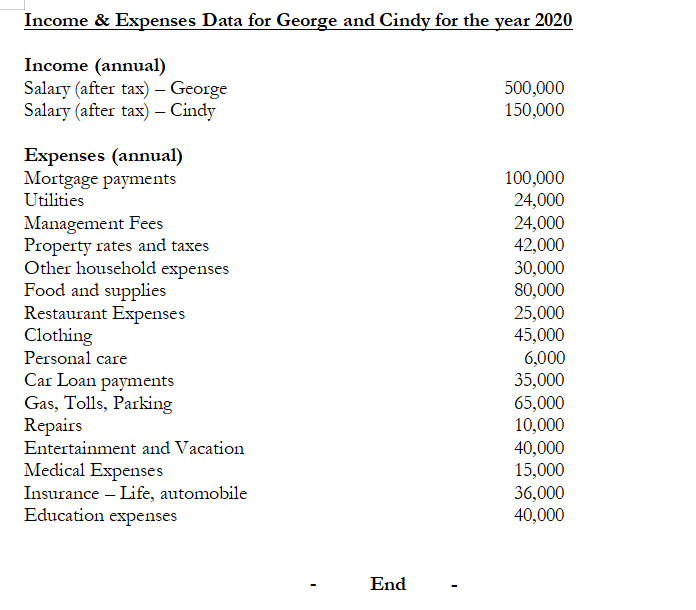

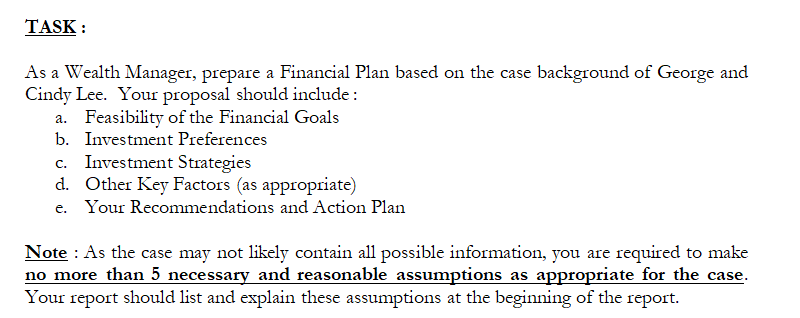

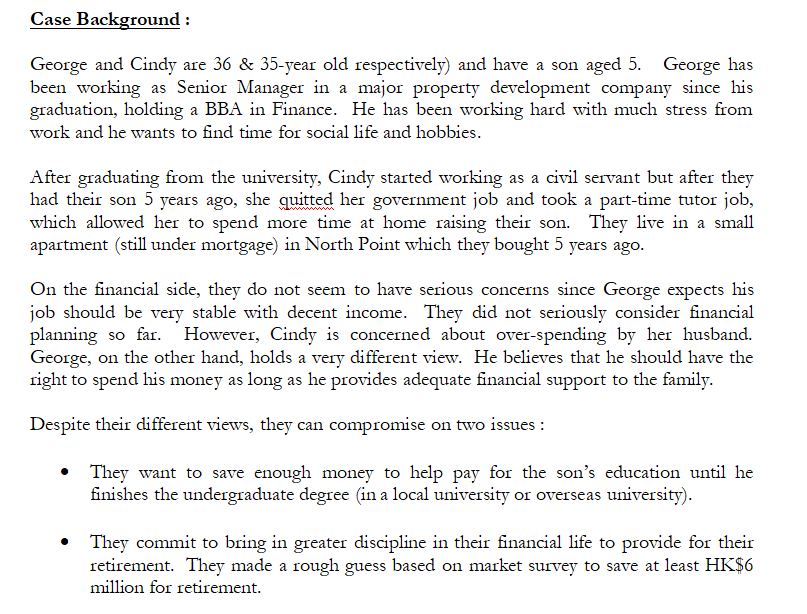

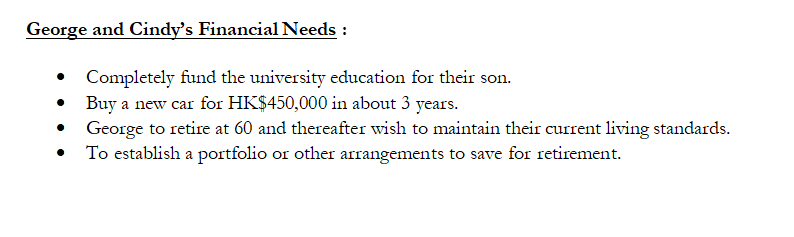

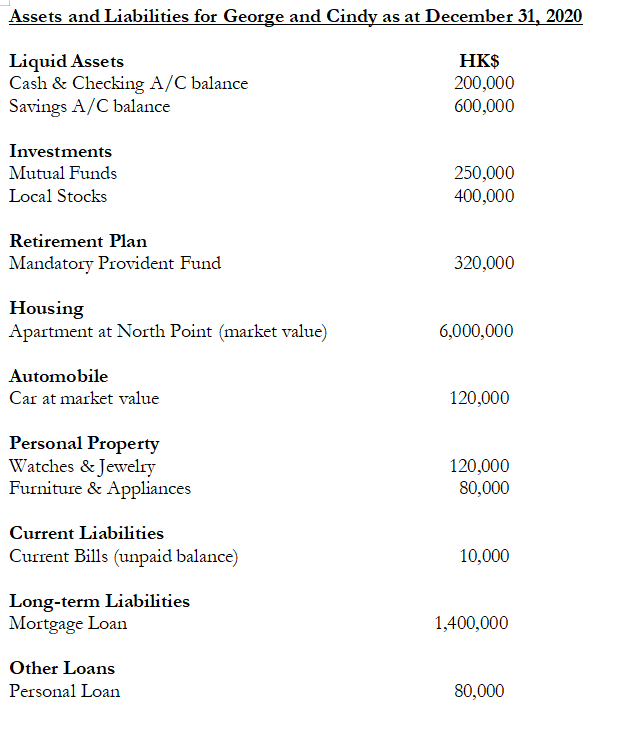

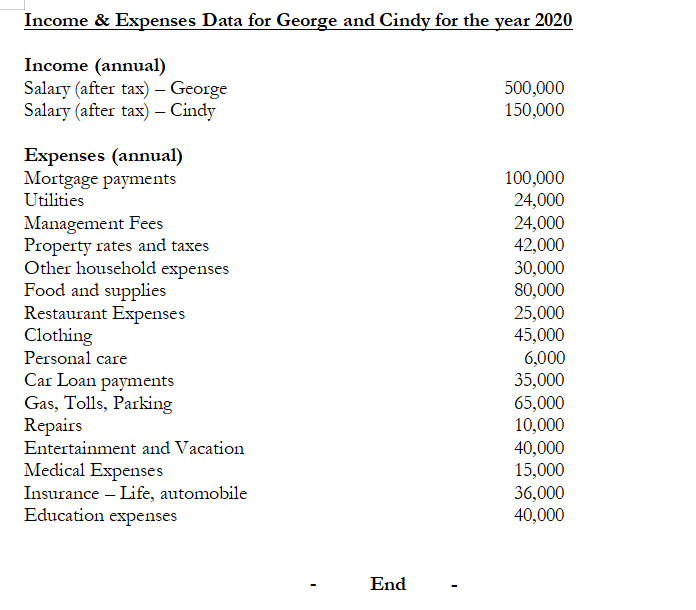

TASK : As a Wealth Manager, prepare a Financial Plan based on the case background of George and Cindy Lee. Your proposal should include: a. Feasibility of the Financial Goals b. Investment Preferences c. Investment Strategies d. Other Key Factors (as appropriate) Your Recommendations and Action Plan e. Note : As the case may not likely contain all possible information, you are required to make no more than 5 necessary and reasonable assumptions as appropriate for the case. Your report should list and explain these assumptions at the beginning of the report. Case Background: George and Cindy are 36 & 35-year old respectively) and have a son aged 5. George has been working as Senior Manager in a major property development company since his graduation, holding a BBA in Finance. He has been working hard with much stress from work and he wants to find time for social life and hobbies. After graduating from the university, Cindy started working as a civil servant but after they had their son 5 years ago, she quitted her government job and took a part-time tutor job, which allowed her to spend more time at home raising their son. They live in a small apartment (still under mortgage) in North Point which they bought 5 years ago. On the financial side, they do not seem to have serious concerns since George expects his job should be very stable with decent income. They did not seriously consider financial planning so far. However, Cindy is concerned about over-spending by her husband. George, on the other hand, holds a very different view. He believes that he should have the right to spend his money as long as he provides adequate financial support to the family. Despite their different views, they can compromise on two issues : They want to save enough money to help pay for the son's education until he finishes the undergraduate degree in a local university or overseas university). They commit to bring in greater discipline in their financial life to provide for their retirement. They made a rough guess based on market survey to save at least HK$6 million for retirement. George and Cindy's Financial Needs : . Completely fund the university education for their son. Buy a new car for HK$450,000 in about 3 years. George to retire at 60 and thereafter wish to maintain their current living standards. To establish a portfolio or other arrangements to save for retirement. Assets and Liabilities for George and Cindy as at December 31, 2020 Liquid Assets Cash & Checking A/C balance Savings A/C balance HK$ 200,000 600,000 Investments Mutual Funds Local Stocks 250,000 400,000 Retirement Plan Mandatory Provident Fund 320,000 Housing Apartment at North Point (market value) 6,000,000 Automobile Car at market value 120,000 Personal Property Watches & Jewelry Furniture & Appliances 120,000 80,000 Current Liabilities Current Bills (unpaid balance) 10,000 Long-term Liabilities Mortgage Loan 1,400,000 Other Loans Personal Loan 80,000 Income & Expenses Data for George and Cindy for the year 2020 Income (annual) Salary after tax) - George Salary after tax) - Cindy 500,000 150,000 Expenses (annual) Mortgage payments Utilities Management Fees Property rates and taxes Other household expenses Food and supplies Restaurant Expenses Clothing Personal care Car Loan payments Gas, Tolls, Parking Repairs Entertainment and Vacation Medical Expenses Insurance - Life, automobile Education expenses 100,000 24,000 24,000 42,000 30,000 80,000 25,000 45,000 6,000 35,000 65,000 10,000 40,000 15,000 36,000 40,000 End TASK : As a Wealth Manager, prepare a Financial Plan based on the case background of George and Cindy Lee. Your proposal should include: a. Feasibility of the Financial Goals b. Investment Preferences c. Investment Strategies d. Other Key Factors (as appropriate) Your Recommendations and Action Plan e. Note : As the case may not likely contain all possible information, you are required to make no more than 5 necessary and reasonable assumptions as appropriate for the case. Your report should list and explain these assumptions at the beginning of the report. Case Background: George and Cindy are 36 & 35-year old respectively) and have a son aged 5. George has been working as Senior Manager in a major property development company since his graduation, holding a BBA in Finance. He has been working hard with much stress from work and he wants to find time for social life and hobbies. After graduating from the university, Cindy started working as a civil servant but after they had their son 5 years ago, she quitted her government job and took a part-time tutor job, which allowed her to spend more time at home raising their son. They live in a small apartment (still under mortgage) in North Point which they bought 5 years ago. On the financial side, they do not seem to have serious concerns since George expects his job should be very stable with decent income. They did not seriously consider financial planning so far. However, Cindy is concerned about over-spending by her husband. George, on the other hand, holds a very different view. He believes that he should have the right to spend his money as long as he provides adequate financial support to the family. Despite their different views, they can compromise on two issues : They want to save enough money to help pay for the son's education until he finishes the undergraduate degree in a local university or overseas university). They commit to bring in greater discipline in their financial life to provide for their retirement. They made a rough guess based on market survey to save at least HK$6 million for retirement. George and Cindy's Financial Needs : . Completely fund the university education for their son. Buy a new car for HK$450,000 in about 3 years. George to retire at 60 and thereafter wish to maintain their current living standards. To establish a portfolio or other arrangements to save for retirement. Assets and Liabilities for George and Cindy as at December 31, 2020 Liquid Assets Cash & Checking A/C balance Savings A/C balance HK$ 200,000 600,000 Investments Mutual Funds Local Stocks 250,000 400,000 Retirement Plan Mandatory Provident Fund 320,000 Housing Apartment at North Point (market value) 6,000,000 Automobile Car at market value 120,000 Personal Property Watches & Jewelry Furniture & Appliances 120,000 80,000 Current Liabilities Current Bills (unpaid balance) 10,000 Long-term Liabilities Mortgage Loan 1,400,000 Other Loans Personal Loan 80,000 Income & Expenses Data for George and Cindy for the year 2020 Income (annual) Salary after tax) - George Salary after tax) - Cindy 500,000 150,000 Expenses (annual) Mortgage payments Utilities Management Fees Property rates and taxes Other household expenses Food and supplies Restaurant Expenses Clothing Personal care Car Loan payments Gas, Tolls, Parking Repairs Entertainment and Vacation Medical Expenses Insurance - Life, automobile Education expenses 100,000 24,000 24,000 42,000 30,000 80,000 25,000 45,000 6,000 35,000 65,000 10,000 40,000 15,000 36,000 40,000 End