Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Task details: Jackson Ltd manufactures two products FRED and MARTHA. The firm uses a single plantwide overhead rate based on direct labour hours Estimated manufacturing

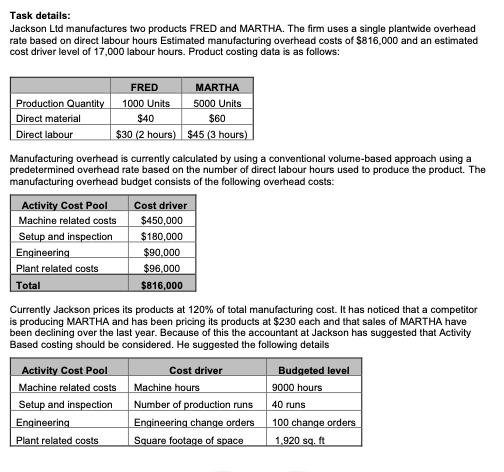

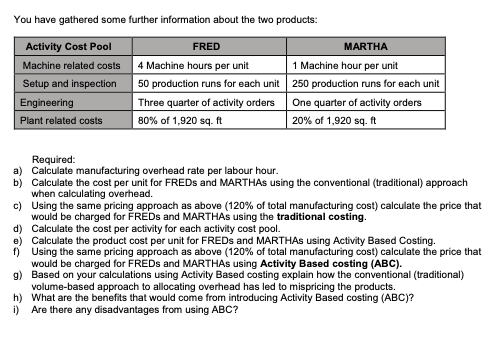

Task details: Jackson Ltd manufactures two products FRED and MARTHA. The firm uses a single plantwide overhead rate based on direct labour hours Estimated manufacturing overhead costs of $816,000 and an estimated cost driver level of 17,000 labour hours. Product costing data is as follows: Manufacturing overhead is currently calculated by using a conventional volume-based approach using a predetermined overhead rate based on the number of direct labour hours used to produce the product. The manufacturing overhead budget consists of the following overhead costs: Currently Jackson prices its products at 120% of total manufacturing cost. It has noticed that a competitor is producing MARTHA and has been pricing its products at $230 each and that sales of MARTHA have been declining over the last year. Because of this the accountant at Jackson has suggested that Activity Based costing should be considered. He suggested the following details You have gathered some further information about the two products: Required: a) Calculate manufacturing overhead rate per labour hour. b) Calculate the cost per unit for FREDs and MARTHAs using the conventional (traditional) approach when calculating overhead. c) Using the same pricing approach as above ( 120% of total manufacturing cost) calculate the price that would be charged for FREDs and MARTHAs using the traditional costing. d) Calculate the cost per activity for each activity cost pool. e) Calculate the product cost per unit for FREDs and MARTHAs using Activity Based Costing. f) Using the same pricing approach as above ( 120% of total manufacturing cost) calculate the price that would be charged for FREDs and MARTHAs using Activity Based costing (ABC). g) Based on your calculations using Activity Based costing explain how the conventional (traditional) volume-based approach to allocating overhead has led to mispricing the products. h) What are the benefits that would come from introducing Activity Based costing (ABC)? i) Are there any disadvantages from using ABC ? Task details: Jackson Ltd manufactures two products FRED and MARTHA. The firm uses a single plantwide overhead rate based on direct labour hours Estimated manufacturing overhead costs of $816,000 and an estimated cost driver level of 17,000 labour hours. Product costing data is as follows: Manufacturing overhead is currently calculated by using a conventional volume-based approach using a predetermined overhead rate based on the number of direct labour hours used to produce the product. The manufacturing overhead budget consists of the following overhead costs: Currently Jackson prices its products at 120% of total manufacturing cost. It has noticed that a competitor is producing MARTHA and has been pricing its products at $230 each and that sales of MARTHA have been declining over the last year. Because of this the accountant at Jackson has suggested that Activity Based costing should be considered. He suggested the following details You have gathered some further information about the two products: Required: a) Calculate manufacturing overhead rate per labour hour. b) Calculate the cost per unit for FREDs and MARTHAs using the conventional (traditional) approach when calculating overhead. c) Using the same pricing approach as above ( 120% of total manufacturing cost) calculate the price that would be charged for FREDs and MARTHAs using the traditional costing. d) Calculate the cost per activity for each activity cost pool. e) Calculate the product cost per unit for FREDs and MARTHAs using Activity Based Costing. f) Using the same pricing approach as above ( 120% of total manufacturing cost) calculate the price that would be charged for FREDs and MARTHAs using Activity Based costing (ABC). g) Based on your calculations using Activity Based costing explain how the conventional (traditional) volume-based approach to allocating overhead has led to mispricing the products. h) What are the benefits that would come from introducing Activity Based costing (ABC)? i) Are there any disadvantages from using ABC

Task details: Jackson Ltd manufactures two products FRED and MARTHA. The firm uses a single plantwide overhead rate based on direct labour hours Estimated manufacturing overhead costs of $816,000 and an estimated cost driver level of 17,000 labour hours. Product costing data is as follows: Manufacturing overhead is currently calculated by using a conventional volume-based approach using a predetermined overhead rate based on the number of direct labour hours used to produce the product. The manufacturing overhead budget consists of the following overhead costs: Currently Jackson prices its products at 120% of total manufacturing cost. It has noticed that a competitor is producing MARTHA and has been pricing its products at $230 each and that sales of MARTHA have been declining over the last year. Because of this the accountant at Jackson has suggested that Activity Based costing should be considered. He suggested the following details You have gathered some further information about the two products: Required: a) Calculate manufacturing overhead rate per labour hour. b) Calculate the cost per unit for FREDs and MARTHAs using the conventional (traditional) approach when calculating overhead. c) Using the same pricing approach as above ( 120% of total manufacturing cost) calculate the price that would be charged for FREDs and MARTHAs using the traditional costing. d) Calculate the cost per activity for each activity cost pool. e) Calculate the product cost per unit for FREDs and MARTHAs using Activity Based Costing. f) Using the same pricing approach as above ( 120% of total manufacturing cost) calculate the price that would be charged for FREDs and MARTHAs using Activity Based costing (ABC). g) Based on your calculations using Activity Based costing explain how the conventional (traditional) volume-based approach to allocating overhead has led to mispricing the products. h) What are the benefits that would come from introducing Activity Based costing (ABC)? i) Are there any disadvantages from using ABC ? Task details: Jackson Ltd manufactures two products FRED and MARTHA. The firm uses a single plantwide overhead rate based on direct labour hours Estimated manufacturing overhead costs of $816,000 and an estimated cost driver level of 17,000 labour hours. Product costing data is as follows: Manufacturing overhead is currently calculated by using a conventional volume-based approach using a predetermined overhead rate based on the number of direct labour hours used to produce the product. The manufacturing overhead budget consists of the following overhead costs: Currently Jackson prices its products at 120% of total manufacturing cost. It has noticed that a competitor is producing MARTHA and has been pricing its products at $230 each and that sales of MARTHA have been declining over the last year. Because of this the accountant at Jackson has suggested that Activity Based costing should be considered. He suggested the following details You have gathered some further information about the two products: Required: a) Calculate manufacturing overhead rate per labour hour. b) Calculate the cost per unit for FREDs and MARTHAs using the conventional (traditional) approach when calculating overhead. c) Using the same pricing approach as above ( 120% of total manufacturing cost) calculate the price that would be charged for FREDs and MARTHAs using the traditional costing. d) Calculate the cost per activity for each activity cost pool. e) Calculate the product cost per unit for FREDs and MARTHAs using Activity Based Costing. f) Using the same pricing approach as above ( 120% of total manufacturing cost) calculate the price that would be charged for FREDs and MARTHAs using Activity Based costing (ABC). g) Based on your calculations using Activity Based costing explain how the conventional (traditional) volume-based approach to allocating overhead has led to mispricing the products. h) What are the benefits that would come from introducing Activity Based costing (ABC)? i) Are there any disadvantages from using ABC Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started