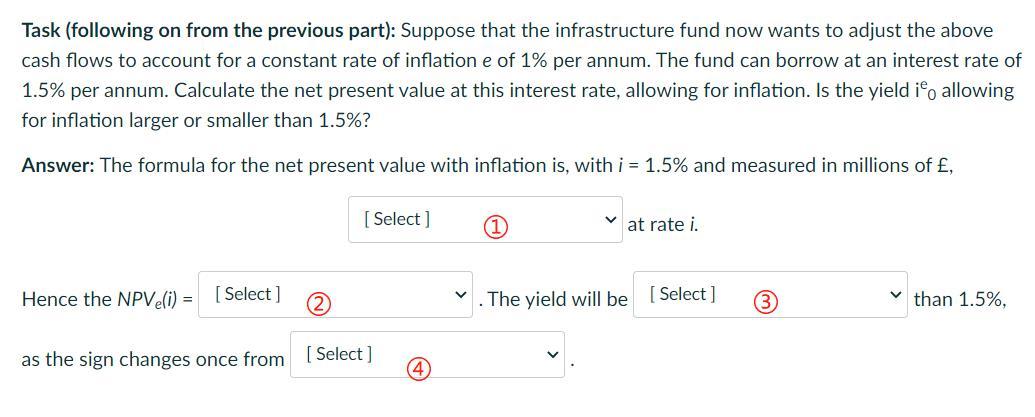

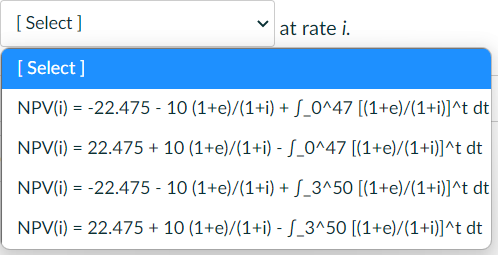

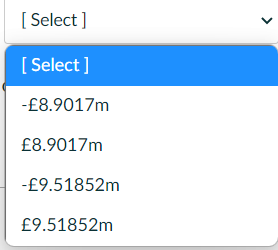

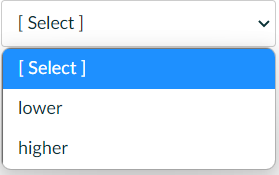

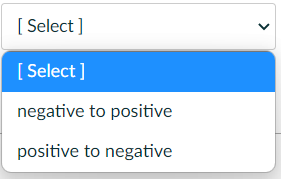

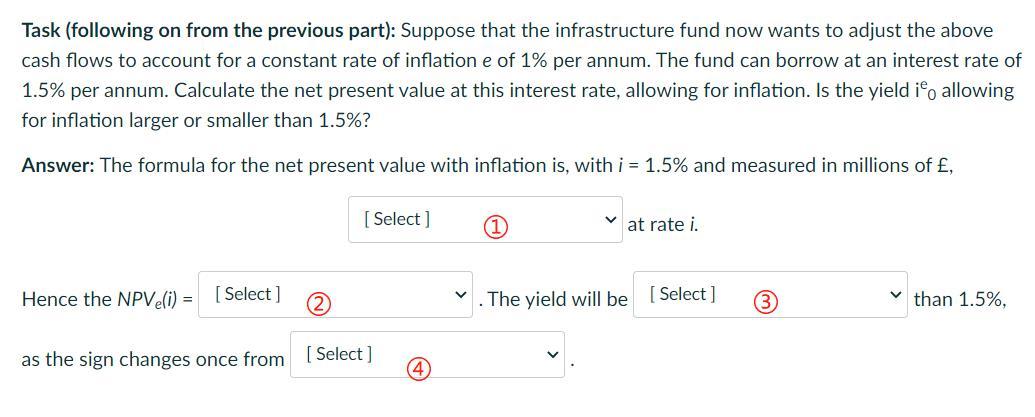

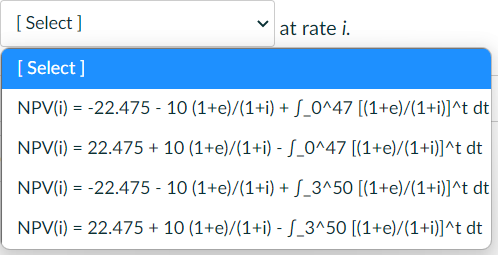

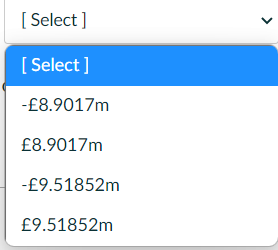

Task (following on from the previous part): Suppose that the infrastructure fund now wants to adjust the above cash flows to account for a constant rate of inflation e of 1% per annum. The fund can borrow at an interest rate of 1.5% per annum. Calculate the net present value at this interest rate, allowing for inflation. Is the yield i, allowing for inflation larger or smaller than 1.5%? Answer: The formula for the net present value with inflation is, with i = 1.5% and measured in millions of , [ Select] at rate i. Hence the NPVeli) [Select] 2 The yield will be [Select] 3 than 1.5%, as the sign changes once from (Select] 4 [ Select ] at rate i. [Select] NPV(i) = -22.475 - 10 (1+e)/(1+i) + S_0^47 [(1+e)/(1+i)]^t dt NPV(i) = 22.475 + 10 (1+e)/(1+i) - S_0^47 [(1+e)/(1+i)]^t dt NPV(i) = -22.475 - 10 (1+e)/(1+i) + S_3450 [(1+e)/(1+i)]^t dt NPV(i) = 22.475 + 10 (1+e)/(1+i) - S_3450 [(1+e)/(1+i)]^t dt [Select] [ Select] -8.9017m 8.9017m -9.51852m 9.51852m [ Select ] [Select ] lower higher [ Select] > [Select] negative to positive positive to negative Task (following on from the previous part): Suppose that the infrastructure fund now wants to adjust the above cash flows to account for a constant rate of inflation e of 1% per annum. The fund can borrow at an interest rate of 1.5% per annum. Calculate the net present value at this interest rate, allowing for inflation. Is the yield i, allowing for inflation larger or smaller than 1.5%? Answer: The formula for the net present value with inflation is, with i = 1.5% and measured in millions of , [ Select] at rate i. Hence the NPVeli) [Select] 2 The yield will be [Select] 3 than 1.5%, as the sign changes once from (Select] 4 [ Select ] at rate i. [Select] NPV(i) = -22.475 - 10 (1+e)/(1+i) + S_0^47 [(1+e)/(1+i)]^t dt NPV(i) = 22.475 + 10 (1+e)/(1+i) - S_0^47 [(1+e)/(1+i)]^t dt NPV(i) = -22.475 - 10 (1+e)/(1+i) + S_3450 [(1+e)/(1+i)]^t dt NPV(i) = 22.475 + 10 (1+e)/(1+i) - S_3450 [(1+e)/(1+i)]^t dt [Select] [ Select] -8.9017m 8.9017m -9.51852m 9.51852m [ Select ] [Select ] lower higher [ Select] > [Select] negative to positive positive to negative