Answered step by step

Verified Expert Solution

Question

1 Approved Answer

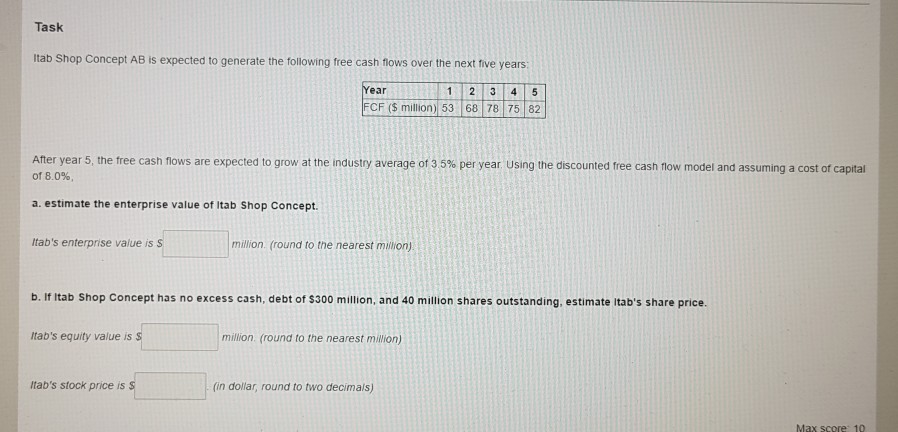

Task Itab Shop Concept AB is expected to generate the following free cash flows over the next tive years: Year FCF (S million) 5368 78

Task Itab Shop Concept AB is expected to generate the following free cash flows over the next tive years: Year FCF (S million) 5368 78 75 82 After year 5 the tree cash flows are expected to grow at the industry average of 35% per year Using the discounted fee cash now model and assuming a cost of capital of 8 0% a. estimate the enterprise value of Itab Shop Concept ltab's enterprise value is s million (round to the nearest million) b. If Itab Shop Concept has no excess cash, debt of $300 million, and 40 million shares outstanding, estimate Itab's share price. Itab's equity value isS million (round to the nearest million) ltab's stock price is (in dollar, round to two decimals)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started