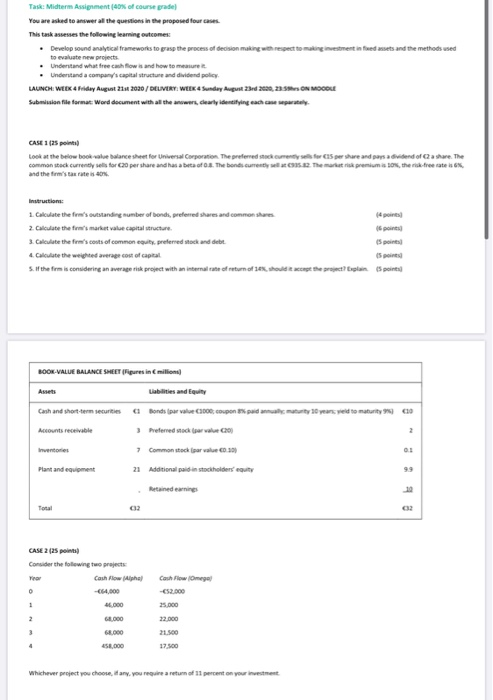

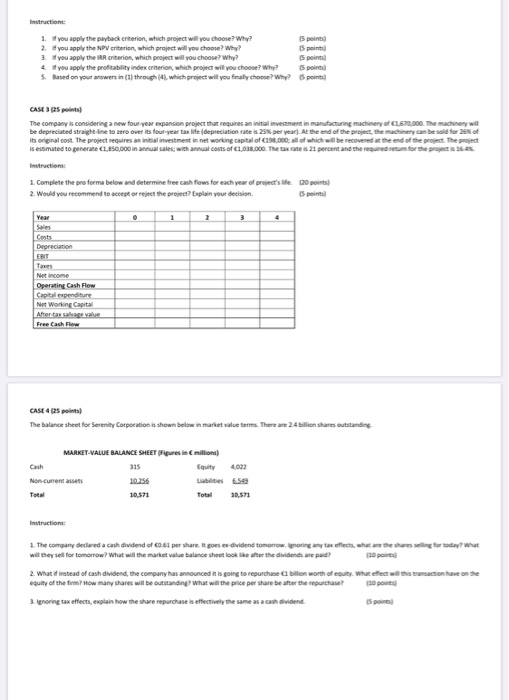

Task: Midterm Assignment (80% of course grade) You are asked to answer all the questions in the proposed four cases This task assesses the following learning outcomes Develop sound analytical frameworks to grasp the process of decision making with respect to making investment influed assets and the methods used to evaluate new projects Understand what free cash flows and how to measure Understand a company's capital structure and dividend policy LAUNCH WEEK 4 Friday August 2284 2020 / DELIVERY WEEK 4 Sunday August 23rd 2020,23 ON MOCOLE Submission file format: Word document with all the answers, clearly identifying each comptly CASE 1 (25 point Look at the below book value balance sheet for Universal Corporation. The preferred stock currently sets for Casper share and pops a vidend of a share. The common stack currently sells for CO per share and has a beta of 0.8. The bond. Currently. The market risk premium so, the free rates 6% and the firm's tax rates Instructions: 1. Calculate the firm's outstanding number of bonds, preferred shares and common shares 2. Calculate the market value capital structure 3. Calculate the firm's costs of common equity, preferred stock and debt. 4. Calculate the weighted average cost of capital S. If the firm is considering an average risk project with an internal rate of return of sex, on the project? plain points BOOK-VALUE BALANCE SHEET(Figures in million Assets Liabilities and Equity Cash and short-term securities Bonds per value Cocoupon % podactyynyield to maturity 10 Accounts receivable Preferred to per valueC20 7 Common stock par le Plant and equipment 21 Additional and in stockholderscout 99 O! 10 Total 02 CASE 2 (25 point Consider the following the projects Cash Flow Omega 0 1 16.000 68,000 2 21.500 17.500 453,000 Whichever project you choose, day, you require a return of 11 percent on your investment Instruction 1. you apply the payback criterion, which project will you choose? Why? I points 2. you apply the NPV criterion, which project will you choose? Why? points 3. If you apply the IRR criterion, which project will you choose? Why? points 4. you apply the profitability index criterion, which project will you choose? Why? points) 5. Based on your answers in (1) through (4), which project will you finally chore?Why? 6 points) CASE 35 points The company is considering a new four year expansion project that requires an initial investment in manufacturing machinery C,000. The machinery wil be depreciated straight line to zero over its four year tax life (depreciation rate is 25% per year). At the end of the project, the machinery can be sold for 25% of its original cost. The project requires an initial investment in networking capital of 258.000: all of which will be recovered the end of the project. The project is estimated to generate C1,250,000 in annual sales with annual costs of C1.038.000. The tax rates 21 percent and the required return for the project is 16.4% 1. Complete the proforma below and determine free cash flows for each year of project's life. (20 points) 2. Would you recommend to accept or reject the project? Explain your decision points Year 2 4 Costs Depreciation EBIT Net income Operating Cash Flow Capital apenditure Net Working Capital Atentar salvage valve Free Cash Flow CASE 4025 points The balance sheet for Serenity Corporation is shown below in market value terms. There are 24 bilion shares outstanding MARKET-VALUE BALANCE SHEET(Figures in million) 315 Equity 4,022 Non current assets Total 10.571 Total 10,571 Instruction: 1. The company declared a cash dividend of 2.61 per share it goes dividend tomorrow ignoring any tax effects, where the resulting for today what wil they sell for tomorrow? What will the market value balance sheet look like after the dividends are paid? po 2. What if instead of cash dividend, the company has announced it is going to repurchase c1 billion worth of equity. What effect will this transaction have on the equity of the tim? How many shares will be outstanding what will the price per share better the purchase? poned 3. ignoring tax effects, explain how the share repurchase is effectively the same as a cash dividend Task: Midterm Assignment (80% of course grade) You are asked to answer all the questions in the proposed four cases This task assesses the following learning outcomes Develop sound analytical frameworks to grasp the process of decision making with respect to making investment influed assets and the methods used to evaluate new projects Understand what free cash flows and how to measure Understand a company's capital structure and dividend policy LAUNCH WEEK 4 Friday August 2284 2020 / DELIVERY WEEK 4 Sunday August 23rd 2020,23 ON MOCOLE Submission file format: Word document with all the answers, clearly identifying each comptly CASE 1 (25 point Look at the below book value balance sheet for Universal Corporation. The preferred stock currently sets for Casper share and pops a vidend of a share. The common stack currently sells for CO per share and has a beta of 0.8. The bond. Currently. The market risk premium so, the free rates 6% and the firm's tax rates Instructions: 1. Calculate the firm's outstanding number of bonds, preferred shares and common shares 2. Calculate the market value capital structure 3. Calculate the firm's costs of common equity, preferred stock and debt. 4. Calculate the weighted average cost of capital S. If the firm is considering an average risk project with an internal rate of return of sex, on the project? plain points BOOK-VALUE BALANCE SHEET(Figures in million Assets Liabilities and Equity Cash and short-term securities Bonds per value Cocoupon % podactyynyield to maturity 10 Accounts receivable Preferred to per valueC20 7 Common stock par le Plant and equipment 21 Additional and in stockholderscout 99 O! 10 Total 02 CASE 2 (25 point Consider the following the projects Cash Flow Omega 0 1 16.000 68,000 2 21.500 17.500 453,000 Whichever project you choose, day, you require a return of 11 percent on your investment Instruction 1. you apply the payback criterion, which project will you choose? Why? I points 2. you apply the NPV criterion, which project will you choose? Why? points 3. If you apply the IRR criterion, which project will you choose? Why? points 4. you apply the profitability index criterion, which project will you choose? Why? points) 5. Based on your answers in (1) through (4), which project will you finally chore?Why? 6 points) CASE 35 points The company is considering a new four year expansion project that requires an initial investment in manufacturing machinery C,000. The machinery wil be depreciated straight line to zero over its four year tax life (depreciation rate is 25% per year). At the end of the project, the machinery can be sold for 25% of its original cost. The project requires an initial investment in networking capital of 258.000: all of which will be recovered the end of the project. The project is estimated to generate C1,250,000 in annual sales with annual costs of C1.038.000. The tax rates 21 percent and the required return for the project is 16.4% 1. Complete the proforma below and determine free cash flows for each year of project's life. (20 points) 2. Would you recommend to accept or reject the project? Explain your decision points Year 2 4 Costs Depreciation EBIT Net income Operating Cash Flow Capital apenditure Net Working Capital Atentar salvage valve Free Cash Flow CASE 4025 points The balance sheet for Serenity Corporation is shown below in market value terms. There are 24 bilion shares outstanding MARKET-VALUE BALANCE SHEET(Figures in million) 315 Equity 4,022 Non current assets Total 10.571 Total 10,571 Instruction: 1. The company declared a cash dividend of 2.61 per share it goes dividend tomorrow ignoring any tax effects, where the resulting for today what wil they sell for tomorrow? What will the market value balance sheet look like after the dividends are paid? po 2. What if instead of cash dividend, the company has announced it is going to repurchase c1 billion worth of equity. What effect will this transaction have on the equity of the tim? How many shares will be outstanding what will the price per share better the purchase? poned 3. ignoring tax effects, explain how the share repurchase is effectively the same as a cash dividend