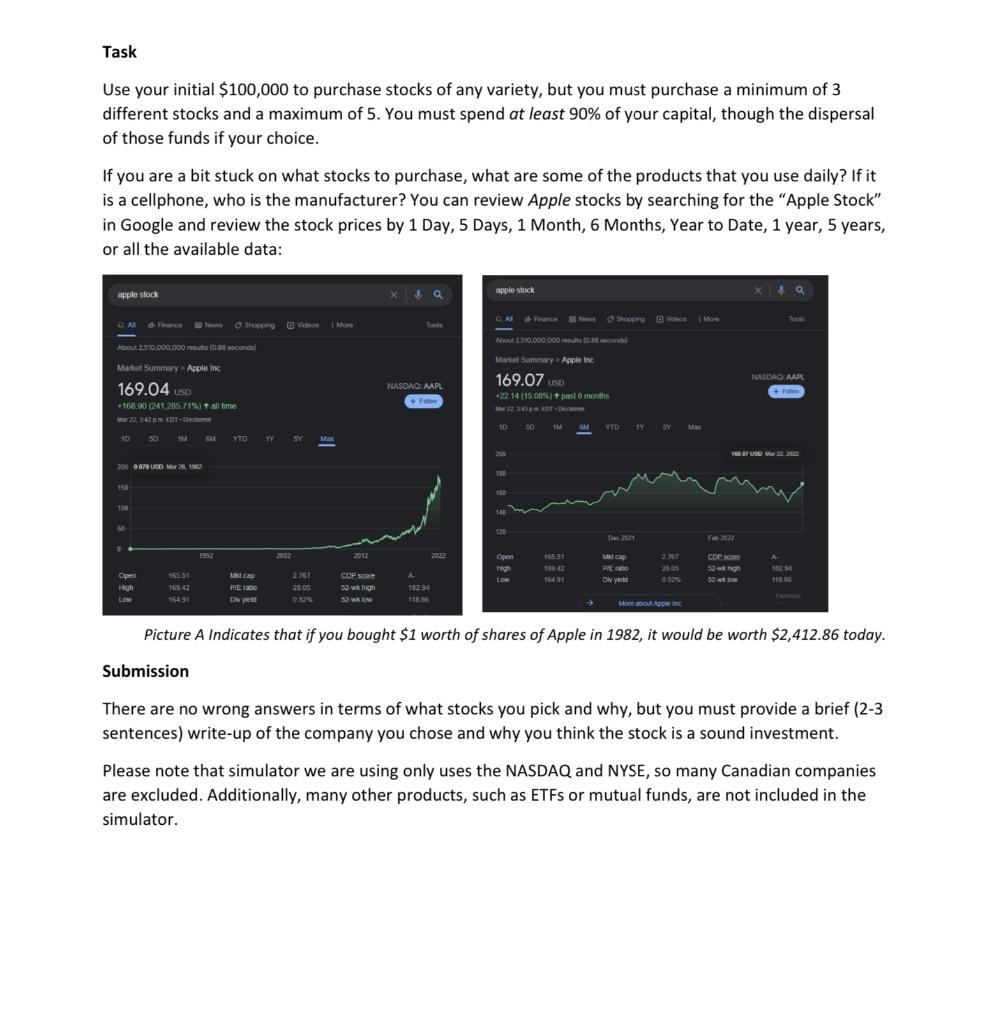

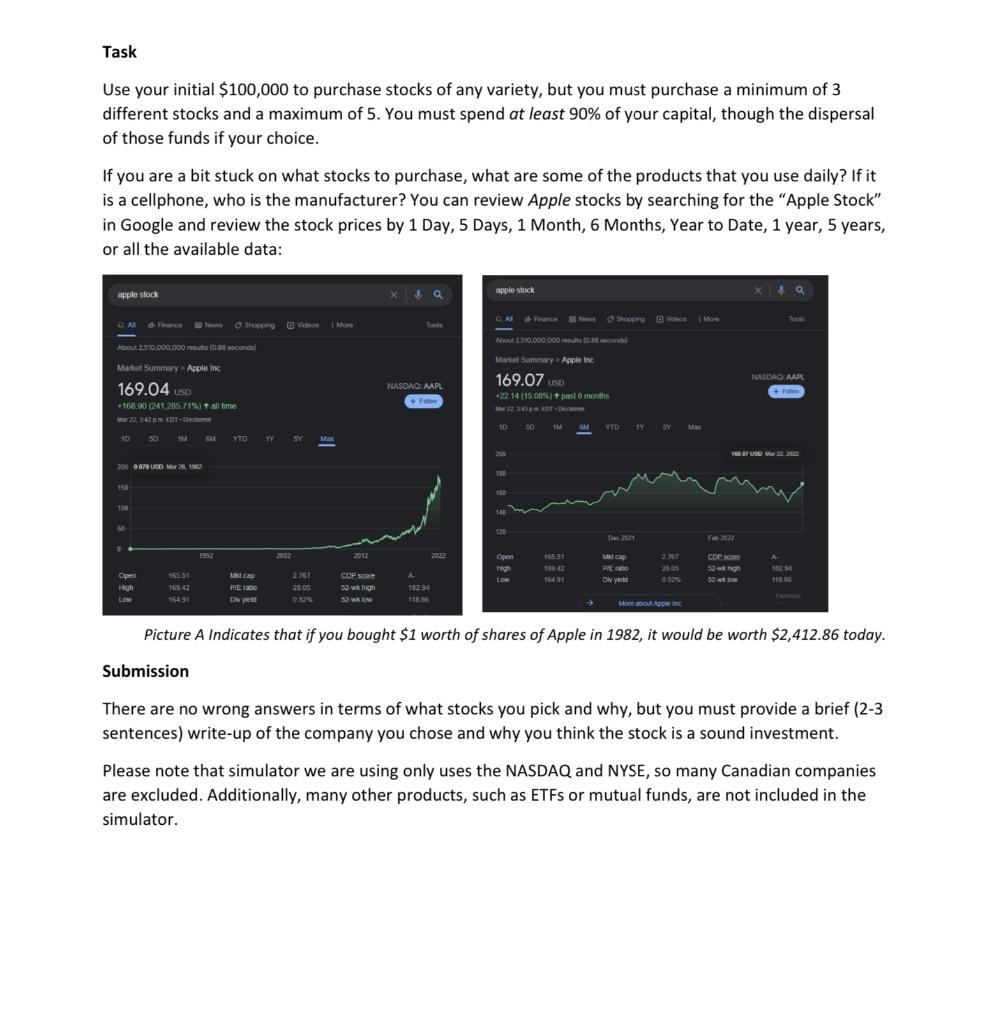

Task Use your initial $100,000 to purchase stocks of any variety, but you must purchase a minimum of 3 different stocks and a maximum of 5. You must spend at least 90% of your capital, though the dispersal of those funds if your choice. If you are a bit stuck on what stocks to purchase, what are some of the products that you use daily? If it is a cellphone, who is the manufacturer? You can review Apple stocks by searching for the "Apple Stock" in Google and review the stock prices by 1 Day, 5 Days, 1 Month, 6 Months, Year to Date, 1 year, 5 years, or all the available data: x sa apple stock a apple stock MwShopping Vice More Tool CLASIC w ng Vichele Video More Tools About 2.310.000.000 condal 000 About 2:910 000 000 afts (38 seconds) Market Summary Apple Inc 169.07 USD NASDAG: AAR Markut Summary Apple Inc 169.04 USD 168.90 (241,285,71) tall time 22,342 EDT- NASDAQ AAPL + + 22.14 (15.08%) + past months MEMOTO 10 SO GM YID 19 Y M 10 5D YTO SY MAX GF V M2 200 0070 USD 902 THE 162 123 Dec2021 222 1932 2002 2012 gen $6550 MCP 2757 COP SCORE 52 g 52 PL Diy yod 182.54 19886 2761 20.05 LOW 16491 Open gh LOW 0.02 16051 16343 1549 cap PIETO Dived CDES 32-high 52 KW 182.94 118 More ARE Picture A Indicates that if you bought $1 worth of shares of Apple in 1982, it would be worth $2,412.86 today. Submission There are no wrong answers in terms of what stocks you pick and why, but you must provide a brief (2-3 sentences) write-up of the company you chose and why you think the stock is a sound investment. Please note that simulator we are using only uses the NASDAQ and NYSE, so many Canadian companies are excluded. Additionally, many other products, such as ETFs or mutual funds, are not included in the simulator. Task Use your initial $100,000 to purchase stocks of any variety, but you must purchase a minimum of 3 different stocks and a maximum of 5. You must spend at least 90% of your capital, though the dispersal of those funds if your choice. If you are a bit stuck on what stocks to purchase, what are some of the products that you use daily? If it is a cellphone, who is the manufacturer? You can review Apple stocks by searching for the "Apple Stock" in Google and review the stock prices by 1 Day, 5 Days, 1 Month, 6 Months, Year to Date, 1 year, 5 years, or all the available data: x sa apple stock a apple stock MwShopping Vice More Tool CLASIC w ng Vichele Video More Tools About 2.310.000.000 condal 000 About 2:910 000 000 afts (38 seconds) Market Summary Apple Inc 169.07 USD NASDAG: AAR Markut Summary Apple Inc 169.04 USD 168.90 (241,285,71) tall time 22,342 EDT- NASDAQ AAPL + + 22.14 (15.08%) + past months MEMOTO 10 SO GM YID 19 Y M 10 5D YTO SY MAX GF V M2 200 0070 USD 902 THE 162 123 Dec2021 222 1932 2002 2012 gen $6550 MCP 2757 COP SCORE 52 g 52 PL Diy yod 182.54 19886 2761 20.05 LOW 16491 Open gh LOW 0.02 16051 16343 1549 cap PIETO Dived CDES 32-high 52 KW 182.94 118 More ARE Picture A Indicates that if you bought $1 worth of shares of Apple in 1982, it would be worth $2,412.86 today. Submission There are no wrong answers in terms of what stocks you pick and why, but you must provide a brief (2-3 sentences) write-up of the company you chose and why you think the stock is a sound investment. Please note that simulator we are using only uses the NASDAQ and NYSE, so many Canadian companies are excluded. Additionally, many other products, such as ETFs or mutual funds, are not included in the simulator