Question

Task02. 1.) What is the main difference between a competitive firm and a monopoly? a. A competitive firm owns a key resource, but a monopoly

Task02.

1.) What is the main difference between a competitive firm and a monopoly?

a. A competitive firm owns a key resource, but a monopoly firm does not.

b. A competitive firm is a price taker, and a monopoly is a price maker.

c. A competitive firm produces output at a lower cost than a monopoly firm.

d. A competitive firm is subject to government regulations, but a monopoly firm is not.

2.) What is the main social problem caused by monopoly?

a. an inefficiently low quantity of output

b. an inefficiently high value of marginal cost

c. excessive monopoly profits

d. excessive producer surplus

3.) If a monopolist sells 100 units at $8 per unit and realizes an average total cost of $5 per unit, what is the monopolist's profit?

a. $200

b. $300

c. $600

d. $800

4.) In a competitive market, a firm's supply curve dictates the amount it will supply. How does a monopoly market compare?

a. The supply curve dictates the amount it will supply.

b. The supply curve conceptually makes sense for price makers and price takers.

c. The supply curve will have limited predictive capacity.

d. The supply curve does not exist.

5.) When is it possible for a natural monopoly to evolve into a competitive market?

a. as a market expands

b. as patent and copyright laws change

c. as technological advances give rise to economies of scale

d. as new resources are discovered

6.) If one were to compare a competitive market to a monopoly that engages in perfect price discrimination, one could say that

a. in both cases, total social welfare is the same.

b. total social welfare is maximized in the competitive market, but not in the perfectly discriminating monopoly.

c. in both cases, some potentially mutually beneficial trades do not occur.

d. consumer surplus is the same in both cases.

7/) For a typical natural monopoly, what is the relationship between average total cost and marginal cost?

a. average total cost is falling, and marginal cost is above average total cost

b. average total cost is falling, and marginal cost is below average total cost

c. average total cost is rising, and marginal cost is below average total cost

d. average total cost is rising, and marginal cost is above average total cost

8.) For a firm to price discriminate, it must

a. be a natural monopoly.

b. be regulated by the government.

c. have some market power.

d. have large fixed costs.

9.) A monopoly firm can sell 200 units of output for $36.00 per unit. Alternatively, it can sell 201 units of output for $35.50 per unit. What is the marginal revenue of the 201st unit of output?

a. -$35.50

b. -$64.50

c. $64.50

d. $35.50

10.) Patent and copyright laws are major sources of

a. natural monopolies.

b. government-created monopolies.

c. resource monopolies.

d. product monopolies.

11.) Since natural monopolies have a declining average-cost curve, regulating natural monopolies by setting price equal to marginal cost would

a. cause the monopolist to operate at a loss.

b. result in a less than optimal total surplus.

c. maximize producer surplus.

d. encourage research in order to recoup lost profits.

12.) Why does inefficiency arise from a monopoly?

a. The monopoly firm earns an excessively large profit.

b. Some buyers will refrain from buying the good, due to the high price.

c. Some sellers will refrain from buying the good, due to the low price.

d. Consumers who buy the goods feel exploited.

13.) In what way does the profit-maximization problem for a monopolist differ from that of a competitive firm?

a. A competitive firm maximizes profit at the point where marginal revenue equals marginal cost; a monopolist maximizes profit at the point where marginal revenue exceeds marginal cost.

b. A competitive firm maximizes profit at the point where average revenue equals marginal cost; a monopolist maximizes profit at a point where average revenue exceeds marginal cost.

c. For a competitive firm, marginal revenue at the profit-maximizing level of output is equal to marginal revenue at all other levels of output; for a monopolist, marginal revenue at the profit-maximizing level of output is smaller than it is for larger levels of output.

d. For a profit-maximizing competitive firm, thinking at the margin is much more important than it is for a profit-maximizing monopolist

14.) Which of the following statements represents a monopoly firm?

a. A monopoly firm is a price taker and has no supply curve.

b. A monopoly firm is a price maker and has no supply curve.

c. A monopoly firm is a price taker and has a downward-sloping demand curve.

d. A monopoly firm is a price maker and has an upward-sloping supply curve.

15.) Which of the following is a perfectly price-discriminating monopolist able to do?

a. maximize profit, and produce a socially optimal level of output

b. maximize profit, but not produce a socially optimal level of output

c. produce a socially optimal level of output, but not maximize profit

d. produce a socially optimal level of output, and minimize the total cost

16.) For a monopoly firm, which of the following equalities holds?

a. price = marginal revenue

b. price = average revenue

c. marginal revenue = demand

d. marginal revenue = average revenue

17.) If a social planner were running a monopoly, that planner could achieve an efficient outcome by charging the price that is determined by

a. the minimum point on the average-total-cost curve.

b. the minimum point on the average-variable-cost curve.

c. the intersection of the marginal-cost curve and the demand curve.

d. the intersection of the marginal-cost curve and the marginal-revenue curve.

18.) In comparison to the price a competitive firm charges, monopoly pricing has the effect of causing

a. a higher level of output.

b. a higher price.

c. a larger consumer surplus.

d. smaller deadweight losses.

19.) In which of the following ways do patent and copyright laws benefit society?

a. These laws help to keep prices down.

b. These laws help to prevent a single firm from acquiring ownership of a key resource.

c. These laws encourage creative activity.

d. These laws discourage excessive amounts of output of certain products.

20.) What is generally the case for a monopolist's average revenue?

a. It is equal to marginal revenue.

b. It is less than marginal revenue.

c. It is equal to the price of its product.

d. It is less than the price of its product

21.) How do competitive firms and monopolists differ?

a. A competitive firm cannot choose its level of output; a monopolist chooses its level of output.

b. A competitive firm's short-run profit is always zero; a monopolist can have a positive short-run profit.

c. A competitive firm's marginal-revenue curve is horizontal; a monopolist's marginal-revenue curve is downward sloping.

d. A competitive firm sets price equal to marginal cost; a monopolist sets price equal to marginal revenue.

22.) What is one method used to control the ability of firms to capture monopoly profit in Canada?

a. government purchase of products produced by monopolists

b. government distribution of a monopolist's excess production

c. enforcement of antitrust laws

d. regulation of firms in highly competitive markets

23.) Supply curves tell us how much producers are willing to supply at any given price. What type of supply curves will monopoly firms have?

a. vertical supply curves

b. steeper supply curves than competitive firms

c. upward-sloping supply curves

d. no supply curves

24.) When will a monopolist choose to increase output?

a. when market price increases

b. when marginal revenue is positive

c. when marginal revenue exceeds marginal cost at the present level of output

d. when marginal revenue is less than marginal cost at the present level of output

25.) What is the typical market demand curve for a monopolist?

a. upward sloping

b. downward sloping

c. horizontal

d. vertical

Part B.

Homework #2 International Trade

1. Consider the numerical examples of exercise 1 and 2 on page 52 in Krugman and Obstfeld (8th Edition).

Draw the production possibility frontier for each country.

Which country has a comparative advantage in apples, which one in bananas?

Which country has an absolute advantage?

Indicate the range of the international prices within which there will be gains from trade for both countries.

Now imagine that Home's technology is different. It turns out that one unit of Home labor can produce 0.2 apples or 1 banana. What would the pattern of production/trade be in this case? Explain the reason why the trade pattern is the way it is.

2.Take the numerical example we used in class to discuss the Ricardo model.

Draw the world production possibility frontier. (Hint: To do so, ask yourself what world output would be for all possible international prices (Pc/Pw)t). Now assume that both countries consume wine and clothing in equal proportions (i.e., their utility function is of the form U(c,w) = min {c,w}. Wine (w) and clothing (c ) are perfect complements) Now indicate on the graph the exact point on the world production possibility frontier at which the world consumes. Compare that point to the world consumption point before trade and before specialization.

As you notice, there are indeed gains from trade.

The question left is whether a world with free trade is the best of all possible worlds. Convince yourself that it is actually not always the best case. Allow for international mobility of labor. In other words, workers are free to decide where they want to work (at home or abroad). Show us how the production possibility frontier will look like in this case. Convince yourself that indeed, under this scenario, the world is better off than in the case of free trade. Now when you consider the international division of production (i.e., where goods will be produced) with internationally mobile labor, would you say that it is in line with the principle of comparative advantage? Discuss

You should realize while doing this exercise how essential the assumption of the international immobility of labor is for international trade and the theory of comparative advantage.

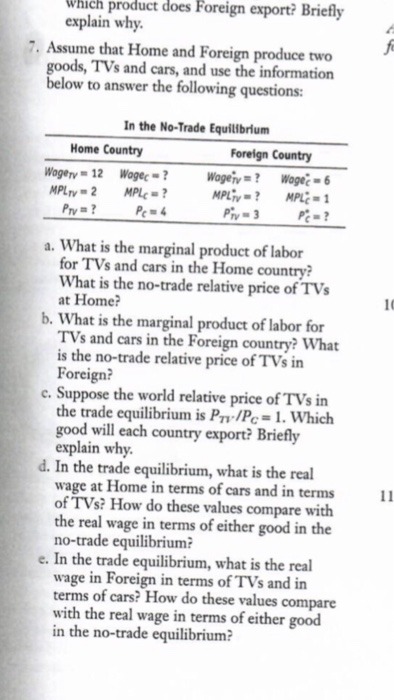

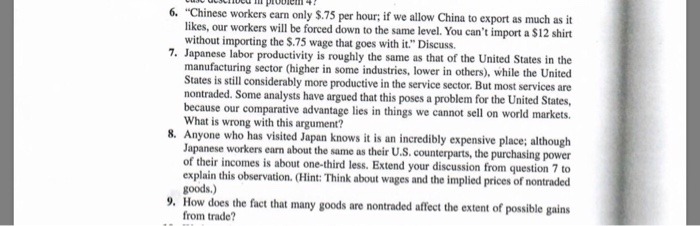

3.Discuss problems 6 and 9 in Krugman and Obstfeld, p. 52.

4.Your country imports high tech products and exports agricultural products.

Suppose you had any control over future technological developments (You have none, but anyway), would you prefer scenario (a), (b) or (c) and why? (Where necessary, illustrate with a graph using the Ricardo nalysis of comparative advantage.)

a. There is a technological revolution abroad in the high tech industry. In other words, productivity increases significantly in the technology sector.

b. There is a productivity increase abroad in the agricultural sector.

c. No technological revolution at all abroad.

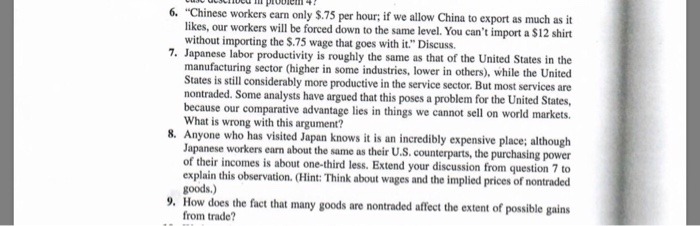

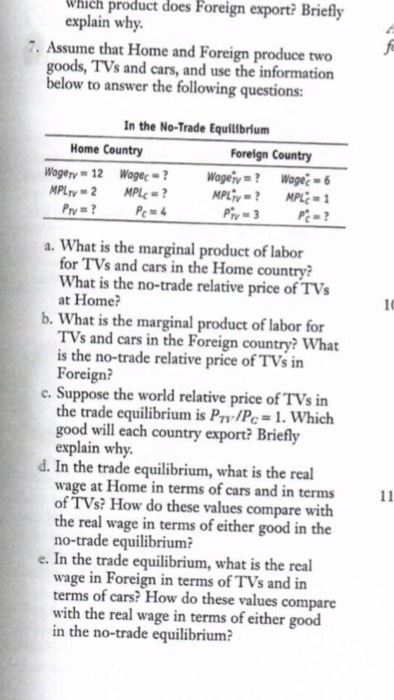

5.Answer the problem 7 in Feenstra and Taylor, p. 57.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started