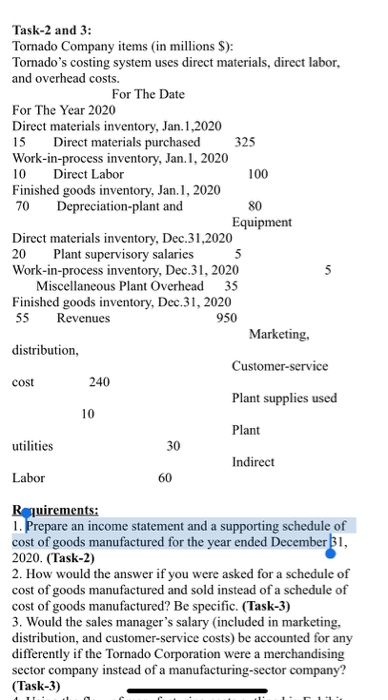

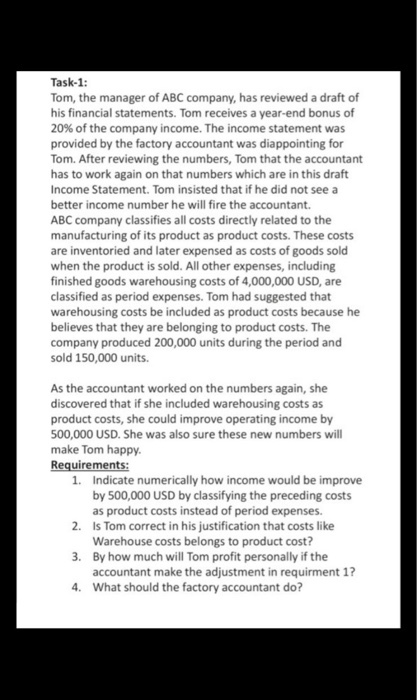

Task-2 and 3: Tornado Company items (in millions $): Tornado's costing system uses direct materials, direct labor, and overhead costs. For The Date For The Year 2020 Direct materials inventory, Jan.1,2020 15 Direct materials purchased 325 Work-in-process inventory, Jan. 1, 2020 10 Direct Labor 100 Finished goods inventory, Jan.1, 2020 70 Depreciation-plant and 80 Equipment Direct materials inventory, Dec.31,2020 Plant supervisory salaries 5 Work-in-process inventory, Dec.31, 2020 5 Miscellaneous Plant Overhead 35 Finished goods inventory, Dec.31, 2020 55 Revenues 950 Marketing, distribution, Customer-service cost 240 Plant supplies used 10 Plant utilities 30 Indirect Labor 60 20 Requirements: 1. Prepare an income statement and a supporting schedule of cost of goods manufactured for the year ended December 31, 2020. (Task-2) 2. How would the answer if you were asked for a schedule of cost of goods manufactured and sold instead of a schedule of cost of goods manufactured? Be specific. (Task-3) 3. Would the sales manager's salary included in marketing, distribution, and customer-service costs) be accounted for any differently if the Tornado Corporation were a merchandising sector company instead of a manufacturing-sector company? (Task-3) Task-1: Tom, the manager of ABC company, has reviewed a draft of his financial statements. Tom receives a year-end bonus of 20% of the company income. The income statement was provided by the factory accountant was diappointing for Tom. After reviewing the numbers, Tom that the accountant has to work again on that numbers which are in this draft Income Statement. Tom insisted that if he did not see a better income number he will fire the accountant. ABC company classifies all costs directly related to the manufacturing of its product as product costs. These costs are inventoried and later expensed as costs of goods sold when the product is sold. All other expenses, including finished goods warehousing costs of 4,000,000 USD, are classified as period expenses. Tom had suggested that warehousing costs be included as product costs because he believes that they are belonging to product costs. The company produced 200,000 units during the period and sold 150,000 units. As the accountant worked on the numbers again, she discovered that if she included warehousing costs as product costs, she could improve operating income by 500,000 USD. She was also sure these new numbers will make Tom happy. Requirements: 1. Indicate numerically how income would be improve by 500,000 USD by classifying the preceding costs as product costs instead of period expenses. 2. Is Tom correct in his justification that costs like Warehouse costs belongs to product cost? 3. By how much will Tom profit personally if the accountant make the adjustment in requirment 1? 4. What should the factory accountant do