Answered step by step

Verified Expert Solution

Question

1 Approved Answer

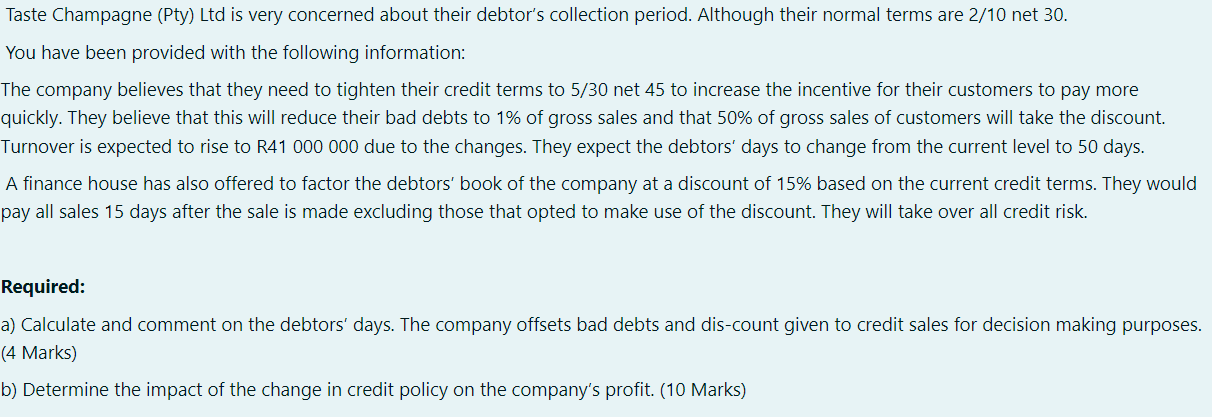

Taste Champagne ( Pty ) Ltd is very concerned about their debtor's collection period. Although their normal terms are 2 / 1 0 net 3

Taste Champagne Pty Ltd is very concerned about their debtor's collection period. Although their normal terms are net

You have been provided with the following information:

The company believes that they need to tighten their credit terms to net to increase the incentive for their customers to pay more

quickly. They believe that this will reduce their bad debts to of gross sales and that of gross sales of customers will take the discount.

Turnover is expected to rise to R due to the changes. They expect the debtors' days to change from the current level to days.

A finance house has also offered to factor the debtors' book of the company at a discount of based on the current credit terms. They would

pay all sales days after the sale is made excluding those that opted to make use of the discount. They will take over all credit risk.

Required:

a Calculate and comment on the debtors' days. The company offsets bad debts and discount given to credit sales for decision making purposes.

Marks

b Determine the impact of the change in credit policy on the company's profit. Marks

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started