Question

Tasty Oil is an oil refining company. It aims to establish operations in Venezuela. However, it is concerned that Maduro might expropriate its operations. Thus,

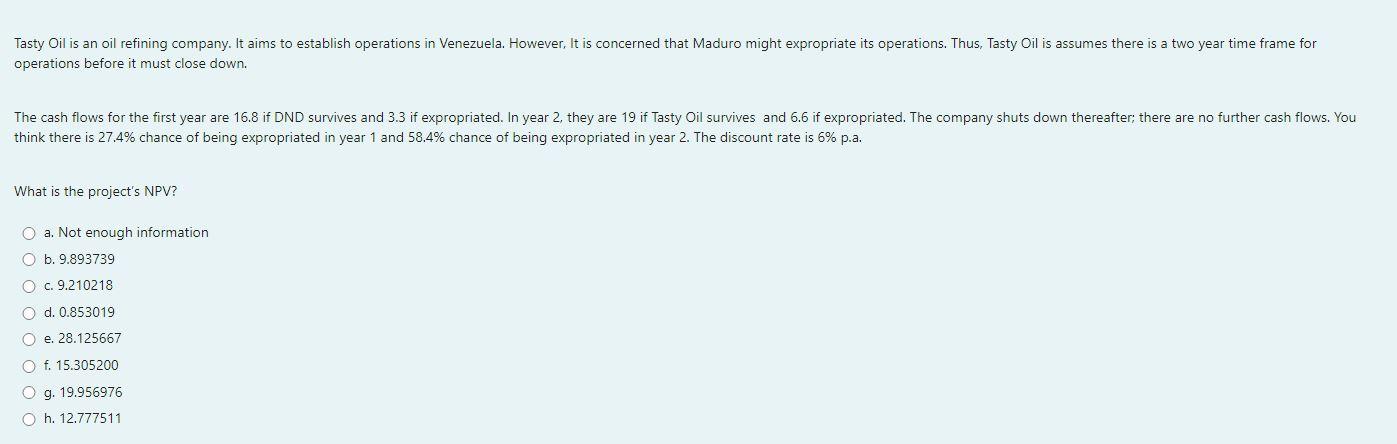

Tasty Oil is an oil refining company. It aims to establish operations in Venezuela. However, it is concerned that Maduro might expropriate its operations. Thus, Tasty Oil is assumes there is a two year time frame for operations before it must close down. The cash flows for the first year are 16.8 if DND survives and 3.3 if expropriated. In year 2, they are 19 if Tasty Oil survives and 6.6 if expropriated. The company shuts down thereafter, there are no further cash flows. You think there is 27.4% chance of being expropriated in year 1 and 58.4% chance of being expropriated in year 2. The discount rate is 6% p.a. What is the project's NPV? a. Not enough information

b. 9.893739

c. 9.210218

d. 0.853019

e. 28.125667

f. 15.305200

g. 19.956976

h. 12.777511

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started