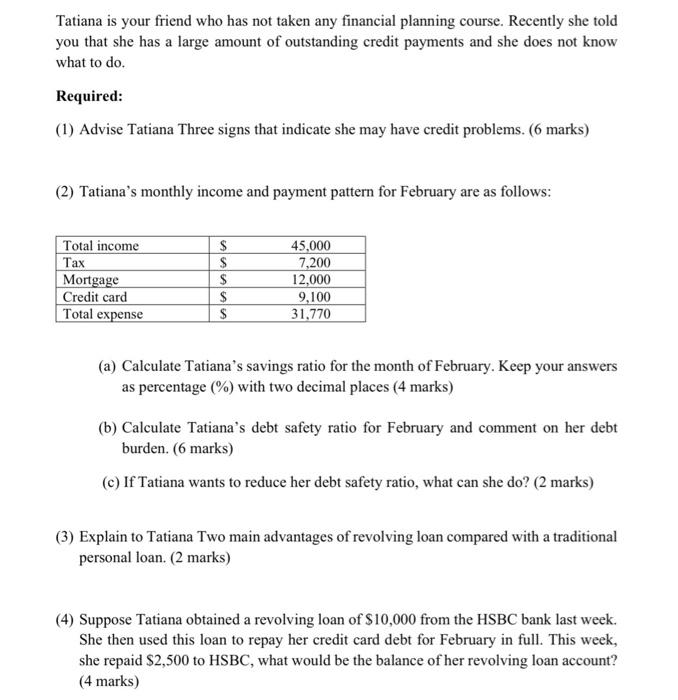

Tatiana is your friend who has not taken any financial planning course. Recently she told you that she has a large amount of outstanding credit payments and she does not know what to do. Required: (1) Advise Tatiana Three signs that indicate she may have credit problems. (6 marks) (2) Tatiana's monthly income and payment pattern for February are as follows: Total income Tax Mortgage Credit card Total expense S $ S $ $ 45,000 7,200 12,000 9,100 31,770 (a) Calculate Tatiana's savings ratio for the month of February. Keep your answers as percentage (%) with two decimal places (4 marks) (b) Calculate Tatiana's debt safety ratio for February and comment on her debt burden. (6 marks) (c) If Tatiana wants to reduce her debt safety ratio, what can she do? (2 marks) (3) Explain to Tatiana Two main advantages of revolving loan compared with a traditional personal loan. (2 marks) (4) Suppose Tatiana obtained a revolving loan of $10,000 from the HSBC bank last week. She then used this loan to repay her credit card debt for February in full. This week, she repaid $2,500 to HSBC, what would be the balance of her revolving loan account? (4 marks) Tatiana is your friend who has not taken any financial planning course. Recently she told you that she has a large amount of outstanding credit payments and she does not know what to do. Required: (1) Advise Tatiana Three signs that indicate she may have credit problems. (6 marks) (2) Tatiana's monthly income and payment pattern for February are as follows: Total income Tax Mortgage Credit card Total expense S $ S $ $ 45,000 7,200 12,000 9,100 31,770 (a) Calculate Tatiana's savings ratio for the month of February. Keep your answers as percentage (%) with two decimal places (4 marks) (b) Calculate Tatiana's debt safety ratio for February and comment on her debt burden. (6 marks) (c) If Tatiana wants to reduce her debt safety ratio, what can she do? (2 marks) (3) Explain to Tatiana Two main advantages of revolving loan compared with a traditional personal loan. (2 marks) (4) Suppose Tatiana obtained a revolving loan of $10,000 from the HSBC bank last week. She then used this loan to repay her credit card debt for February in full. This week, she repaid $2,500 to HSBC, what would be the balance of her revolving loan account? (4 marks)