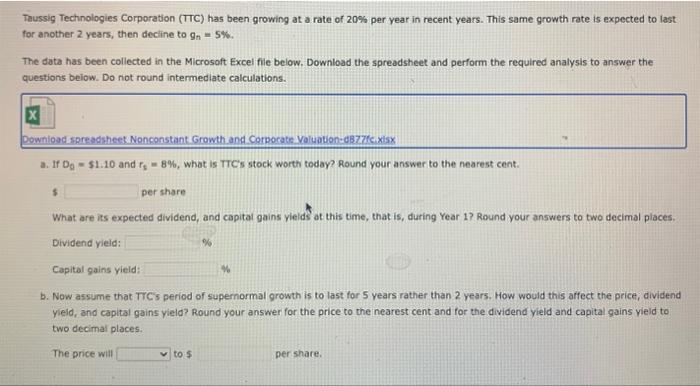

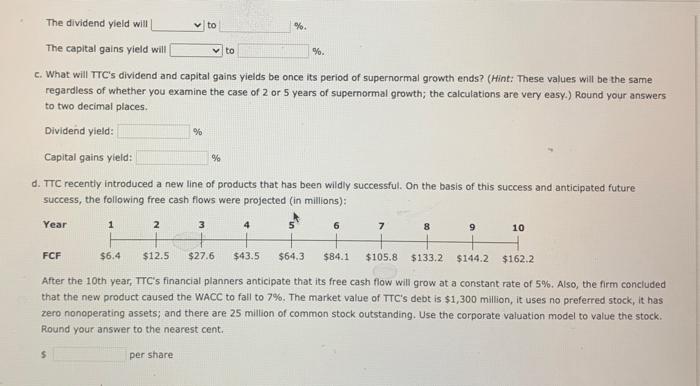

Taussig Technologies Corporation (TCC) has been growing at a rate of 20% per year in recent years. This same growth rate is expected to last for another 2 years, then decline to gn=5%. The data has been collected in the Microsoft Excel file below. Download the spreadsheet and perform the required analysis to answer the questions beiow. Do not round intermediate calculations. Downioad spreadsheet Nonconstant Growth and Corporate Valuation-d377tcixisx a. If D0=51.10 and rs=8%, what is TTC's stock worth today? Round your answer to the nearest cent. 1 per share What are its expected dividend, and capital gains yields at this time, that is, during Year 1 ? Round your answers to two decimal places. Dividend yield: Capital gains yield: b. Now assume that TTCs period of supernormal growth is to last for 5 years rather than 2 years. How would this arfect the price, dividend yield, and capital gains yield? Round your answer for the price to the nearest cent and for the dividend yield and capital gains vield to two decimal places. The price will to 5 per share. The dividend yield will to %. The capital gains yield will c. What will TTC's dividend and capital gains yields be once its period of supernormal growth ends? (Hint: These values will be the same regardless of whether you examine the case of 2 or 5 years of supernormal growth; the calculations are very easy.) Round your answers to two decimal places. Dividend yield: Capital gains yield: % d. TTC recently introduced a new line of products that has been wildly successful. On the basis of this success and anticipated future success, the following free cash flows were projected (in millions): After the 10th year, TCC's financial planners anticipate that its free cash flow will grow at a constant rate of 5%. Also, the firm concluded that the new product caused the WACC to fall to 7%. The market value of TTC's debt is $1,300 million, it uses no preferred stock, it has zero nonoperating assets; and there are 25 million of common stock outstanding. Use the corporate valuation model to value the stock. Round your answer to the nearest cent. per share