Answered step by step

Verified Expert Solution

Question

1 Approved Answer

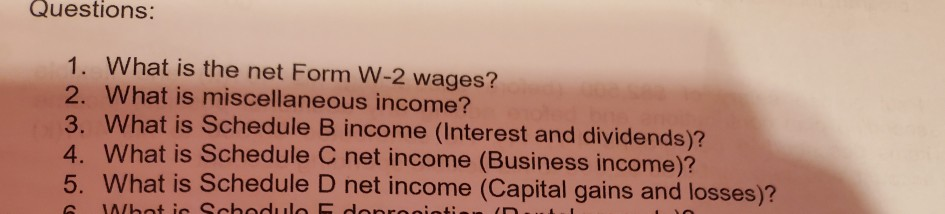

Tax 1 Questions: 1. What is the net Form W-2 wages? 2. What is miscellaneous income? 3. What is Schedule B income (Interest and dividends)?

Tax 1

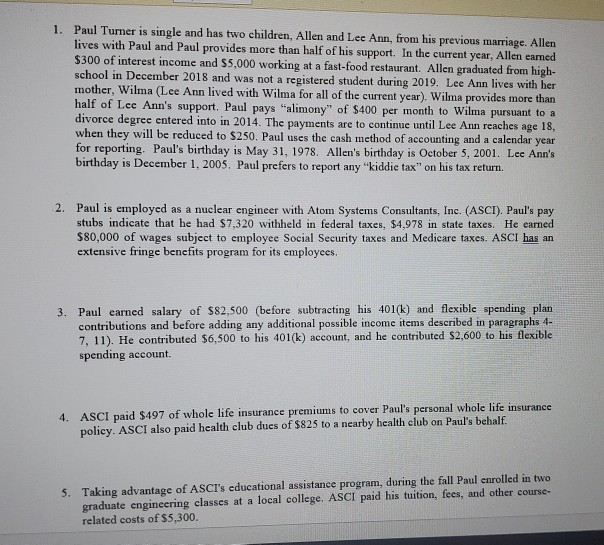

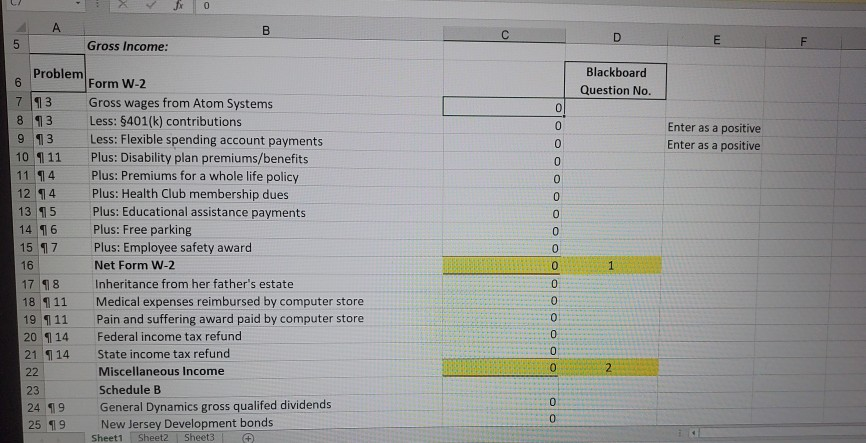

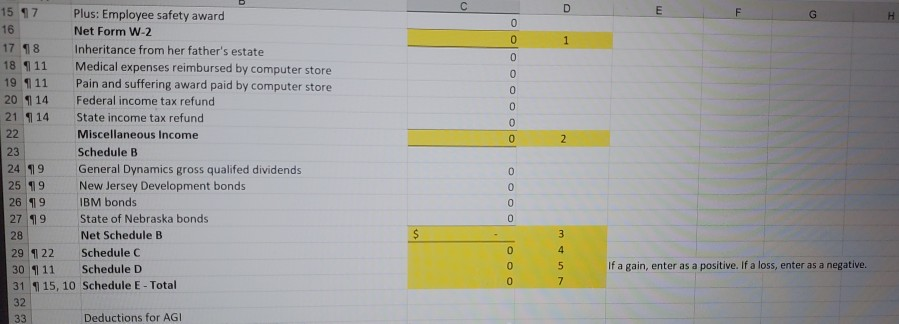

Questions: 1. What is the net Form W-2 wages? 2. What is miscellaneous income? 3. What is Schedule B income (Interest and dividends)? 4 What is Schedule C net income (Business income)? 5. What is Schedule D net income (Capital gains and losses)? Whetic Schodule C danramintiin. 1. Paul Turner is single and has two children, Allen and Lee Ann, from his previous marriage. Allen lives with Paul and Paul provides more than half of his support. In the current year, Allen earned $300 of interest income and $5,000 working at a fast-food restaurant. Allen graduated from high- school in December 2018 and was not a registered student during 2019. Lee Ann lives with her mother, Wilma (Lee Ann lived with Wilma for all of the current year). Wilma provides more than half of Lee Ann's support. Paul pays "alimony" of $400 per month to Wilma pursuant to a divorce degree entered into in 2014. The payments are to continue until Lee Ann reaches age 18, when they will be reduced to $250. Paul uses the cash method of accounting and a calendar year for reporting. Paul's birthday is May 31, 1978. Allen's birthday is October 5, 2001. Lee Ann's birthday is December 1, 2005. Paul prefers to report any "kiddie tax" on his tax return. 2. Paul is employed as a nuclear engineer with Atom Systems Consultants, Inc. (ASCI). Paul's pay stubs indicate that he had $7,320 withheld in federal taxes, $4,978 in state taxes. He earned $80,000 of wages subject to employee Social Security taxes and Medicare taxes. ASCI bas an extensive fringe benefits program for its employees 3. Paul carned salary of $82,500 (before subtracting his 401(k) and flexible spending plan utions and before adding any additional possible income items described in paragraphs 4- 7, 11). He contributed $6,500 to his 401(k) account, and he contributed $2,600 to his flexible spending account. 4. ASCI paid $497 of whole life insurance premiums to cover Paul's personal whole life insurance policy. ASCI also paid health club dues of $825 to a nearby health club on Paul's behalf. 5. Taking advantage of ASCI's educational assistance program, during the fall Paul enrolled in two graduate engineering classes at a local college. ASCI paid his tuition fees, and other course related costs of $5,300. Gross Income: Problem Form W-2 Blackboard Question No. Enter as a positive Enter as a positive 7 13 8 13 9 13 10 111 11 94 12 94 13 15 14 16 15 17 Gross wages from Atom Systems Less: $401(k) contributions Less: Flexible spending account payments Plus: Disability plan premiums/benefits Plus: Premiums for a whole life policy Plus: Health Club membership dues Plus: Educational assistance payments Plus: Free parking Plus: Employee safety award Net Form W-2 Inheritance from her father's estate Medical expenses reimbursed by computer store Pain and suffering award paid by computer store Federal income tax refund State income tax refund Miscellaneous Income Schedule B General Dynamics gross qualifed dividends New Jersey Development bonds Sheet1 Sheet2 Sheet3 OOOOOOOOOOOO 17 98 18 111 19 111 20 114 21 14 22 23 Ooooo 24 19 25 19 F 15 17 Plus: Employee safety award 16 Net Form W-2 17 18 Inheritance from her father's estate 18 11 Medical expenses reimbursed by computer store 19 111 Pain and suffering award paid by computer store 20 114 Federal income tax refund 21 14 State income tax refund Miscellaneous Income Schedule B 24 19 General Dynamics gross qualifed dividends 25 19 New Jersey Development bonds 26 19 IBM bonds 27 19 State of Nebraska bonds Net Schedule B 29 422 Schedule C 30 111 Schedule D 31 915, 10 Schedule E - Total $ - If a gain, enter as a positive. If a loss, enter as a negative. Deductions for AGIStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started