Answered step by step

Verified Expert Solution

Question

1 Approved Answer

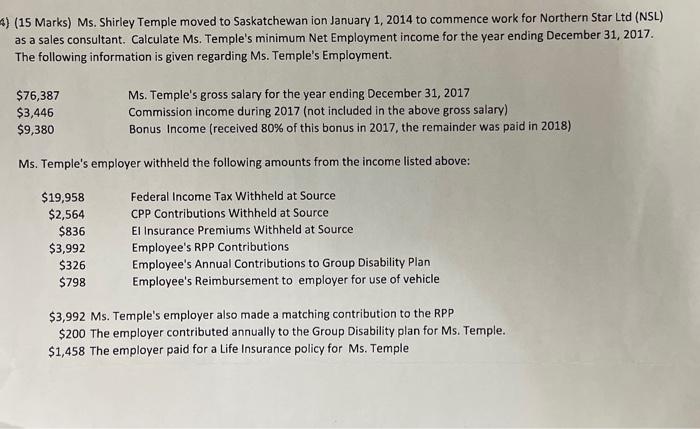

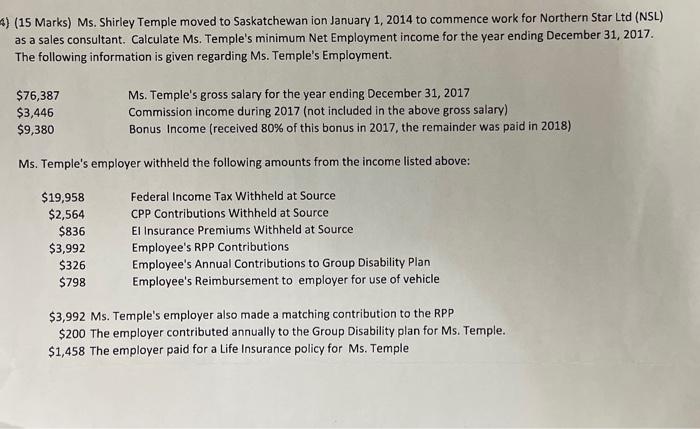

tax 4) (15 Marks) Ms. Shirley Temple moved to Saskatchewan ion January 1, 2014 to commence work for Northern Star Ltd (NSL) as a sales

tax

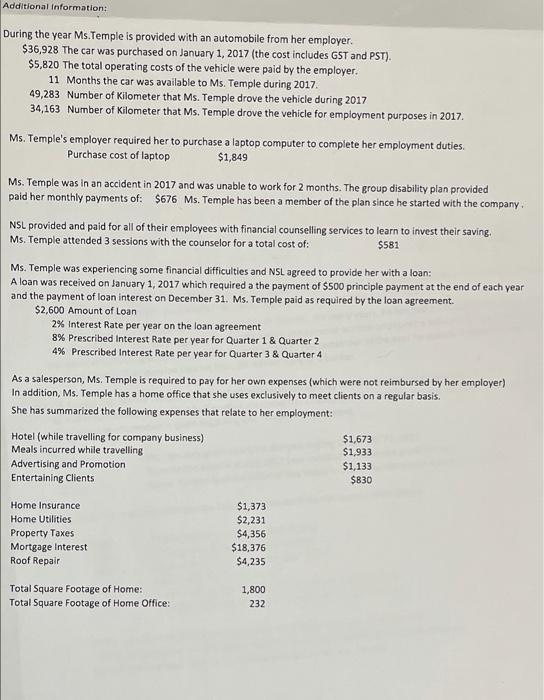

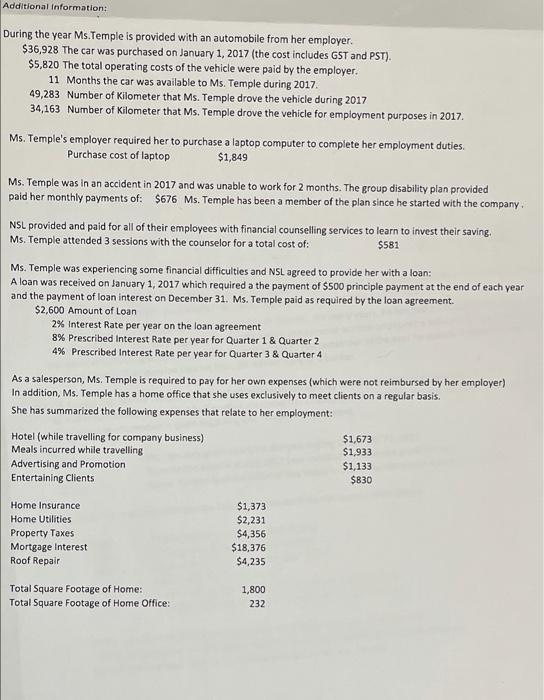

4) (15 Marks) Ms. Shirley Temple moved to Saskatchewan ion January 1, 2014 to commence work for Northern Star Ltd (NSL) as a sales consultant. Calculate Ms. Temple's minimum Net Employment income for the year ending December 31, 2017 The following information is given regarding Ms. Temple's Employment. $76,387 $3,446 $9,380 Ms. Temple's gross salary for the year ending December 31, 2017 Commission income during 2017 (not included in the above gross salary) Bonus Income (received 80% of this bonus in 2017, the remainder was paid in 2018) Ms. Temple's employer withheld the following amounts from the income listed above: $19,958 $2,564 $836 $3,992 $326 $798 Federal Income Tax Withheld at Source CPP Contributions Withheld at Source El Insurance Premiums Withheld at Source Employee's RPP Contributions Employee's Annual Contributions to Group Disability Plan Employee's Reimbursement to employer for use of vehicle $3,992 Ms. Temple's employer also made a matching contribution to the RPP $200 The employer contributed annually to the Group Disability plan for Ms. Temple. $1,458 The employer paid for a Life Insurance policy for Ms. Temple Additional information: During the year Ms.Temple is provided with an automobile from her employer. $36,928 The car was purchased on January 1, 2017 (the cost includes GST and PST). $5,820 The total operating costs of the vehicle were paid by the employer. 11 Months the car was available to Ms. Temple during 2017 49,283 Number of Kilometer that Ms. Temple drove the vehicle during 2017 34,163 Number of Kilometer that Ms. Temple drove the vehicle for employment purposes in 2017. Ms. Temple's employer required her to purchase a laptop computer to complete her employment duties. Purchase cost of laptop $1,849 Ms. Temple was in an accident in 2017 and was unable to work for 2 months. The group disability plan provided paid her monthly payments of: $676 Ms. Temple has been a member of the plan since he started with the company NSL provided and paid for all of their employees with financial counselling services to learn to invest their saving. Ms. Temple attended 3 sessions with the counselor for a total cost of: $581 Ms. Temple was experiencing some financial difficulties and NSL agreed to provide her with a loan: A loan was received on January 1, 2017 which required a the payment of $500 principle payment at the end of each year and the payment of loan interest on December 31. Ms. Temple paid as required by the loan agreement. $2,600 Amount of Loan 2% Interest Rate per year on the loan agreement 8% Prescribed Interest Rate per year for Quarter 1 & Quarter 2 4% Prescribed Interest Rate per year for Quarter 3 & Quarter 4 As a salesperson, Ms. Temple is required to pay for her own expenses (which were not reimbursed by her employer) In addition, Ms. Temple has a home office that she uses exclusively to meet clients on a regular basis. She has summarized the following expenses that relate to her employment: Hotel (while travelling for company business) $1,673 Meals incurred while travelling $1,933 Advertising and Promotion $1,133 Entertaining Clients $830 Home Insurance Home Utilities Property Taxes Mortgage Interest Roof Repair $1,373 $2,231 $4,356 $18,376 $4,235 Total Square Footage of Home: Total Square footage of Home Office: 1,800 232

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started