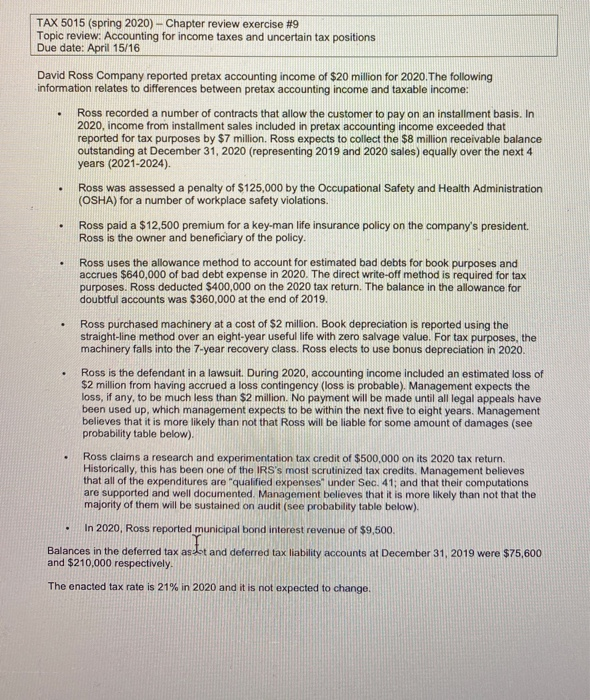

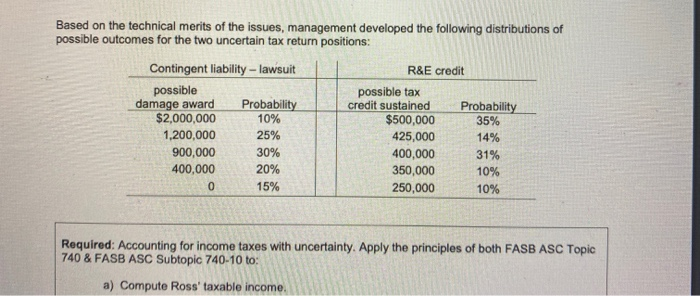

TAX 5015 (spring 2020) - Chapter review exercise #9 Topic review: Accounting for income taxes and uncertain tax positions Due date: April 15/16 David Ross Company reported pretax accounting income of $20 million for 2020. The following information relates to differences between pretax accounting income and taxable income: Ross recorded a number of contracts that allow the customer to pay on an installment basis. In 2020, income from installment sales included in pretax accounting income exceeded that reported for tax purposes by $7 million. Ross expects to collect the $8 million receivable balance outstanding at December 31, 2020 (representing 2019 and 2020 sales) equally over the next 4 years (2021-2024). Ross was assessed a penalty of $125,000 by the Occupational Safety and Health Administration (OSHA) for a number of workplace safety violations. Ross paid a $12,500 premium for a key-man life insurance policy on the company's president Ross is the owner and beneficiary of the policy. Ross uses the allowance method to account for estimated bad debts for book purposes and accrues $640,000 of bad debt expense in 2020. The direct write-off method is required for tax purposes. Ross deducted $400,000 on the 2020 tax return. The balance in the allowance for doubtful accounts was $360,000 at the end of 2019. Ross purchased machinery at a cost of $2 million. Book depreciation is reported using the straight-line method over an eight-year useful life with zero salvage value. For tax purposes, the machinery falls into the 7-year recovery class. Ross elects to use bonus depreciation in 2020. Ross is the defendant in a lawsuit. During 2020, accounting income included an estimated loss of $2 million from having accrued a loss contingency (loss is probable). Management expects the loss, if any, to be much less than $2 million. No payment will be made until all legal appeals have been used up, which management expects to be within the next five to eight years. Management believes that it is more likely than not that Ross will be liable for some amount of damages (see probability table below). Ross claims a research and experimentation tax credit of $500,000 on its 2020 tax return Historically, this has been one of the IRS's most scrutinized tax credits Management believes that all of the expenditures are "qualified expenses under Sec. 41, and that their computations are supported and well documented. Management believes that it is more likely than not that the majority of them will be sustained on audit (see probability table below). In 2020, Ross reported municipal bond interest revenue of $9,500. Balances in the deferred tax assist and deferred tax liability accounts at December 31, 2019 were $75,600 and $210,000 respectively. The enacted tax rate is 21% in 2020 and it is not expected to change. Based on the technical merits of the issues, management developed the following distributions of possible outcomes for the two uncertain tax return positions: Contingent liability-lawsuit possible damage award Probability $2,000,000 10% 1,200,000 25% 900,000 30% 400,000 20% 15% R&E credit possible tax credit sustained Probability $500,000 35% 425,000 14% 400,000 31% 350,000 10% 250,000 10% Required: Accounting for income taxes with uncertainty. Apply the principles of both FASB ASC Topic 740 & FASB ASC Subtopic 740-10 to: a) Compute Ross' taxable income. TAX 5015 (spring 2020) - Chapter review exercise #9 Topic review: Accounting for income taxes and uncertain tax positions Due date: April 15/16 David Ross Company reported pretax accounting income of $20 million for 2020. The following information relates to differences between pretax accounting income and taxable income: Ross recorded a number of contracts that allow the customer to pay on an installment basis. In 2020, income from installment sales included in pretax accounting income exceeded that reported for tax purposes by $7 million. Ross expects to collect the $8 million receivable balance outstanding at December 31, 2020 (representing 2019 and 2020 sales) equally over the next 4 years (2021-2024). Ross was assessed a penalty of $125,000 by the Occupational Safety and Health Administration (OSHA) for a number of workplace safety violations. Ross paid a $12,500 premium for a key-man life insurance policy on the company's president Ross is the owner and beneficiary of the policy. Ross uses the allowance method to account for estimated bad debts for book purposes and accrues $640,000 of bad debt expense in 2020. The direct write-off method is required for tax purposes. Ross deducted $400,000 on the 2020 tax return. The balance in the allowance for doubtful accounts was $360,000 at the end of 2019. Ross purchased machinery at a cost of $2 million. Book depreciation is reported using the straight-line method over an eight-year useful life with zero salvage value. For tax purposes, the machinery falls into the 7-year recovery class. Ross elects to use bonus depreciation in 2020. Ross is the defendant in a lawsuit. During 2020, accounting income included an estimated loss of $2 million from having accrued a loss contingency (loss is probable). Management expects the loss, if any, to be much less than $2 million. No payment will be made until all legal appeals have been used up, which management expects to be within the next five to eight years. Management believes that it is more likely than not that Ross will be liable for some amount of damages (see probability table below). Ross claims a research and experimentation tax credit of $500,000 on its 2020 tax return Historically, this has been one of the IRS's most scrutinized tax credits Management believes that all of the expenditures are "qualified expenses under Sec. 41, and that their computations are supported and well documented. Management believes that it is more likely than not that the majority of them will be sustained on audit (see probability table below). In 2020, Ross reported municipal bond interest revenue of $9,500. Balances in the deferred tax assist and deferred tax liability accounts at December 31, 2019 were $75,600 and $210,000 respectively. The enacted tax rate is 21% in 2020 and it is not expected to change. Based on the technical merits of the issues, management developed the following distributions of possible outcomes for the two uncertain tax return positions: Contingent liability-lawsuit possible damage award Probability $2,000,000 10% 1,200,000 25% 900,000 30% 400,000 20% 15% R&E credit possible tax credit sustained Probability $500,000 35% 425,000 14% 400,000 31% 350,000 10% 250,000 10% Required: Accounting for income taxes with uncertainty. Apply the principles of both FASB ASC Topic 740 & FASB ASC Subtopic 740-10 to: a) Compute Ross' taxable income