Answered step by step

Verified Expert Solution

Question

1 Approved Answer

tax accounting, just want help to make sure i learned the content since the professor isnt going over it 1. Which of the following statements

tax accounting, just want help to make sure i learned the content since the professor isnt going over it

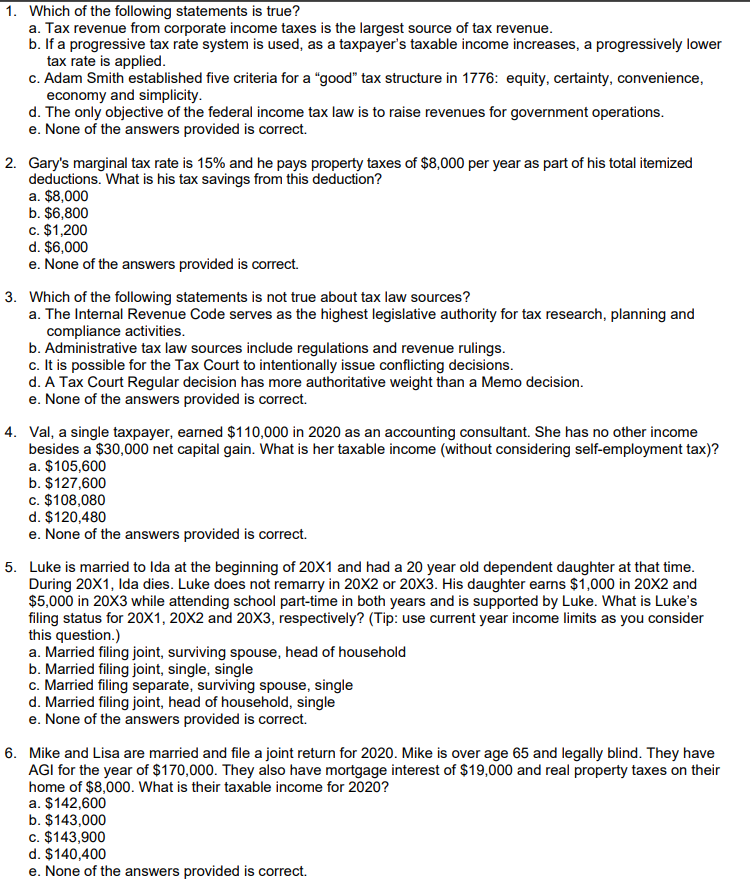

1. Which of the following statements is true? a. Tax revenue from corporate income taxes is the largest source of tax revenue. b. If a progressive tax rate system is used, as a taxpayer's taxable income increases, a progressively lower tax rate is applied c. Adam Smith established five criteria for a good tax structure in 1776: equity, certainty, convenience, economy and simplicity. d. The only objective of the federal income tax law is to raise revenues for government operations. e. None of the answers provided is correct. 2. Gary's marginal tax rate is 15% and he pays property taxes of $8,000 per year as part of his total itemized deductions. What is his tax savings from this deduction? a. $8,000 b. $6,800 c. $1,200 d. $6,000 e. None of the answers provided is correct. 3. Which of the following statements is not true about tax law sources ? a. The Internal Revenue Code serves as the highest legislative authority for tax research, planning and compliance activities. b. Administrative tax law sources include regulations and revenue rulings. c. It is possible for the Tax Court to intentionally issue conflicting decisions. d. A Tax Court Regular decision has more authoritative weight than a Memo decision. e. None of the answers provided is correct. 4. Val, a single taxpayer, earned $110,000 in 2020 as an accounting consultant. She has no other income besides a $30,000 net capital gain. What is her taxable income (without considering self-employment tax)? a. $ 105,600 b. $127,600 c. $108,080 d. $120,480 e. None of the answers provided is correct. 5. Luke is married to Ida at the beginning of 20X1 and had a 20 year old dependent daughter at that time. During 20X1, Ida dies. Luke does not remarry in 20x2 or 20x3. His daughter earns $1,000 in 20X2 and $5,000 in 20X3 while attending school part-time in both years and is supported by Luke. What is Luke's filing status for 20X1, 20X2 and 20X3, respectively? (Tip: use current year income limits as you consider this question.) a. Married filing joint, surviving spouse, head of household b. Married filing joint, single, single C. Married filing separate, surviving spouse, single d. Married filing joint, head of household, single e. None of the answers provided is correct. 6. Mike and Lisa are married and file a joint return for 2020. Mike is over age 65 and legally blind. They have AGI for the year of $170,000. They also have mortgage interest of $19,000 and real property taxes on their home of $8,000. What is their taxable income for 2020? a. $142,600 b. $143,000 c. $143,900 d. $140,400 e. None of the answers provided is correct Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started