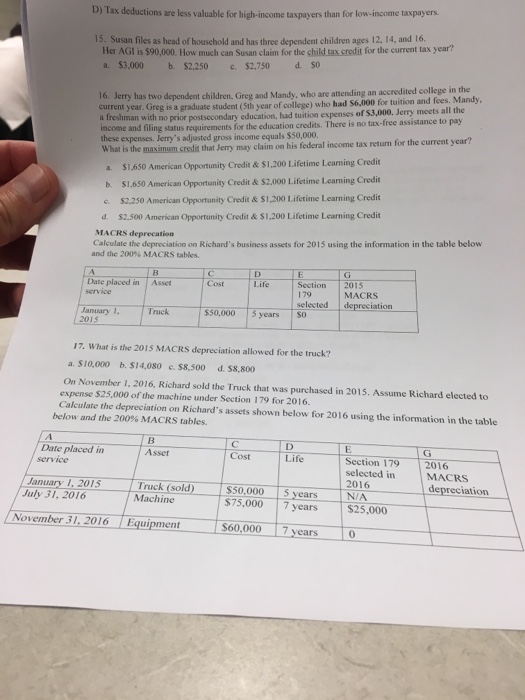

Tax deductions are less valuable for high-income taxpayers than for low-income taxpayers. Susan files as head of household and has three dependent children ages 12, I4, and 16 Her AGI is $90,000. How much can Susan claim for the child tax credit for the current tax year? a. $3,000 b. $2, 250 c. $2, 750 d. $0 Jerry has two dependent children. Greg and Mandy, who are an accredited college in the current year. Greg is a graduate student (5th year college) had $6.000 for tuition and fees. Mandy a freshman with no prior postsecondary education, had tuition expenses of $3,000. Jerry meets all the income and filling status requirements for the education credits. There is no tax-free assistance to pay these expenses. Jerry's adjusted gross income equals $50,000. What is the maximum credit that Jerry may claim on his federal income tax return for the current year? a. $1, 650 American opportunity Credit & $1, 200 Lifetime Learning Credit b $1, 650 American opportunity Credit & $2,000 Lifetime Learning Credit c. $2, 250 American opportunity Credit & $1, 200 Lifetime Learning Credit d $2, 500 American opportunity Credit & $1, 200 Lifetime Learning Credit Calculate the depreciation on Richard's business assets for 2015 using the information in the table below and the 200% MACRS tables. What is the 2015 MACRS depreciation allowed for the truck? a. $10,000 b. $14, 080 c. $8, 500 d. $8, 800 On November 2016, Richard sold the Truck that was purchased in 2015. Assume Richard elected to expense $25,000 of the machine under Section 179 for 2016. Calculate the depreciation on Richard's assets shown below for 2016 using the information in the table below and the 200% MACRS tables. Tax deductions are less valuable for high-income taxpayers than for low-income taxpayers. Susan files as head of household and has three dependent children ages 12, I4, and 16 Her AGI is $90,000. How much can Susan claim for the child tax credit for the current tax year? a. $3,000 b. $2, 250 c. $2, 750 d. $0 Jerry has two dependent children. Greg and Mandy, who are an accredited college in the current year. Greg is a graduate student (5th year college) had $6.000 for tuition and fees. Mandy a freshman with no prior postsecondary education, had tuition expenses of $3,000. Jerry meets all the income and filling status requirements for the education credits. There is no tax-free assistance to pay these expenses. Jerry's adjusted gross income equals $50,000. What is the maximum credit that Jerry may claim on his federal income tax return for the current year? a. $1, 650 American opportunity Credit & $1, 200 Lifetime Learning Credit b $1, 650 American opportunity Credit & $2,000 Lifetime Learning Credit c. $2, 250 American opportunity Credit & $1, 200 Lifetime Learning Credit d $2, 500 American opportunity Credit & $1, 200 Lifetime Learning Credit Calculate the depreciation on Richard's business assets for 2015 using the information in the table below and the 200% MACRS tables. What is the 2015 MACRS depreciation allowed for the truck? a. $10,000 b. $14, 080 c. $8, 500 d. $8, 800 On November 2016, Richard sold the Truck that was purchased in 2015. Assume Richard elected to expense $25,000 of the machine under Section 179 for 2016. Calculate the depreciation on Richard's assets shown below for 2016 using the information in the table below and the 200% MACRS tables