Question

TAX FORM 1120 Year 2015 SR & Associates Inc was established in Texas in 10/1/2006 as a C- Corporation by George Schwabs (owns 50% and

TAX FORM 1120 Year 2015

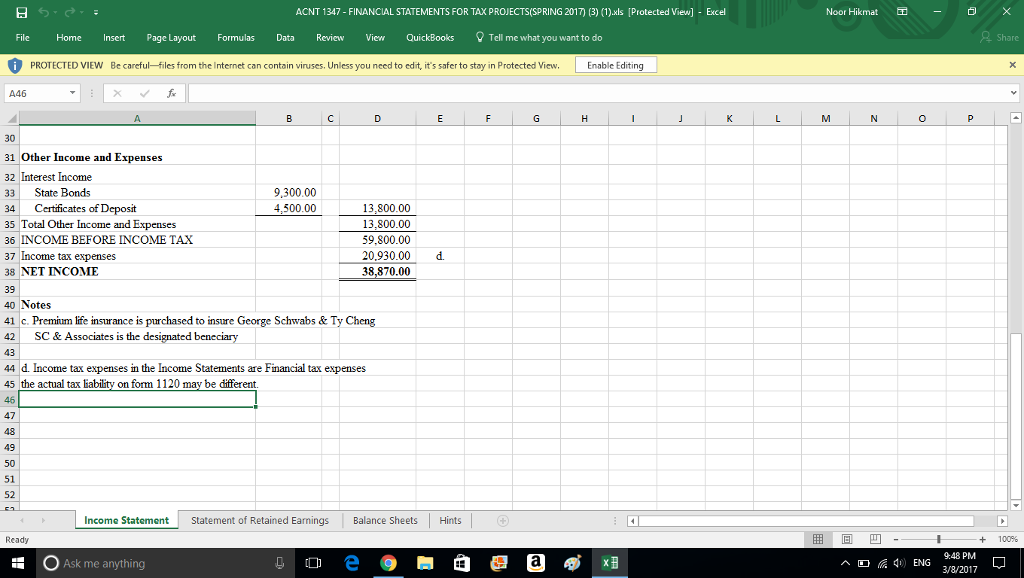

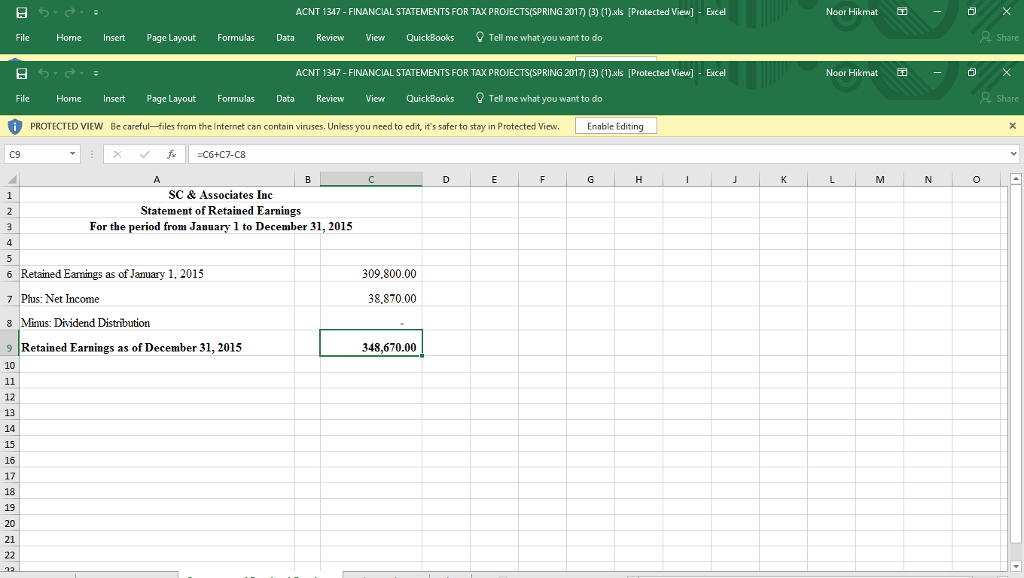

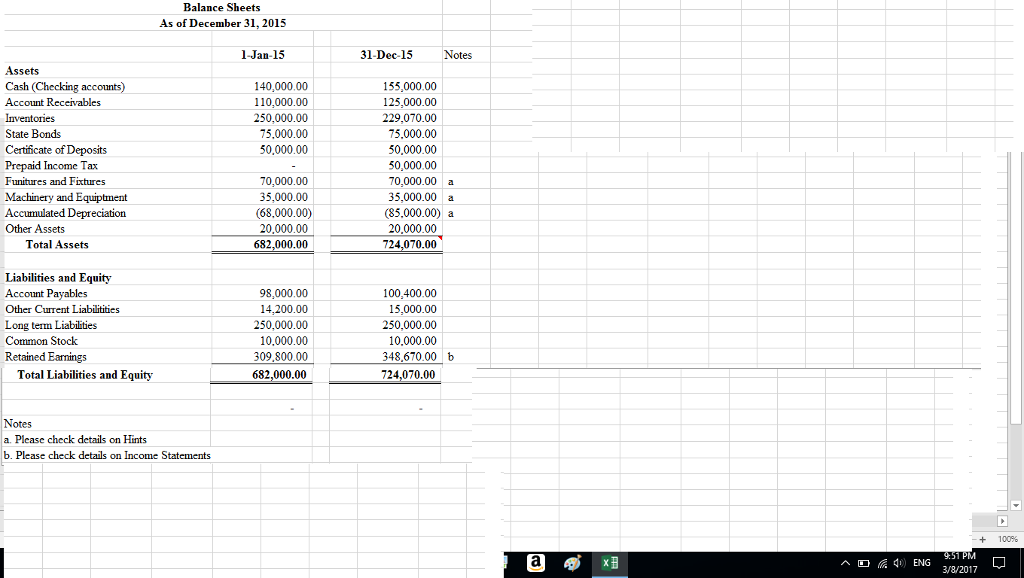

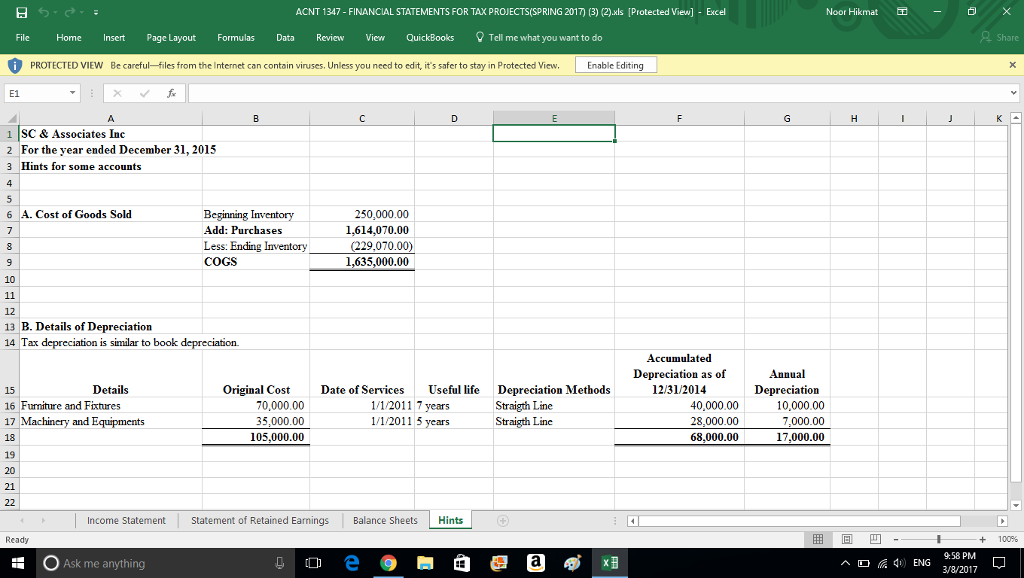

SR & Associates Inc was established in Texas in 10/1/2006 as a C- Corporation by George Schwabs (owns 50% and Ty Cheng: 50%). The main activity is trading (wholesales) engineering materialsBusiness address: 9999 Bellaire Blvd, Houston, TX 77036Employer Identification Number: 76-1234567George and Ty each own 50% of common stock. There are no other class of stocks authorized. George is President & Secretary and Ty is Vice President and Treasury. Both of them are fulltime employees. George (SSN: 123-11-3245) earned $180,000 in 2015 and Ty SSN: 123-11-3344) earned $170,000 in 2015.George and Ty use their office address as their own mailing addressSR & Associates Inc uses the accrual accounting method and inventory is determined by the lower of cost or market methods. Depreciation is used as Straight-line methods for book and tax purposes.SR & Associates Inc follows the calendar year ended December 31.The financial datas for the year ended December 31, 2015 are presented in the attached spreadsheets.See Attached Spreadsheets for additional information on Financial Statements.

Required

Prepare the forms 1120, including schedule L, Schedule M-1 indicating the differences between financial income and tax income, schedule M-2, Schedule G, Schedule 1125-E, etc. The other supporting forms and schedule should be attached to form 1120

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started