Question

Tax: Help please: Support Local (Pty) Limited (Support Local), a resident of the Republic of South Africa, manufactures South African souvenirs and related products. The

Tax: Help please:

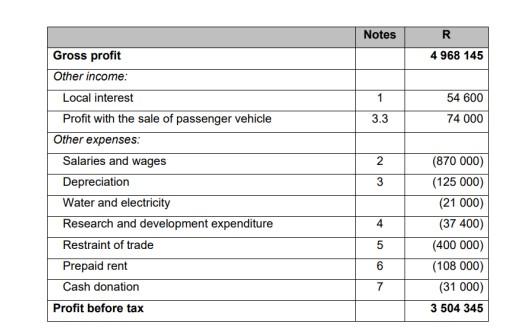

Support Local (Pty) Limited (Support Local), a resident of the Republic of South Africa, manufactures South African souvenirs and related products. The company sells its products to local retailers and directly to the public through a tourism shop which Support Local recently purchased. Support Locals statement of profit or loss and other comprehensive income for its financial year (and year of assessment) which ended 28 February 2023 reflected a profit before tax of R3 504 345:

Notes: 1. Interest earned on the business bank account with a bank in South Africa.

2. Salaries and wages consist of the following amounts:

2.1.Net salaries and wages amounting to R760 000 paid to employees.

2.2.Employees tax amounting to R110 000 in respect of salaries and wages paid to SARS

2.3.On 1 September 2022 Support Local employed Zuki Modise, an apprentice (a learner) on a full-time basis at a salary of R15 000 per month. Zuki is a person with a disability and has an NQF level 5 qualification. Support Local entered into a two-year registered learnership agreement with Zuki in the course of Support Locals trade. The learnership agreement is registered with the relevant SETA and complies with all the Skills Development Levies Act requirements. No recording was done in Support Locals books for this learnership agreement transaction.

3. The R125 000 depreciation expense was recognised in accordance with the accounting policy of Support Local on the following assets: 3.1.On 1 April 2021 Support Local purchased a new machine, machine A, on a cash basis under an arms length transaction for R150 000. This machine was immediately brought into use in Support Locals manufacturing process.

3.2.On 30 September 2022 Support Local purchased a more-advanced, new and unused machine, machine B. Machine B was purchased on a cash basis under an arms length transaction for R160 000. This more advanced machine was immediately brought into use in Support Locals manufacturing process.

3.3.Support Local purchased a passenger vehicle and granted the right of use to the Sales Director. The vehicle was bought on 1 June 2021 for R345 000. Support Local sold the vehicle to the Sales Director on 31 January 2023 for R235 000. At that time, the market value of the vehicle was R260 000.

4. Support Local developed a unique process to produce products made from recycled materials. To perfect this process, Support Local incurred capital expenditure of R37 400. The Minister of Science and Technology approved this research and development expense under the provisions of section 11D(9). Support Local was granted a South African patent for this invention on 31 August 2022 and used this patent in Support Locals trade. To register this patent, Support Local paid legal expenses of R3 600 which was not recorded in Support Locals books. The patent confers protection for 20 years.

5. A restraint of trade payment of R400 000 was paid to Thato Komane, a talented local artist, who is employed by Support Local. Thato received a job offer overseas and left Support Local on 30 September 2022. The restraint of trade agreement is effective for two years commencing on 1 October 2022. 6. Support Local leases offices at a monthly rate of R9 000. These offices are used for trading purposes. R108 000 (12 x R9 000) was paid for the 2023 year of assessment. The landlord needed cash, and on 28 February 2023, Support Local agreed to pay the rental for the months of March, April, and May 2023 in advance. No portion of the prepaid rent for the three months was expensed to the statement of profit or loss. 7. A section 18A receipt was obtained for the R31 000 cash donation made to the Child and Family Welfare Society, a registered public benefit organisation.

REQUIRED: Calculate, with reference to the relevant sections of the Income Tax Act, the taxable income of Support Local (Pty) Limited for the 2023 year of assessment.

Start your answer with the profit before tax. Round to the nearest rand. Ignore any capital gains tax and VAT implications.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started